Formation of a Flag pattern on EURUSD increases the probability of trend continuation

The EURUSD pair continues to rise amid a combination of bullish momentum and uncertainty surrounding US monetary policy. The current quote stands at 1.1732. Details — in our analysis for 15 December 2025.

EURUSD forecast: key trading points

- Market expectations for the first ECB rate hike are shifting to 2026

- Delayed macroeconomic data has increased uncertainty in assessing the state of the US economy

- EURUSD forecast for 15 December 2025: 1.1865

Fundamental analysis

The EURUSD pair is strengthening for the fourth consecutive trading session. Buyers have tested strong resistance near the 1.1755 level, where the upward move noticeably slowed. Investors expect the ECB to keep interest rates unchanged, while market expectations are gradually shifting toward a possible first rate hike by the regulator in 2026.

Additional uncertainty comes from delays in the publication of US macroeconomic data. A government shutdown has postponed the release of statistics; however, upcoming reports should provide investors with a clearer picture of the state of the world’s largest economy. The key focus remains the US employment report for November, scheduled for release on Tuesday.

Last week, the Federal Reserve cut interest rates, but Fed Chair Jerome Powell signaled that further monetary policy easing in the near term is unlikely. The regulator is waiting for a clearer assessment of economic conditions.

EURUSD technical analysis

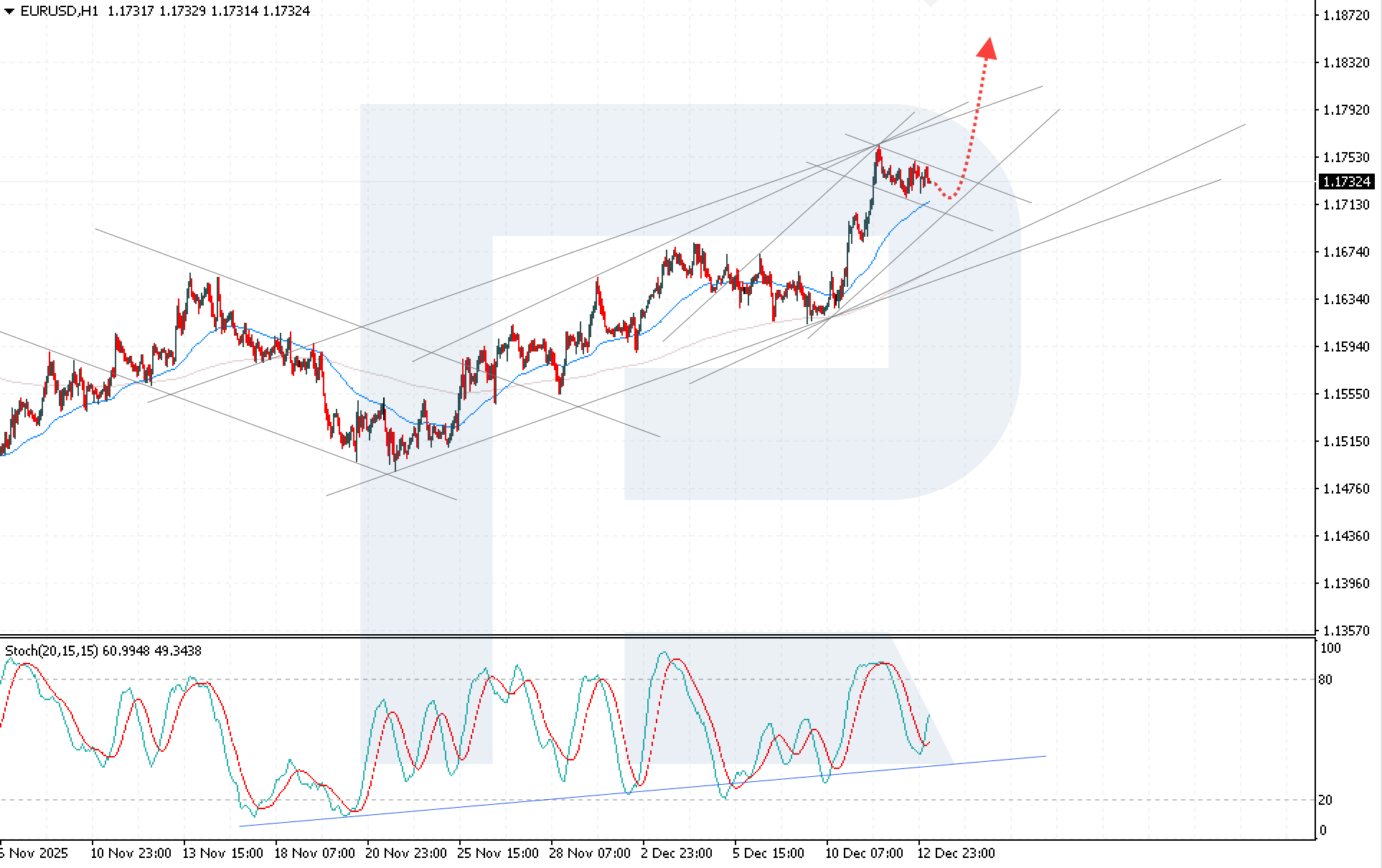

The EURUSD pair is correcting after rebounding from the upper boundary of the bullish channel. The current price structure indicates the formation of a bullish Flag pattern, with a projected target at 1.1865.

The EURUSD outlook for today suggests a continuation of the upward move, with the nearest target at 1.1835. An additional signal in favor of further growth is provided by the Stochastic Oscillator. The indicator’s signal lines have turned upward and formed a bullish crossover, indicating a renewal of upward momentum.

A firm consolidation above the 1.1760 level will confirm the bullish scenario and signal a breakout above the upper boundary of the Flag pattern.

Summary

The current EURUSD advance is constrained by resistance at 1.1755, while the pair’s further dynamics will depend on US labor market data and signals from the Federal Reserve against the backdrop of expectations for a stable ECB policy stance. Technical analysis of EURUSD points to the preservation of the bullish scenario with growth potential toward the 1.1835 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.