EURUSD weekly forecast: US budget deficit and trade wars in focus

Last week the euro reached new peaks but EURUSD corrected by week’s end, stabilising amid the US holiday and market readiness to react swiftly to changing conditions. This weekly EURUSD forecast analyses factors that could drive the pair to fresh 2025 highs.

EURUSD forecast for this week: quick overview

- Market focus: Donald Trump signs measures set to push the US budget deficit to its limits. On 9 July maximum trade tariffs come into effect.

- Current trend: The medium-term uptrend remains intact; short-term consolidation is near 1.1780.

- EURUSD forecast for 7-11 July 2025: Growth target – retest of the 1.1836 high; support levels – 1.1680 and 1.1439.

EURUSD fundamental analysis

EURUSD fundamentals remain mixed and contradictory. The dollar strengthened after the US jobs report showed 147,000 new jobs created in June – above forecasts and May’s reading. Unemployment fell to 4.1 % despite expectations of a rise. These figures lowered the chance of a near-term Fed rate cut and briefly restored dollar demand as a relatively stable currency.

In the UK and eurozone, attention turns to central bank policy. The Bank of England signals readiness to cut rates in August amid fears of overheating and a sharp economic slowdown. The ECB remains more reserved: President Christine Lagarde stated that further steps depend on data and that current rates are near neutral. This gives EUR local stability while the dollar weakens overall.

Geopolitics adds uncertainty. Reports of a US-Vietnam trade deal buoyed markets, but geopolitical risks rose as Iran suspended cooperation with the IAEA, potentially escalating Middle-East tensions. This boosts demand for safe havens, including the dollar.

Investors approach next week cautiously. Eurozone inflation data and US consumption figures will take centre stage. The eurozone’s preliminary CPI will show if ECB pause expectations hold, while US spending data will test demand resilience. These releases could set EURUSD’s short-term direction.

Meanwhile, Donald Trump is about to sign legislation that will skyrocket US national debt. Additionally, on 9 July tariffs for many countries reach their peak. Both factors carry significant market risk

EURUSD technical analysis

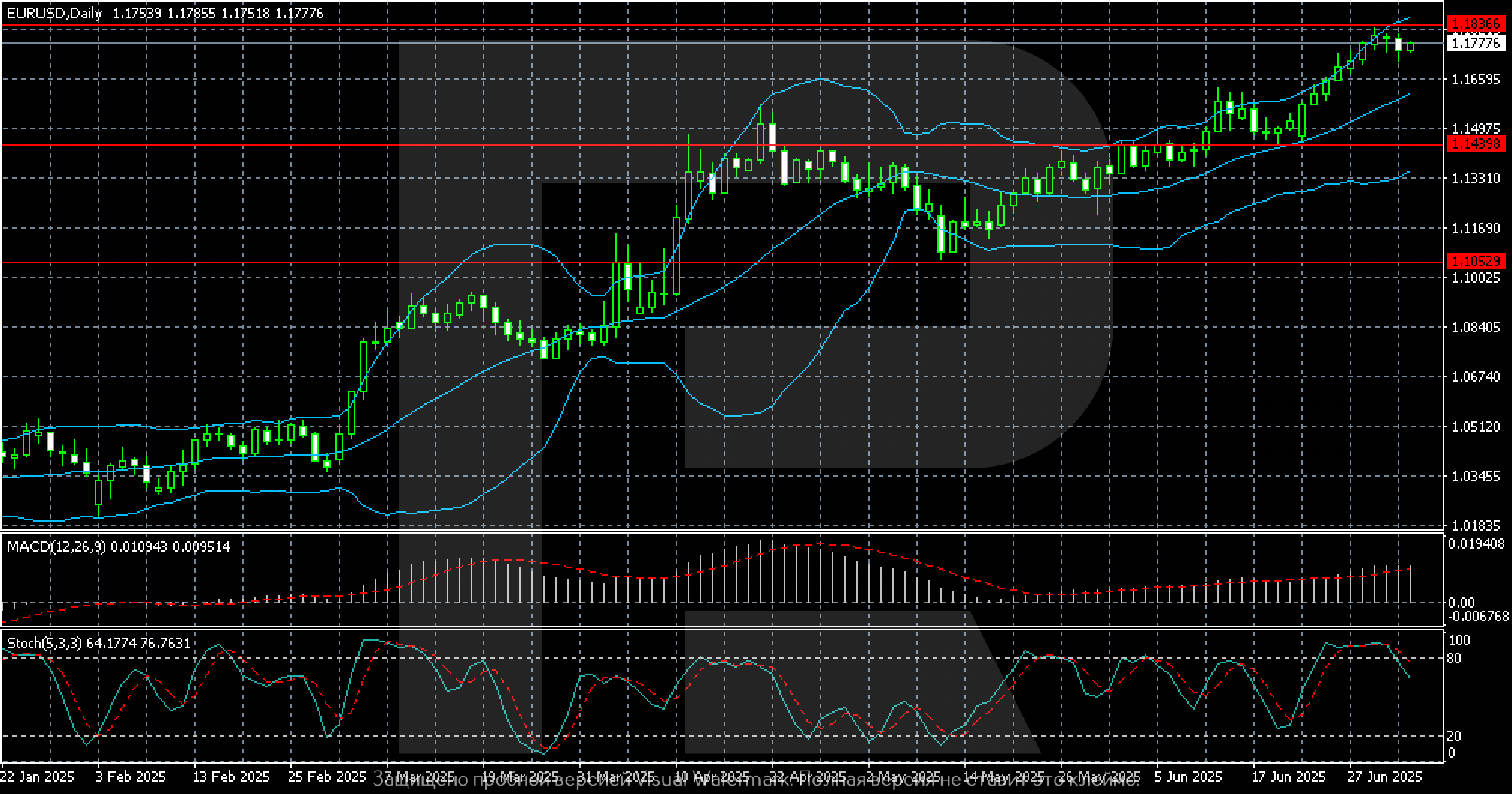

The daily chart shows EURUSD in a solid uptrend since mid-February 2025. Price broke key resistance levels, secured positions above 1.1680, and approached the local high of 1.1836 – the current major resistance.

Technical indicators support bullish sentiment:

- Bollinger Bands widen as price holds near the upper band, reflecting strong momentum.

- MACD remains positive with a rising histogram, signalling reinforced upward pressure.

- Stochastic (5,3,3) stays in overbought territory (around 76) but gives no clear reversal signal. This suggests growth could slow yet continue.

Key levels:

- Resistance: 1.1836 – the local high, a break of which opens the path to new peaks.

- Support: 1.1680, then 1.1439 – holding these areas is crucial to sustain the bullish outlook.

Overall, the technical picture stays positive: as long as price holds above 1.1680 and no adverse fundamental surprises emerge, EURUSD may test and break 1.1836. However, local overbought conditions could prompt a short-term correction before a new upward impulse.

EURUSD trading scenarios

Given the current outlook, sentiment remains cautiously bullish for next week, though confirmation is needed:

- Buy scenario:

If EURUSD stays above 1.1685 and stabilises near current levels (e.g., consolidation or a bounce on the daily/4H chart with volume or oscillator confirmation), longs can be considered. The nearest target is resistance at 1.1835. A break here paves the way to 1.1900 and beyond. Stop-loss – below 1.1630 to avoid trend-break risks.

- Sell scenario:

If the pair fails to hold above 1.1835 and forms a reversal pattern (e.g., bearish engulfing or double top) amid dollar strength, shorts can be taken. Immediate targets – 1.1685 and 1.1630. Stop-loss – above 1.1855 to limit losses from false signals. This scenario is mostly short-term as the medium-term trend remains upward.

Summary

The euro’s uptrend continues, backed by firm eurozone data and the Fed’s cautious tone as it awaits inflation clarity.

As long as EURUSD stays above 1.1685, the forecast for next week favours a move towards resistance at 1.1835, potentially extending to 1.1900 if momentum persists.

Key drivers will be fresh eurozone inflation data and US news. Their deviation from forecasts will decide who gains control – buyers or sellers.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.