GBPUSD surges higher

The GBPUSD rate jumped above 1.3600 as the US dollar weakened amid the ceasefire in the Middle East. Discover more in our analysis for 25 June 2025.

GBPUSD forecast: key trading points

- Market focus: the pound is rising on the Middle East ceasefire

- Current trend: uptrend persists

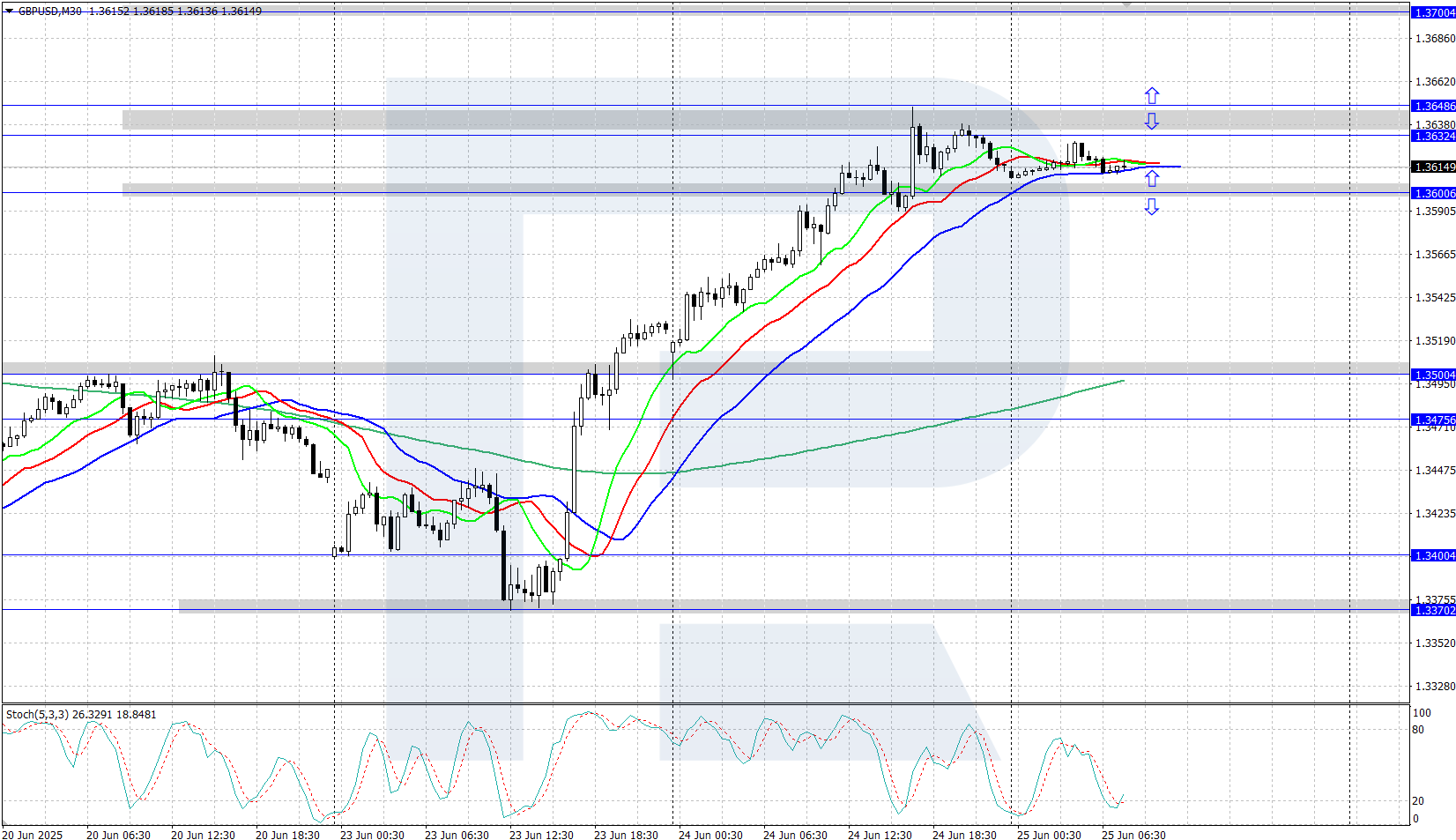

- GBPUSD forecast for 25 June 2025: 1.3600 and 1.3648

Fundamental analysis

The British pound climbed above 1.3600 on Tuesday, reaching its highest level since January 2022, as the US dollar weakened on expectations of Fed rate cuts and easing geopolitical tensions.

Market participants anticipate that the Federal Reserve may lower rates following Chairman Jerome Powell’s comment that many paths are possible, highlighting that weak inflation or employment data could prompt earlier action from the central bank.

In the UK, Bank of England Governor Andrew Bailey and Deputy Governor Dave Ramsden confirmed that rates are likely to decline slightly during the year, citing stagnation signs in the labour market.

GBPUSD technical analysis

On the H4 chart, the GBPUSD pair maintains its strong upward trajectory, climbing into a three-year high region. The Alligator indicator is pointing upwards, confirming bullish momentum. The key trend support lies at 1.3370.

The short-term GBPUSD forecast suggests prospects for growth towards the 1.3648 resistance level and higher if bulls hold above the 1.3600 support level. Conversely, a downward correction may begin if bears gain a foothold below 1.3600, with the next target at the 1.3500 support level.

Summary

The GBPUSD pair rose above 1.3600 amid easing geopolitical tensions in the Middle East. Market expectations continue to lean towards further Federal Reserve rate cuts.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.