EURUSD under pressure, but a rebound remains possible

The EURUSD pair is hovering around 1.1617. The euro is trading at a three-week low due to the firm position of the US dollar. Discover more in our analysis for 16 July 2025.

EURUSD forecast: key trading points

- The EURUSD pair fell to a three-week low amid expectations of stable Federal Reserve monetary policy

- Investors doubt there will be several rate cuts this year

- EURUSD forecast for 16 July 2025: 1.1659

Fundamental analysis

The EURUSD rate has frozen around 1.1617 as the market reassesses expectations for a Fed rate cut. Today, investors await the latest US Producer Price Index (PPI) report, which could shed light on the inflationary impact of the Trump administration's tariff policy.

On Tuesday, the dollar strengthened after mixed US consumer inflation data. The figures prompted the market to revise its Fed rate cut outlook. While the headline inflation index matched forecasts both year-on-year and month-on-month, the core reading came in below expectations.

Federal Reserve Bank of Dallas President Lorie Logan confirmed the regulator’s cautious approach, stating that rates will likely need to remain at current levels longer to curb inflation amid trade barriers.

As a result, market participants reduced the odds of multiple rate cuts in 2025. The chances of policy easing in September are now only slightly above 50%.

The EURUSD forecast is negative.

EURUSD technical analysis

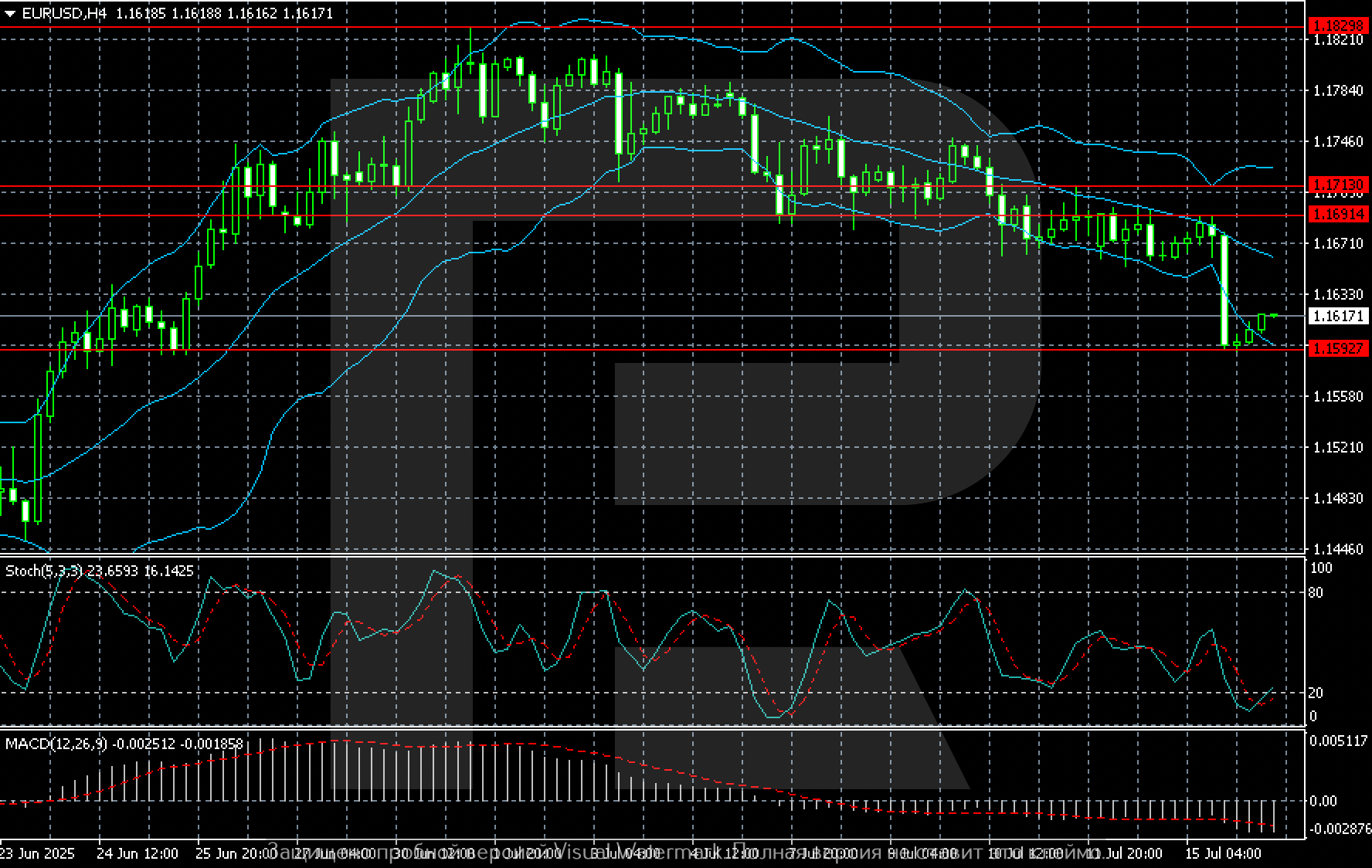

On the H4 chart, the EURUSD pair shows a local rebound from the key support level of 1.1592, which held off selling pressure and marked a turning point. The pair remains within the descending channel formed at the end of June. The current recovery is still moderate. The nearest resistance lies at 1.1659, a level that previously served as support. The next target for buyers is 1.1713, where the upper boundary of the short-term range runs.

If the EURUSD pair holds above 1.1592, a consolidation phase is possible, with attempts to test 1.1659-1.1713. A breakout below support would return the pair to selling pressure and could pave the way to new lows.

Summary

The EURUSD pair stabilised after a sharp decline but remains within a descending channel. The EURUSD forecast for today, 16 July 2025, does not rule out a move towards 1.1659.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.