The dollar on thin ice: US labor market data could ignite EURUSD

The euro continues to strengthen against the US dollar, with EURUSD quotes testing the 1.1750 level. Details — in our analysis for 16 December 2025.

EURUSD forecast: key trading points

- US Nonfarm Employment Change: previous value — 119K, forecast — 50K

- US Unemployment Rate: previous value — 4.4%, forecast — 4.5%

- EURUSD forecast for 16 December 2025: 1.1800

Fundamental analysis

The EURUSD forecast takes into account that the euro is forming a corrective wave today, with the pair trading around the 1.1750 level.

According to the forecast for December 16, 2025, US nonfarm employment growth may slow to 50K, compared with 119K in the previous period. If expectations align with the actual data, markets may experience heightened volatility along with another bout of US dollar weakness.

The effects of the US government shutdown continue to be felt, with statistical data being released gradually as calculations are completed. Nonfarm Payrolls are no exception. The publication of the actual figures almost always triggers strong market reactions and can either support the US dollar or, conversely, deprive it of its current positions.

The US unemployment rate reflects the percentage of people who are actively seeking work and are ready to start immediately. The indicator measures the number of unemployed individuals relative to the total labor force.

Fundamental analysis for December 16, 2025 assumes that the US unemployment rate may rise to 4.5%, up from 4.4% in the previous period. Actual data may differ from forecasts, which could have a direct impact on the EURUSD exchange rate.

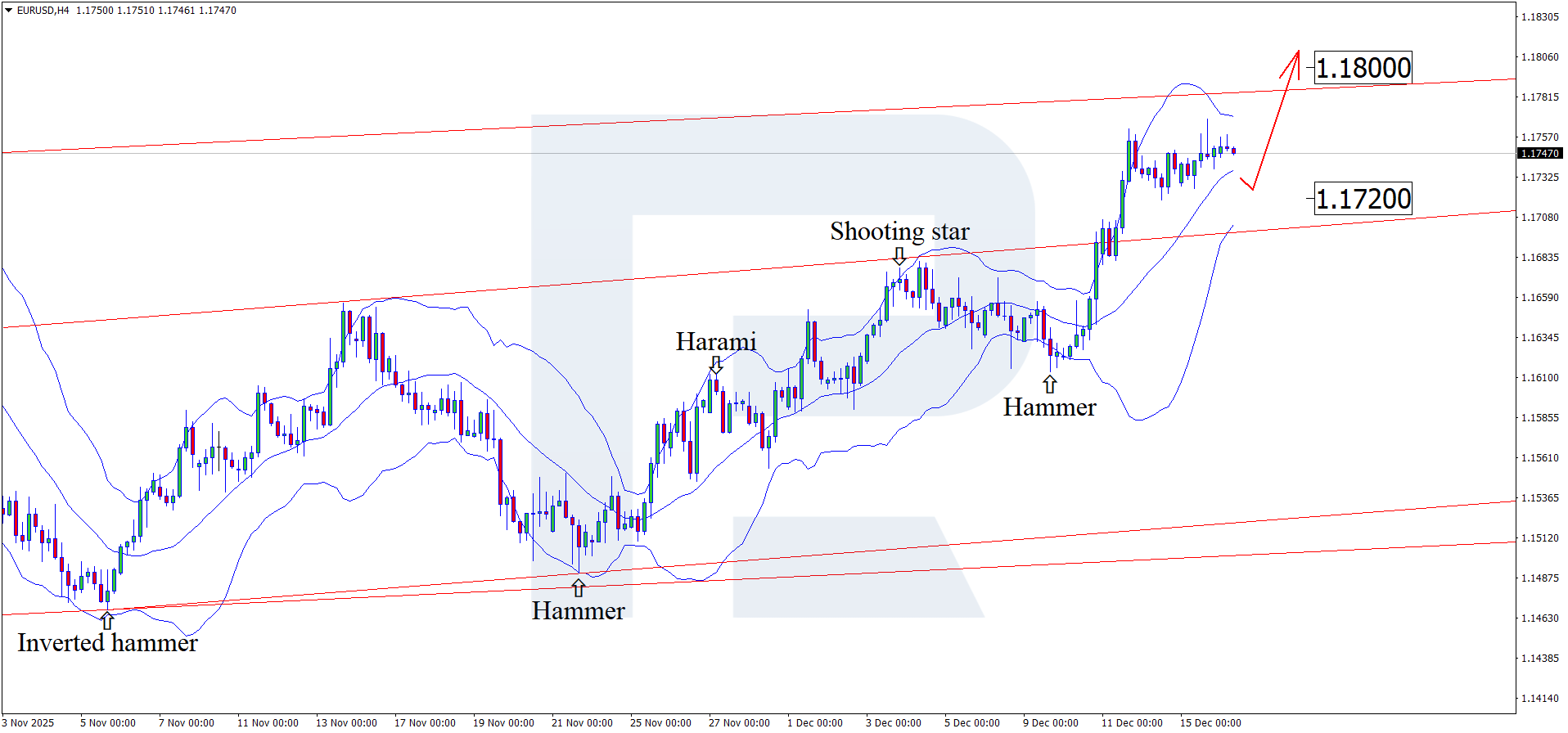

EURUSD technical analysis

On the H4 chart, EURUSD has formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, the pair may continue its upward wave as part of the pattern’s follow-through. Given that prices remain within an ascending channel, EURUSD may move toward the 1.1800 level. A breakout above this level would open the way for further continuation of the uptrend.

At the same time, today’s EURUSD forecast also considers an alternative scenario, in which the pair corrects toward the 1.1720 level before resuming growth.

Summary

The euro continues to strengthen amid upcoming US labor market data. EURUSD technical analysis suggests a pullback toward the 1.1720 support level before a potential continuation of the upward move.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.