AUDUSD down 1% over the week: data and USD weigh on the Aussie

The AUDUSD pair has fallen to 0.7041, with Australia’s national currency struggling under pressure from the US dollar. Discover more in our analysis for 20 February 2026.

AUDUSD forecast: key takeaways

- The AUDUSD pair is under pressure due to rate expectations and PMI data

- A strong US dollar prevents the Aussie from stabilising

- AUDUSD forecast for 20 February 2026: 0.7015

Fundamental analysis

The AUDUSD rate is moderately declining on Friday, moving towards 0.7041. Over the week, the AUD has lost about 1%. The pressure has been driven by a stronger US dollar and weaker preliminary domestic PMI data.

February business activity indices slowed across all sectors. The composite, services, and manufacturing readings declined compared to January but remained above the 50 mark, indicating continued economic growth amid persistent inflationary pressures.

An additional factor is the strong US dollar, supported by solid macroeconomic data and hawkish signals from the Federal Reserve.

At the same time, expectations of a rate hike in Australia are rising. The market estimates the likelihood of policy tightening by the Reserve Bank of Australia by May at 76%, with the chances of a move as early as March up to 28%.

The shift in expectations is linked to more resilient domestic data and hawkish comments from the regulator. However, the baseline scenario remains a May meeting move unless January CPI and Q4 GDP deliver a significant positive surprise.

The AUDUSD forecast is mixed.

Technical outlook

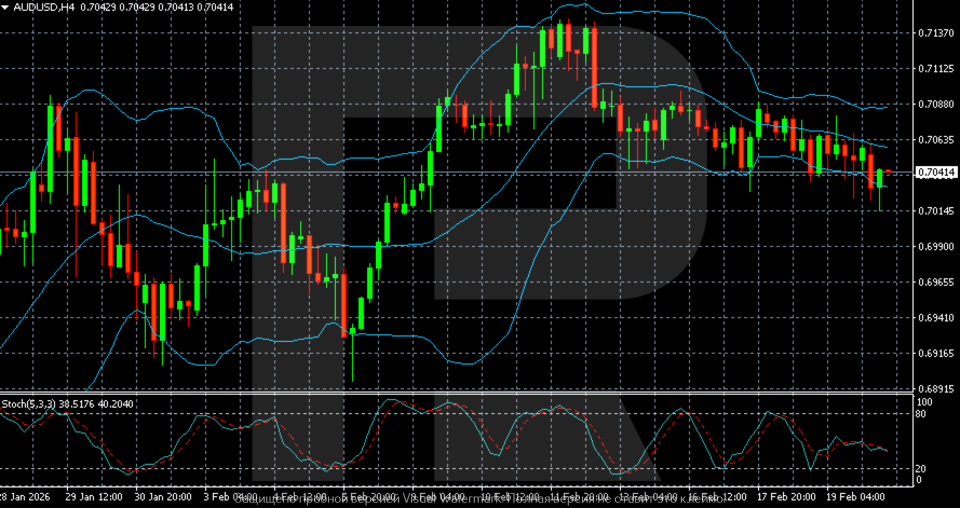

On the H4 chart, after a momentum-driven rise towards 0.7130–0.7140, the AUDUSD pair entered a phase of gradual correction. A series of lower highs is forming, indicating waning bullish momentum. The pair is currently trading around 0.7040, approaching the lower boundary of the short-term range.

Bollinger Bands have begun to narrow after widening at the peak of the move, signalling declining volatility and a transition into consolidation. The price is trading near the indicator’s midline, confirming a balance of forces after the pullback.

The Stochastic Oscillator is in neutral territory and moving lower, without clear oversold signals, suggesting continued moderate downside pressure.

The nearest support level lies in the 0.7015–0.7000 zone, while resistance is located at 0.7080–0.7110. As long as the pair holds below 0.7080, the short-term bias remains neutral to bearish.

AUDUSD overview

- Asset: AUDUSD

- Timeframe: H4 (Intraday)

- Trend: bearish

- Key resistance levels: 0.7080 and 0.7110

- Key support levels: 0.7015 and 0.7000

AUDUSD trading scenarios for today

Main scenario (Sell Limit)

Sustained pressure below 0.7080 confirms a corrective decline after the rally to 0.7130–0.7140. Near the 0.7070–0.7080 zone, short positions may target 0.7015. Additional support for this scenario comes from the strong US dollar and weak domestic PMI dynamics.

- Sell Limit: 0.7075

- Take Profit: 0.7015

- Stop Loss: 0.7115

Alternative scenario (Buy Stop)

A breakout and consolidation above 0.7110 would signal a return of buyers and cancel the short-term bearish bias. In this case, recovery towards 0.7140 is likely.

- Buy Stop: 0.7110

- Take Profit: 0.7140

- Stop Loss: 0.7065

Risk factors

Risks for the Aussie include further strengthening of the US dollar amid hawkish Fed rhetoric and weak domestic economic data. Support for the AUD may come from stronger CPI and GDP figures and rising expectations of tighter policy from the Reserve Bank of Australia.

Summary

The AUDUSD pair continues to move lower. The forecast for 20 February 2026 suggests selling pressure towards 0.7015.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.