US dollar weakness opens the way for AUDUSD growth

US industrial stagnation gives AUDUSD a chance to rise towards 0.6530. Find out more in our analysis for 17 October 2025.

AUDUSD forecast: key trading points

- US industrial production for September: previously at 0.1%, projected at 0.1%

- AUDUSD forecast for 17 October 2025: 0.6530

Fundamental analysis

Today’s AUDUSD outlook favours the Australian dollar, which has a chance to partially regain ground against the US dollar. The pair is currently trading near 0.6470.

The decline in the AUDUSD rate has largely been driven by weaker Australian labour market data, with the unemployment rate up to 4.5%, the highest since 2021.

Another factor weighing on the Aussie is the expectation that the Reserve Bank of Australia may lower interest rates again in the coming months.

Meanwhile, the US dollar remains under pressure as markets anticipate further Federal Reserve monetary easing. These expectations are weighing on the USD and creating room for the Australian dollar to strengthen.

According to the forecast for 17 October 2025, US industrial production may remain flat at 0.1% in September, signalling stagnation in the manufacturing sector. This would add further pressure on the dollar and could push the AUDUSD pair higher.

AUDUSD technical analysis

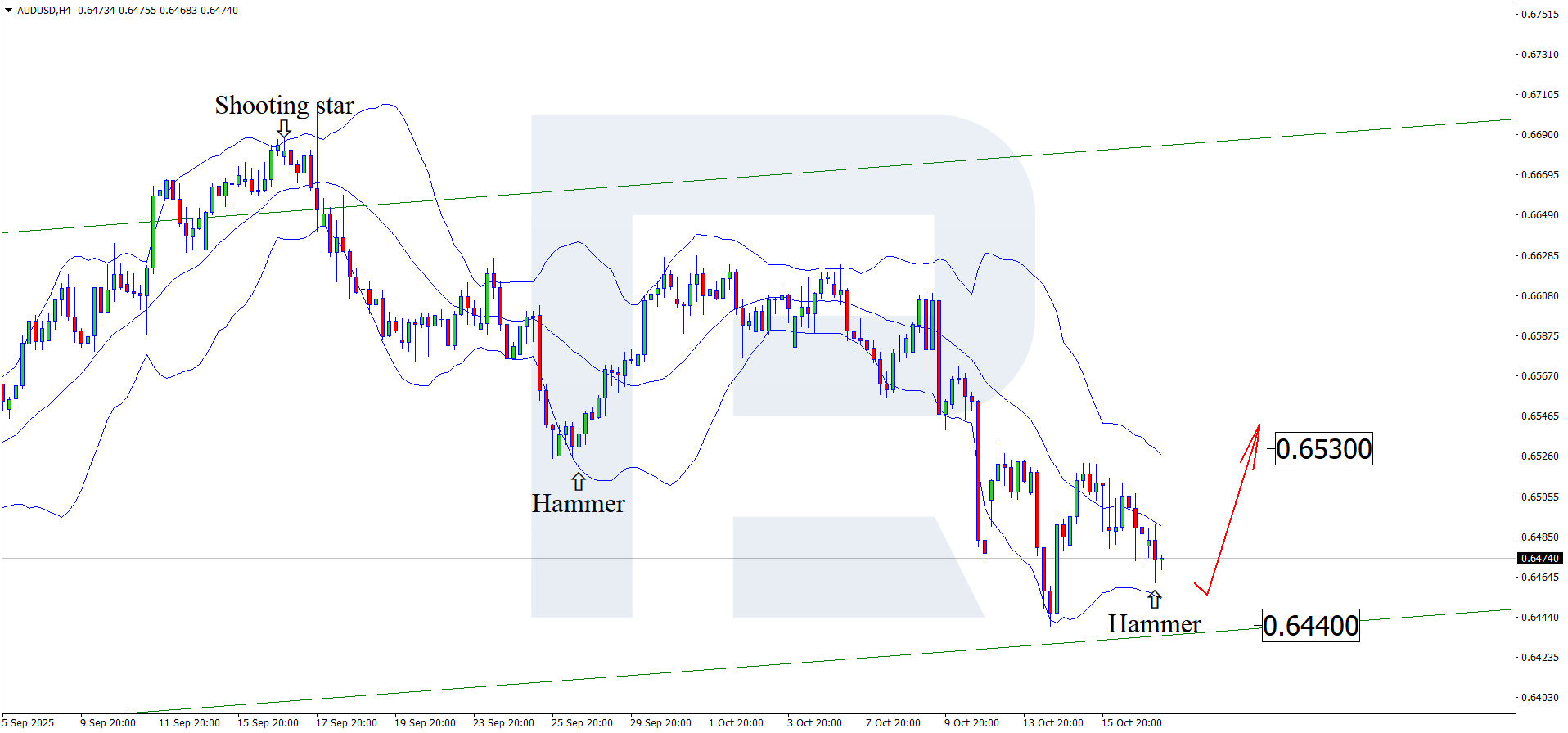

On the H4 chart, the AUDUSD rate tested the lower Bollinger Band and formed a Hammer reversal pattern. At this stage, prices may develop a corrective wave following this signal, with the target for the pullback at the 0.6530 resistance level.

The AUDUSD forecast also considers an alternative scenario, where the pair could extend its decline towards the nearest support at 0.6440 without a correction towards the resistance level.

Summary

The AUDUSD forecast for 17 October 2025 suggests a potential partial recovery of the Australian dollar. Technical analysis indicates a possible corrective wave towards 0.6530 before a decline.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.