EURUSD fell below 1.1700 ahead of US inflation data

The EURUSD rate has declined below 1.1700 amid a downward correction and expectations of new tariffs on EU goods. The market awaits today's US inflation report. Discover more details in our analysis for 15 July 2025.

EURUSD forecast: key trading points

- Market focus: today, the market expects US inflation data – Consumer Price Index

- Current trend: correcting downwards

- EURUSD forecast for 15 July 2025: 1.1760 or 1.1640

Fundamental analysis

The euro is retreating moderately following US President Donald Trump’s threat to impose 30% tariffs on EU goods, expected to come into effect on 1 August. However, market participants still hope these measures might be softened through ongoing trade negotiations.

Today, the main market focus shifts to the release of US inflation data for June – the Consumer Price Index (CPI). Forecasts point to a 0.3% rise month-on-month and a 2.6% year-on-year increase. The CPI figures could influence the Federal Reserve's rate decision at the upcoming meeting.

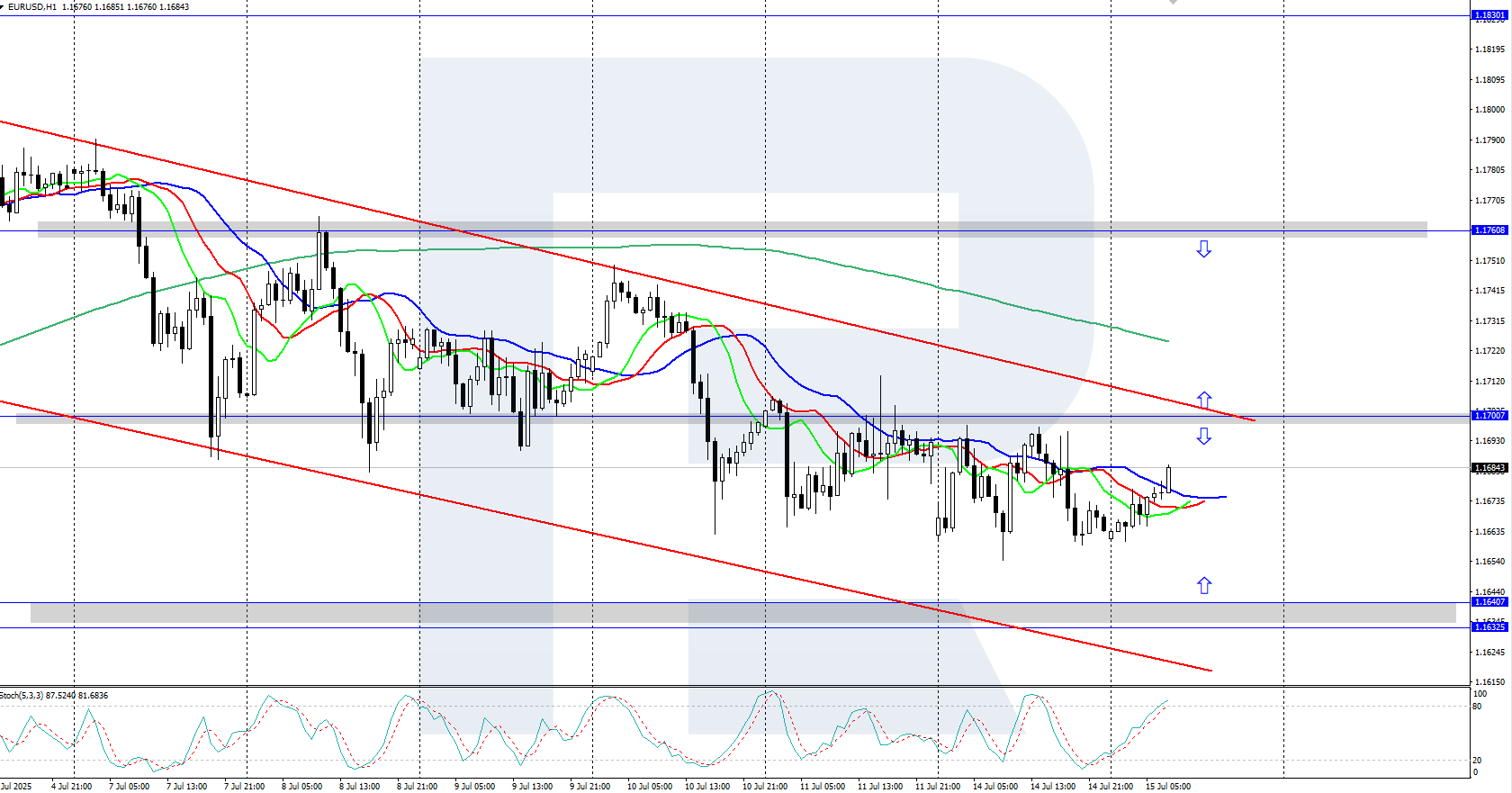

EURUSD technical analysis

On the H4 chart, the EURUSD pair continues to correct within a downward price channel, having fallen this morning below the 1.1700 level. A continued move down towards the 1.1640 support level remains possible. The daily trend for the pair remains upward, which means a resumption of growth is still possible after the correction ends.

The short-term EURUSD forecast suggests a decline towards 1.1640 in the near term if bears keep the price below 1.1700. However, if bulls succeed in reclaiming the 1.1700 area, growth may continue towards resistance at 1.1760 and higher.

Summary

EURUSD has fallen below 1.1700 in a downward correction. Today’s key focus is the US CPI data release.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.