EURUSD weekly forecast: shutdown and weak eurozone data in focus

Expectations of continued Fed easing after the 25-basis-point rate cut in September remain the main driver for the currency market. The likelihood of further steps is already largely priced in, but uncertainty is growing amid inflationary pressure in the US and the political crisis associated with the government shutdown.

For the EURUSD pair, the key remains the balance of signals from the Federal Reserve and ECB, as well as investor reaction to a limited macroeconomic data flow, as some US releases are temporarily frozen due to the halt in federal agency operations.

This forecast outlines the EURUSD scenarios for 6–10 October.

EURUSD forecast for this week: quick overview

- Market focus: the US government shutdown is weighing on the market, with the release of key statistics temporarily suspended, and the prospects for a compromise between Democrats and Republicans remaining unclear.

- Current trend: the EURUSD pair is trading near 1.1725–1.1750, staying within range. Attempts to rise are capped by a strong US dollar and the Fed's dovish but not aggressive rhetoric. Technically, the pair remains balanced, but the 1.1650–1.1780 range is key.

- Outlook for 6 – 10 October: the base case suggests consolidation within the 1.1650–1.1830 range. A breakout above the resistance level would open the path to 1.1915, while consolidation below 1.1650 increases pressure and could push the pair down to 1.1570–1.1500.

EURUSD fundamental analysis

The EURUSD pair ended the week in a neutral range, balancing between the Fed’s dovish trajectory and weak eurozone macroeconomic data. The US Dollar Index held near 97.8 points, with the market nearly fully pricing in a 25-basis-point Federal Reserve rate cut in October and another by December. Delays in key US data due to the shutdown increase uncertainty. The absence of the Non-Farm Payrolls (NFP) report limits guidance for the Fed, although Dallas Fed President Lorie Logan emphasised that the employment slowdown is gradual and does not yet require accelerated easing.

In the eurozone, September inflation came in at 2.2% y/y in line with expectations but above July’s 2.0%, discouraging the ECB from rapid rate cuts. However, the manufacturing PMI remains in contraction territory (49.8), unemployment rose to 6.3%, and consumer confidence remains low at -14.9. Business climate and economic expectations indices also reflect a fragile recovery.

Thus, the EURUSD fundamental backdrop remains mixed: the US dollar benefits from its safe-haven status and expectations of Fed easing, while the euro balances inflationary pressure with weak employment and production data. In the coming days, the pair’s movement will be influenced by US shutdown updates, central bank rhetoric, and secondary statistics.

EURUSD technical analysis

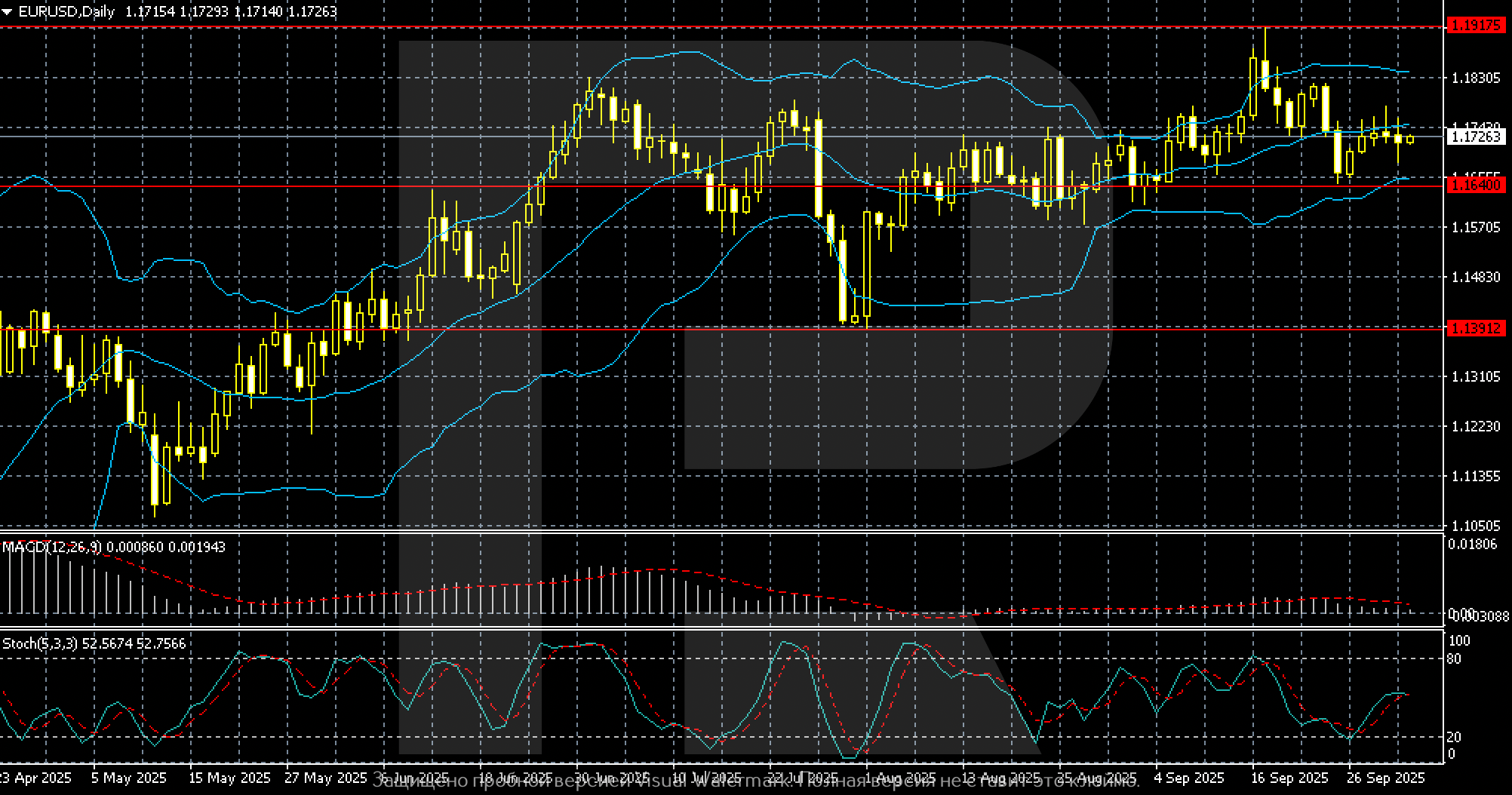

On the daily timeframe, the EURUSD pair is trading in a consolidation phase following its summer rally, with the price currently at 1.1726. The nearest support level lies at 1.1640, and a downward breakout could open the path to 1.1390. Resistance levels are at 1.1780 and 1.1917 — the latter being the late August high.

Indicators confirm a neutral setup. Bollinger Bands are narrowing, reflecting reduced volatility. MACD is hovering near the zero line, and the Stochastic Oscillator remains in the middle zone (52), signalling balanced momentum.

Thus, the pair is hovering within the 1.1640–1.1780 range. A breakout above 1.1780 is needed to confirm growth, while a move below 1.1640 could strengthen selling pressure.

EURUSD trading scenarios

The sentiment for EURUSD remains neutral with a cautious bias for the coming week.

Technically, the pair consolidates within the 1.1640–1.1780 range. It is trading near the centre of the corridor, with MACD and Stochastic signals remaining neutral, and narrowing Bollinger Bands pointing to lower volatility. The fundamental backdrop limits upside: the US shutdown and data delays increase uncertainty, but the dollar maintains demand as a safe-haven asset. Federal Reserve rate decisions and fresh inflation data remain the main drivers.

- Buy scenario (long):

Long positions are possible if the pair holds above 1.1750 and dovish Fed signals are confirmed. Targets are 1.1830 and 1.1915.

Stop-loss is below 1.1660.

- Sell scenario (short):

Short positions are relevant if the price breaks below 1.1640, especially on strong US data and rising Treasury yields. Targets are 1.1570 and 1.1500.

Stop-loss is above 1.1780.

Conclusion: the baseline scenario sees the pair remaining in range with a focus on caution – movement will depend on Fed commentary and the US political situation.

Summary

Overall sentiment on EURUSD remains cautiously positive for the euro after the Fed’s 25-basis-point rate cut. The market expects two more cuts before the end of the year. US inflation remains above target, supporting expectations for continued easing.

An additional uncertainty factor is the US government shutdown: no congressional compromise has been reached yet, and several key macroeconomic publications are delayed.

This increases demand for the dollar as a safe-haven, capping euro gains.

The technical picture still allows for movement towards 1.1830–1.1915, but fundamentals restrain momentum. In the base case, the pair will aim to stay above current levels with attempts to test the upper boundary of the range.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.