EURUSD weekly forecast: Fed decision nears, risks increase

Expectations of a Federal Reserve rate cut at the 17 September meeting remain the main driver for the currency market. Markets have fully priced in a 25-basis-point dovish move.

EURUSD dynamics are shaped by the balance between Fed and ECB signals, and reactions to fresh macroeconomic data from both the US and the eurozone. This review explores potential movement scenarios for the pair in mid-September, taking into account inflation data, Fed expectations, and the internal stability of the European economy.

EURUSD forecast for this week: quick overview

- Market focus

The EURUSD pair closed the week of 8–12 September around 1.1690, remaining in the middle of the range seen in recent months. The US Dollar Index held around 97.8 points amid weaker US producer price data – the PPI fell by 0.1% m/m against a 0.3% rise expected — and anticipation of the 17 September Federal Reserve meeting. The market fully prices in a 25-basis-point rate cut, with some investors even betting on a sharper 50-basis-point move. In the eurozone, data remained moderate, with inflation still below the ECB's target.

- Current trend

The pair continues to consolidate within the 1.1570–1.1740 range. The dollar receives mixed signals: falling industrial prices and a soft labour market increase rate-cut chances, while strong previous GDP growth and political risks surrounding the Fed limit downside pressure. The euro holds steady, supported by a stable labour market and expectations of dovish rhetoric from the Fed.

- Outlook for 15–19 September

The baseline scenario suggests sideways trading within the 1.1570–1.1740 range. Upside potential exists if the Federal Reserve confirms dovish signals at the 17 September meeting, in which case the pair may test 1.1780–1.1830. A breakout below 1.1570 would intensify selling pressure, with 1.1380 as the next target. The balance of factors remains mixed: euro support comes from expected Fed easing, while the dollar benefits from strong macroeconomic data and its safe-haven status.

EURUSD fundamental analysis

The EURUSD pair ended the week near 1.1694.

The US Producer Price Index unexpectedly declined by 0.1% in August after a revised 0.7% rise in July. The drop contradicted forecasts of a 0.3% increase and eased inflation concerns, strengthening expectations of imminent policy easing.

Markets have fully priced in a 25-basis-point rate cut at the 17 September Fed meeting, with the likelihood of a more aggressive 50-basis-point move estimated at 8%. Markets anticipate at least one more cut before the end of the year.

On the political front, Donald Trump’s administration announced it would appeal the federal court’s decision temporarily blocking his attempt to remove Fed Governor Lisa Cook.

Meanwhile, the Senate is advancing the nomination of Stephen Miran, known for his dovish stance, to a Federal Reserve position.

EURUSD technical analysis

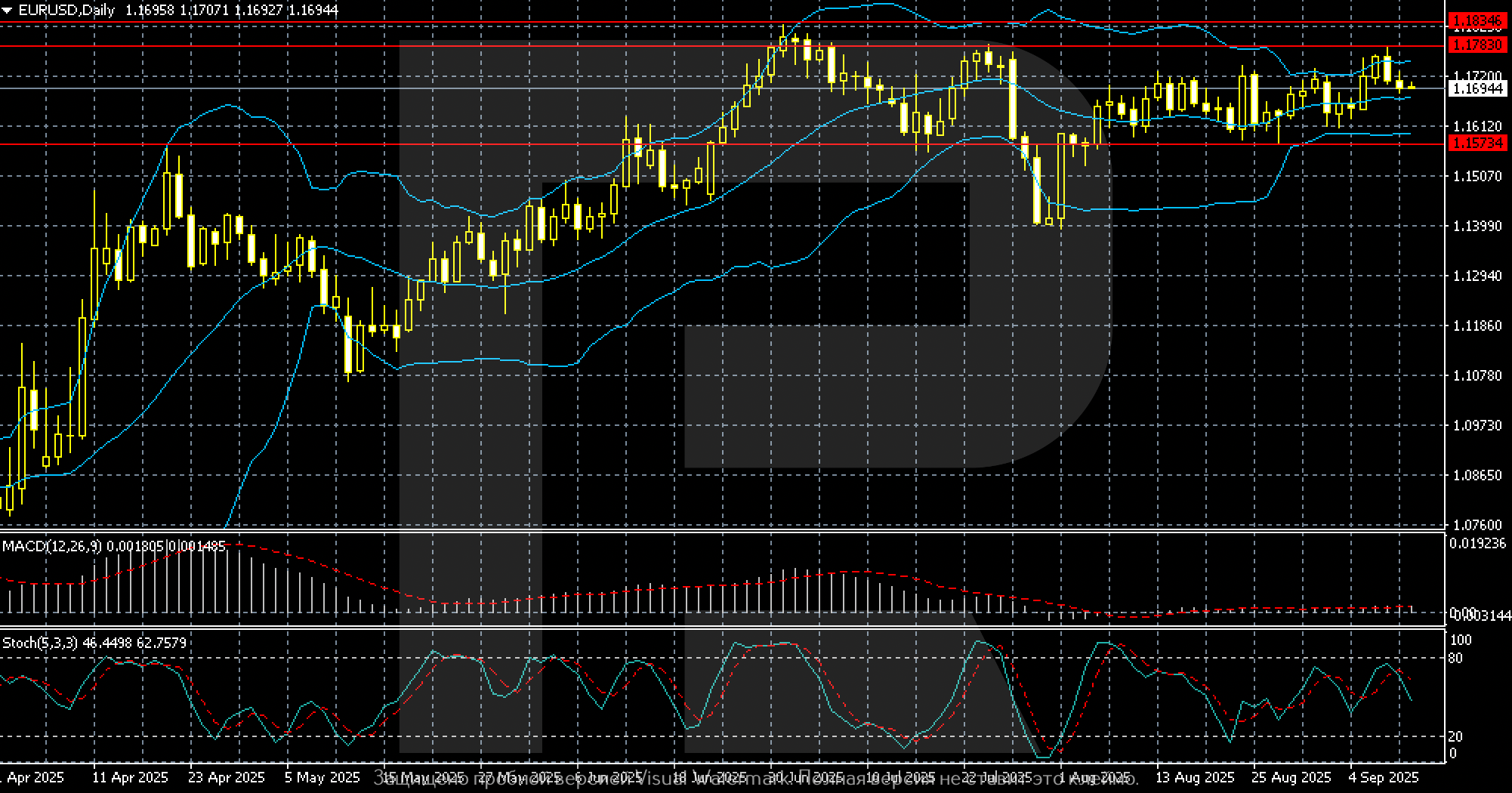

On the daily chart, the EURUSD pair is consolidating near 1.1694 after a period of notable fluctuations.

Since April, prices have trended upwards, peaking at 1.1834–1.1783 in July before undergoing a correction. In August, the euro stabilised in the 1.1573–1.1780 range, and currently the pair remains within these limits.

Technical indicators reflect uncertainty. Bollinger Bands have narrowed, indicating reduced volatility. The Stochastic hovers in the middle zone with no clear directional signal, while MACD sits near the zero line, confirming a lack of momentum.

Key resistance levels remain at 1.1780 and 1.1834, with support near 1.1573. A breakout above 1.1720 could open the path to the upper boundary of the range, while a breakdown could lead to a decline towards 1.1610–1.1570.

In summary, the pair is trading in a sideways range, with future direction largely dependent on external events and news flow.

EURUSD trading scenarios

Market sentiment for EURUSD remains cautiously neutral. Traders fully price in a 25-basis-point Federal Reserve rate cut on 17 September, with the likelihood of a more aggressive 50-basis-point move estimated at 8%. The euro holds above 1.1620, but upside remains capped due to dollar strength and global market uncertainty.

- Buy scenario (long)

Long positions remain relevant if the price holds above 1.1620–1.1650. An additional confirmation would come from consolidation above 1.1650 and clear dovish signals from the Fed. Targets are 1.1710 and 1.1740; if sentiment turns risk-on, a move towards 1.1780–1.1830 is possible.

Stop-loss is below 1.1580; a breakout below this level would increase seller pressure.

- Sell scenario (short)

Short positions become viable if the price breaks below 1.1580, especially amid strong US data and rising global demand for the US dollar as a safe-haven asset. The nearest downside targets are 1.1500 and 1.1380 if a downward wave develops.

Stop-loss is above 1.1675; consolidation above this level would confirm continued upward momentum.

Summary

The overall sentiment for the EURUSD pair remains moderately bullish for the euro, supported by expectations of a 25-basis-point Federal Reserve rate cut on 17 September.

The market has fully priced in this dovish step, although a small chance of a sharper move remains.

Despite strong US macroeconomic data, including GDP growth and certain labour market metrics, the US dollar remains under pressure due to easing inflation and increased attention to political risks around the Federal Reserve’s independence. In the absence of new bullish drivers for the dollar, the EURUSD pair may consolidate above current levels and test the resistance zone.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.