EURUSD reacts to strong US labour market data

The EURUSD rate remains under pressure amid strong US macroeconomic data and reduced expectations of aggressive Federal Reserve easing, currently standing at 1.1752. Discover more in our analysis for 20 February 2026.

EURUSD forecast: key takeaways

- The US dollar gained support from strong macroeconomic data and hawkish Fed rhetoric

- US initial jobless claims fell by 23 thousand to 206 thousand

- The decline in claims confirmed the resilience of the US labour market and strengthened the dollar

- EURUSD forecast for 20 February 2026: 1.1695

Fundamental analysis

The EURUSD rate has declined for the third consecutive trading session, with sellers increasing pressure and attempting to gain a foothold below the key 1.1775 support level. The US dollar gained support from strong macroeconomic data and hawkish signals from the Federal Reserve. Traders have scaled back expectations of aggressive monetary easing by the regulator, although the market still prices in two 25-basis-point rate cuts by year-end.

US initial jobless claims fell significantly more than expected. The number of Americans filing for unemployment benefits for the first time decreased by 23 thousand to 206 thousand, while traders had forecast a decline only to 225 thousand. The drop in claims confirmed the strength of the labour market and reinforced the US dollar. Today, the market will focus on the release of preliminary US GDP data. The economy is expected to have grown by 3% in Q4 of last year. Confirmation of strong growth could provide additional support to the US dollar and increase pressure on the EURUSD pair.

Technical outlook

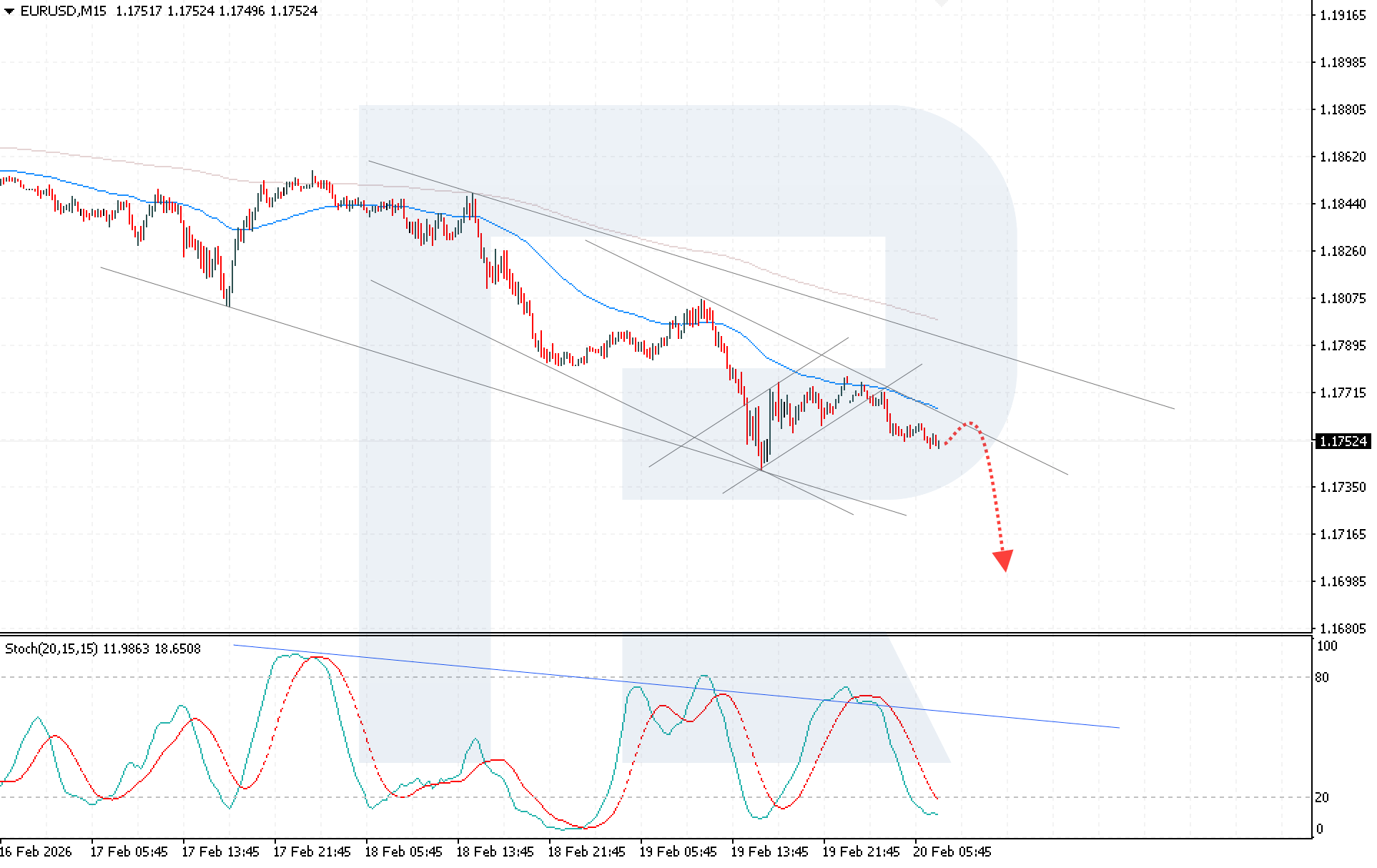

The EURUSD pair continues to decline within a steady bearish channel. Sellers have broken below the key support level at 1.1775 and are now attempting to consolidate below this level to maintain control.

Today’s EURUSD forecast suggests a decline towards 1.1695. The current technical structure indicates that the downside scenario remains intact. Previously, the Stochastic Oscillator rebounded from the resistance level, after which the price resumed its decline. The signal lines are now turning upwards from oversold territory, indicating a potential increase in selling pressure.

A breakout and consolidation below the nearest support level at 1.1745 would further confirm the bearish scenario.

The alternative scenario is possible if the price breaks above the upper boundary of the descending channel and consolidates above the 1.1775 resistance level. Such a signal would indicate easing selling pressure and a shift in control back to buyers.

EURUSD overview

- Asset: EURUSD

- Timeframe: M15 (Intraday)

- Trend: bearish

- Key resistance levels: 1.1775 and 1.1805

- Key support levels: 1.1745 and 1.1695

EURUSD trading scenarios for today

Main scenario (Sell Limit)

A rebound from the upper boundary of the descending channel at 1.1765 is expected to trigger a renewed bearish impulse. The potential move is about 70 pips with a risk of around 20 pips, resulting in a risk-to-reward ratio above 1:3.

- Take Profit: 1.1695

- Stop Loss: 1.1785

Alternative scenario (Buy Stop)

Consolidation above 1.1785 would confirm a breakout above the upper boundary of the descending channel and trigger a bullish correction.

- Take Profit: 1.1845

- Stop Loss: 1.1760

Risk factors

The downside EURUSD scenario may be threatened by weak US GDP data, which would strengthen the euro. A technical risk would be consolidation above 1.1775, signalling weakening selling pressure.

Summary

Strong US macroeconomic data and hawkish Fed rhetoric continue to bolster the dollar and keep risks tilted towards further EURUSD decline. Technical analysis indicates dominant bearish momentum, with a priority move towards 1.1695 as long as prices remain below the broken 1.1775 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.