A hole in Australia’s wallet: falling exports could crash AUDUSD

The decline in Australia’s trade balance may trigger a correction in the AUDUSD rate to 0.6545. Details – in our analysis for 4 July 2025.

AUDUSD forecast: key trading points

- Australia’s trade balance: previous value – 4.859 bln, forecast – 2.238 bln

- AUDUSD is forming a corrective wave

- AUDUSD forecast for 4 July 2025: 0.6545

Fundamental analysis

Australia’s trade balance is the difference between the value of all goods and services Australia sells abroad (exports) and what it buys from other countries (imports). If exports exceed imports – a surplus arises; if less – a deficit.

For Australia, the trade balance is especially important, as the lion’s share of its exports consists of raw materials (iron ore, coal, gas), which strongly influence the Australian dollar’s exchange rate and the country’s economy as a whole. The indicator shows how much the country earns from global trade and how vulnerable it is to commodity price fluctuations.

Today’s AUDUSD forecast considers that for the previous reporting period the figure fell to 2.238 bln, and this decline has been ongoing for the past three months. Against this backdrop, the AUDUSD rate is forming a corrective wave after significant growth.

AUDUSD technical analysis

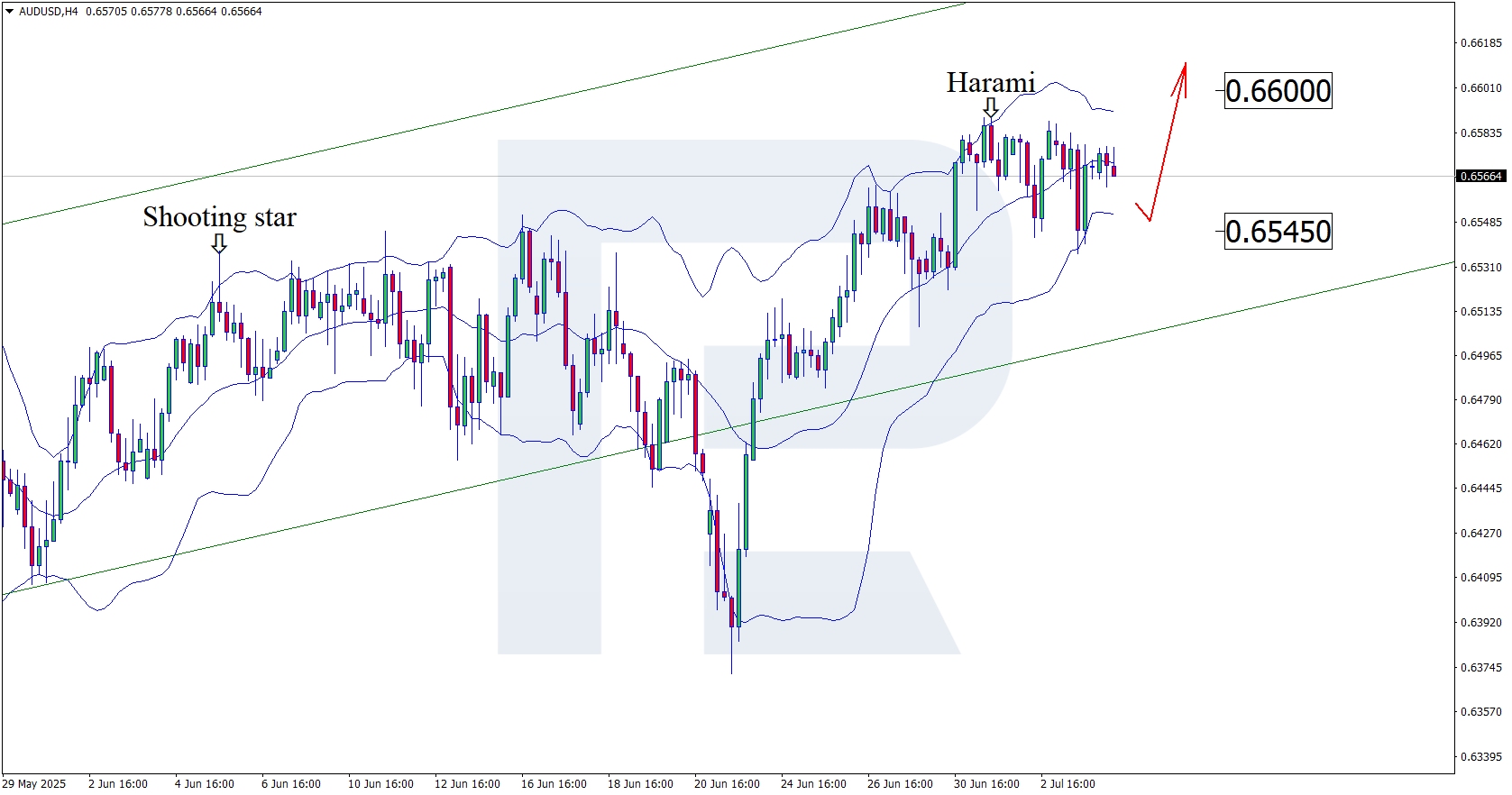

On the H4 chart, AUDUSD tested the upper Bollinger Band and formed a Harami reversal pattern. At this stage, it is developing a corrective wave in line with the received signal. The target for the pullback may be the support level at 0.6545.

The AUDUSD forecast also considers an alternative market scenario. Taking into account that quotes have been forming a correction over the past few trading sessions, after its completion, further growth towards the nearest resistance at 0.6600 can be expected. A breakout of this level will open the prospect for the continuation of the upward trend.

Summary

The decline in Australia’s economic indicators, combined with AUDUSD technical analysis, suggests a correction to support at 0.6545 before resuming growth.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.