EURUSD weekly forecast: what will the Fed say

Market expectations for a Fed rate cut in September remain high, although the jump in US July PPI has reduced the probability of a more aggressive move. Profit-taking and moderate investor interest in risk assets add to pressure on the dollar.

EURUSD dynamics are shaped by the difference in policy expectations between the Fed and the ECB, as well as the market’s reaction to new data. If the Fed maintains its dovish stance, the euro may climb higher and test new local levels.

This outlook reviews the EURUSD prospects in late August.

EURUSD forecast for this week: quick overview

- Market focus

EURUSD stands at 1.1590 following Fed Chair Jerome Powell’s speech in Jackson Hole. The dollar index remains above 98.6 points. The probability of a 25-basis-point rate cut in September is now estimated at 75%, down from over 90% a week ago. Strong economic data provided additional support to the US dollar: home sales rose by 2.0% m/m, and the manufacturing PMI climbed to 53.3, the highest in three years.

- Current trend

The pair holds the 1.1550 support level but failed to consolidate above 1.1700. The medium-term trend is consolidation with a neutral bias, as the market balances Fed easing expectations with inflation risks.

- Outlook for 25-29 August

The base case scenario suggests a range of 1.1550-1.1710. A rise is possible on weak US data, while a drop below 1.1550 would open the way to around 1.1380.

EURUSD fundamental analysis

The market will analyse the outcome of Jerome Powell’s speech at the Jackson Hole Symposium, still seeking clarity on further rate cuts.

Interest rate futures now price in a 75% chance of a 25-basis-point Fed cut in September, compared to over 90% a week ago. Policymakers have warned that tariff-driven price pressures continue to pose inflation risks, while there are still no clear signs of a significant weakening in the labour market.

Previously, Kansas City Fed President Jeffrey Schmid stated that a moderately tight policy remains appropriate due to inflation threats. Cleveland Fed President Beth Hammack also emphasised that she currently does not support a rate cut.

Strong US data earlier supported the dollar. July existing home sales rose by 2.0% m/m versus a forecasted 0.2% drop and a previous 2.7% decline. The Leading Economic Index decreased by only 0.1% versus an expected -0.2%. Preliminary PMI data for August also beat expectations, with the S&P composite PMI coming in at 55.4, up from 55.1 in July, the manufacturing PMI at 53.3, up from 49.8, and the services PMI remaining unchanged at 55.4.

This marks the strongest increase in US manufacturing activity in three years.

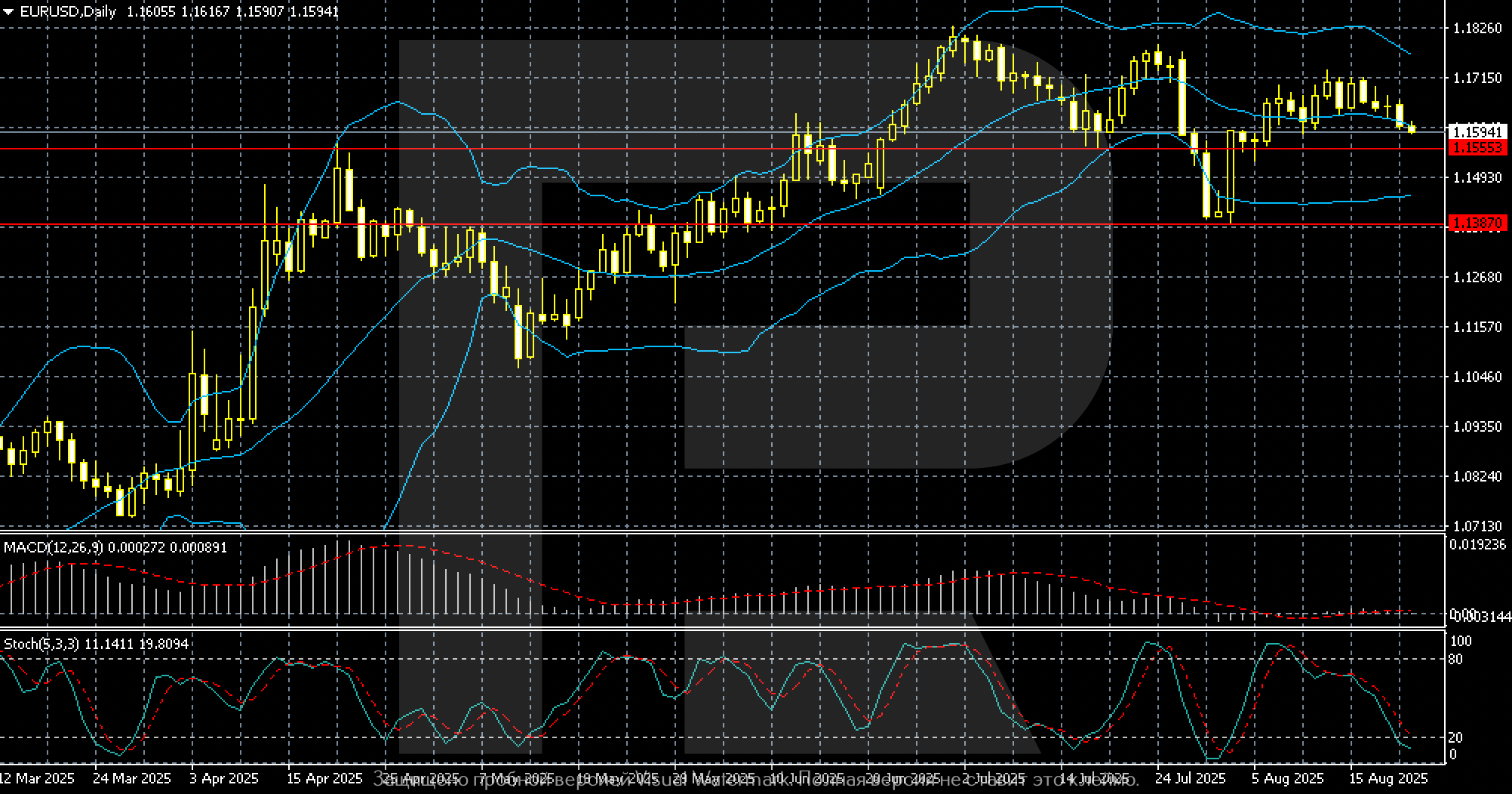

EURUSD technical analysis

On the daily chart, the EURUSD pair is trading near 1.1590, remaining under pressure after a mid-August drop. A support zone has formed around 1.1555, with deeper support at 1.1387. Resistance remains between 1.1715-1.1820.

The price has approached the lower Bollinger Band, suggesting local oversold conditions. The Stochastic Oscillator is also in oversold territory, indicating the possibility of a technical rebound. Meanwhile, MACD is moving near the zero line, signalling a weak trend and ongoing consolidation.

If the 1.1555 holds, a rebound towards 1.1650-1.1710 is possible. A breakout below this level would open the path to 1.1387. Overall, the pair’s momentum remains restrained, and further direction will depend on macroeconomic signals from the US and Europe.

EURUSD trading scenarios

The outlook for EURUSD this week is neutral-to-cautious.

The dollar consolidated above 98.6 points after Jerome Powell’s Jackson Hole speech and strong data: US home sales rose by 2.0% m/m, and the manufacturing PMI climbed to 53.3, a three-year high. The probability of a 25-basis-point Fed rate cut in September has dropped to 75%, down from over 90% a week ago. The euro is holding its ground, supported by Q2 eurozone GDP growth of +0.3% q/q. However, the pair failed to break above 1.1700.

- Buy (long) scenario:

Buying is relevant if the pair holds above 1.1620-1.1650. Additional confirmation would come from consolidation above 1.1650 and weak US data.

Targets are 1.1710 and 1.1740; with a favourable backdrop, the price could move to 1.1830.

Stop-loss is below 1.1580; a breakout below this level would signal a decline.

- Sell (short) scenario:

Selling becomes viable if the price drops below 1.1580, especially amid profit-taking and neutral eurozone data. The technical picture suggests a possible correction.

Targets are 1.1500 and 1.1380 if downward momentum builds.

Stop-loss is above 1.1675; consolidation above this level would confirm continued upward movement.

Summary

Positive sentiment in EURUSD persists, supported by expectations of a Fed rate cut in September. While the dollar index is hovering near highs, pressure on the US currency persists. The market still prices in a 75% chance of a dovish Fed move. Despite strong July US PPI data, which lowered the chances of a more aggressive rate cut, demand for risk assets and profit-taking support the euro.

The overall tone remains moderately positive. Market participants await fresh signals, with key data points including US retail sales and consumer confidence, as well as comments from Fed officials. In the absence of new USD drivers, the euro may hold its gains and test the upper range of August’s trading channel.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.