Record-breaking buyback and tariff threat: updated forecast for Apple shares

Tariffs may cost Apple 900 million USD, but the 110 billion USD buyback program could support AAPL shares

Apple Inc. (NASDAQ: AAPL) has delivered better-than-expected results for Q2 2025 of the financial year, with revenue reaching 95.4 billion USD and earnings per share standing at 1.65 USD. The increase was driven by higher-than-anticipated sales of iPhone, iPad, and Mac, while service revenue rose by 12% but fell short of forecasts. Despite these strong results, the company’s shares dropped by more than 4% following the announcement. Investors were concerned about potential costs related to the introduction of tariffs, which Apple’s management has estimated at 900 million USD.

This article examines Apple Inc., conducts a fundamental analysis of its financial report, strengths and weaknesses, and provides a technical analysis of Apple shares, forming the basis for Apple’s stock forecast for 2025.

About Apple Inc.

Apple Inc. is a US company founded in 1976 by Steve Jobs, Stephen Wozniak, and Ronald Wayne. Initially, it focused on manufacturing personal computers, but later expanded its operations to become the leader in the consumer electronics industry. Apple is renowned for its innovative devices – the iPhone, iPad, Mac, Apple Watch, and AirPods – and its unique ecosystem, which integrates these products into its existing services.

Apple went public on the NASDAQ on 12 December 1980 under the AAPL ticker symbol. The company raised approximately 100 million USD, marking it as one of the largest and most successful initial public offerings of its time.

Consistent demand from investors drove up the value of Apple shares, eventually limiting the number of participants able to afford them. As a result, the company has conducted four stock splits in its history, each time lowering the share value and increasing the number of shares. In 1980, there were approximately 4.6 million shares in circulation; by 2024, this figure had exceeded 15 billion.

In addition to investor demand, Apple generates market demand for its stock through share buybacks. This strategy enables the company to reduce the total number of outstanding shares, thereby increasing earnings per share for the remaining stock and making the securities more appealing to investors. Since Apple introduced its share buyback program in 2012, it has allocated approximately 700 billion USD to this initiative, making it one of the world’s leading companies in stock buyback volume, surpassing major corporations in other sectors.

The stock buyback is financed through free cash flow and low-interest loans.

Image of the company name Apple Inc.Apple Inc.’s main revenue streams

In 2025, the company’s revenue came from the following streams:

- iPhone: the primary source of income, generating about half of the company’s total revenue due to its popular smartphone models

- iPad and Mac: earnings from tablet and computer sales for both personal and business use. Although their share of total revenue has declined, they remain a vital part of Apple’s business model

- Wearables, home goods, and accessories: revenue from sales of Apple Watch, AirPods, and other accessories, including MagSafe and apps for iPhone, Mac, and iPad

- Services: a rapidly expanding area that includes subscriptions to Apple Music, Apple TV+, iCloud, App Store, and other services. Services have become one of the company’s most profitable revenue streams

- Financial services: Apple is constantly improving its financial products, such as the Apple Pay payment system and the Apple Card credit cards, and actively expanded its offerings in this area in 2024

- Products for businesses and corporate services: Apple offers a range of devices and services tailored for corporate clients, including businesses, educational institutions, and healthcare organisations

Conclusion: based on the above, Apple generates revenue from manufacturing and selling hardware devices and earns from digital service subscriptions and commissions on App Store transactions.

Apple Inc.’s strengths and weaknesses

Apple has several significant advantages over its competitors that help it remain one of the world’s most successful and profitable companies:

- Strong brand and customer loyalty: Apple boasts one of the world’s most recognisable and valuable brands. User loyalty to Apple products is exceptionally high, with customers often staying with the brand for years, regularly upgrading their devices and increasing their overall expenditure on Apple products and services

- Unique product ecosystem: Apple has built an integrated ecosystem in which devices (iPhone, iPad, Mac, Apple Watch, and others) and services (iCloud, Apple Music, Apple TV+, and the App Store) work together seamlessly. This user-friendly system fosters loyalty and makes switching to competitors less appealing

- Control over hardware and software: the company rigorously analyses the performance of the products it launches, enabling it to design optimised and high-performing devices. This approach ensures high quality, security, and stability – advantages that are difficult for competitors relying on external suppliers and outsourced operating systems to replicate

- Innovation and design: Apple is renowned for its distinctive design philosophy and focus on user preferences. The company continuously invests in research and development to introduce exclusive features and deliver compelling designs

- High-margin products and services: Apple maintains stable profitability due to its premium pricing strategy and high-margin offerings. This approach allows the company to preserve financial stability while investing in future innovations, marketing efforts, and stock buybacks

- Focus on confidentiality and security: Apple pays special attention to protecting its customers’ personal data and keeping it private. The company has implemented advanced security measures in iOS and its other products, ensuring biometric safeguards for sensitive information while restricting data-sharing with external parties

- Diversified revenue streams: besides selling electronic devices, Apple actively develops services and financial products (Apple Pay, Apple Card). These ventures ensure a steady income stream even during potential declines in gadget sales

The above advantages enable Apple to sustain its market leadership despite intense competition from other technologically advanced companies.

Apple also faces several vulnerabilities that its competitors could exploit. These weaknesses are associated with specific aspects of its ecosystem and external factors, including antitrust investigations into the company.

- Reliance on closed-loop systems: the Apple ecosystem (App Store, iCloud, iMessage, and other services) operates on a closed-loop model, significantly limiting user opportunities. Competitors offering more open ecosystems (e.g. Android devices with a broader application selection) attract users who value feature diversity and freedom of choice. Antitrust authorities have also criticised Apple’s closed system for stifling competition

- High App Store commissions: the substantial fees imposed on App Store product developers have caused negative reactions from major players, including Epic Games (the developer of Fortnite), which accused Apple of excessive monopolisation. Many developers seek ways to bypass the App Store, potentially impacting Apple’s revenue. In addition, antitrust authorities are demanding changes to the App Store’s policies, which could reduce commissions and limit Apple’s control over its ecosystem

- Antitrust investigations: Apple is subject to numerous antitrust cases in the US, EU, and other regions regarding alleged monopolistic practices, particularly concerning the App Store and Apple Pay. If required to make significant changes to its business model, Apple may face reduced profitability and diminished control over its ecosystem

- Reliance on iPhone sales: Apple derives a considerable share of its revenue from iPhone sales. Despite attempts to diversify (through Apple Watch, AirPods, and services), reliance on the iPhone remains high. Competitors like Samsung Electronics Co Ltd and Xiaomi Corp offer alternative devices with innovative cameras, screens, and designs, posing a serious threat to iPhone sales. If interest in the iPhone declines, this would greatly impact Apple’s revenue

- Intensifying competition in the services and subscriptions segment: Apple is rapidly expanding its services and subscriptions segment (Apple Music, Apple TV+, iCloud, and Apple Arcade). However, it faces prominent rivals in this area, such as Netflix Inc. (NASDAQ: NFLX), Spotify Technology S.A. (NYSE: SPOT), Walt Disney Co. (NYSE: DIS) and others. These competitors offer more affordable and open solutions, which could lead to an outflow of users from Apple’s ecosystem if they are not bound to its devices

These vulnerabilities pose both external and internal risks to Apple. In particular, antitrust investigations jeopardise its control over the App Store and its policies on handling competitors. Hefty fines or a shift in its business model could significantly impact its profitability and market position. In Q3 2024, Apple paid a 10.2 billion USD fine imposed by the European Union, adversely affecting its profitability. The European regulator continues to monitor the company closely, with Apple facing the threat of a new fine that could amount to 10% of its total annual revenue.

Apple Inc. Q4 2024 financial report

Apple reported strong financial results for Q4 of the 2024 fiscal year. Below are the key figures from the report:

- Revenue: 94.93 billion USD (+6%)

- Net income: 14.73 billion USD (-36%)

- Earnings per share: 0.97 USD (-34%)

- Operating profit: 29.59 billion USD (+9%)

Revenue by segment:

- iPhone: 46.22 billion USD (+5%)

- Mac: 7.74 billion USD (+2%)

- iPad: 6.95 billion USD (+8%)

- Wearables, Home, and Accessories: 9.04 billion USD (-3%)

- Services: 24.97 billion USD (+12%)

Revenue by region:

- Americas: 41.66 billion USD (+4%)

- Europe: 24.92 billion USD (+11%)

- Greater China: 15.03 billion USD (-1%)

- Japan: 5.92 billion USD (+8%)

- Rest of Asia Pacific: 7.38 billion USD (+16%)

Nearly all metrics, except for data from the Wearables, Home, and Accessories segments, demonstrated growth. However, the company’s net profit still dropped by 36%. This decline was due to a 10.2 billion USD fine imposed by the European Union. Excluding this one-off payment, the net profit growth in Q4 2024 would have been 8%.

The company provided a conservative forecast for the next quarter. Revenue is expected to grow in the low to mid-single digits year-on-year, service income is anticipated to reach double-digit figures, and gross profit is forecasted to be 46-47%, 1-2% higher than the previous quarter.

Apple Inc. Q1 2025 financial report

Apple released its Q1 2025 earnings report on 30 January 2025. The key report data is outlined below:

- Revenue: 124.30 billion USD (+4%)

- Net income: 36.33 billion USD (+7%)

- Earnings per share: 2.40 USD (+10%)

- Operating profit: 42.83 billion USD (+6%)

Revenue by segment:

- iPhone: 69.13 billion USD (-1%)

- Mac: 8.99 billion USD (+15%)

- iPad: 8.09 billion USD (+15%)

- Wearables, Home, and Accessories: 11.75 billion USD (-2%)

- Services: 26.34 billion USD (+14%)

Revenue by region:

- Americas: 52.44 billion USD (+4%)

- Europe: 33.86 billion USD (+11%)

- Greater China: 18.51 billion USD (-11%)

- Japan: 8.98 billion USD (+15%)

- Rest of Asia Pacific: 10.29 billion USD (+1%)

In its Q2 2025 forecast, Apple anticipates revenue growth in the low to mid-single digits year-on-year. Given the Q2 2024 revenue of 95 billion USD, this suggests a range of approximately 98 to 100 billion USD. The revenue from services was expected to increase in the low single digits.

Based on the report data, Apple delivered record financial results in Q1 2025 despite challenges in certain segments. Total revenue rose by 4% to an all-time high of 124.3 billion USD, while EPS increased by 10% to 2.40 USD, exceeding analysts’ expectations.

The iPhone segment saw a modest decline in revenue, suggesting stagnant demand or a weaker-than-expected reception for the new iPhone 16 line-up. Mac sales grew, driven by new models featuring M4 chips. The iPad segment also expanded, benefitting from model upgrades. Conversely, the Wearables, Home, and Accessories segment declined, possibly indicating market saturation or intensifying competition. Apple’s services, including the App Store, Apple Music, iCloud, and AppleCare, posted strong growth, highlighting the company’s strategic shift towards revenue diversification through subscriptions and services.

Sales in China fell sharply by 11%, reflecting difficulties in this market due to local competition and potential geopolitical factors. However, growth in other regions, including the Americas, Europe, and Asia-Pacific, helped offset some losses. Overall, Apple reaffirmed its resilience and growth potential despite various market challenges.

Apple Inc. Q2 2025 financial report

Apple released its Q2 2025 financial year report on 1 May 2025. Below are the key figures from the report compared with the same period in 2024:

- Revenue: 95.35 billion USD (+5%)

- Net income: 24.78 billion USD (+5%)

- Earnings per share: 1.65 USD (+8%)

- Operating profit: 29.58 billion USD (+6%)

Revenue by segment:

- Net sales Products: 68.71 billion USD (+3%)

- Net sales Services: 26.65 billion USD (+12%)

- iPhone: 46.84 billion USD (+2%)

- Mac: 7.95 billion USD (+7%)

- iPad: 6.40 billion USD (+15%)

- Wearables, Home and Accessories: 7.52 billion USD (-5%)

Revenue by region:

- Americas: 40.31 billion USD (+8%)

- Europe: 24.45 billion USD (+1%)

- Greater China: 16.00 billion USD (-2%)

- Japan: 7.30 billion USD (+16%)

- Rest of Asia Pacific: 7.29 billion USD (+8%)

The Apple Inc. report for Q2 2025 of the financial year revealed a combination of solid growth and emerging challenges. Revenue reached 95.4 billion USD, a 5% increase compared to the same period last year, while earnings per share rose by 8% to 1.65 USD.

The services division performed particularly well, achieving record figures. Revenue amounted to 26.65 billion USD, up 12% year-on-year, underscoring Apple’s successful strategic shift towards stable, recurring income streams. As of May 2025, the number of paid subscriptions exceeded 1 billion.

iPhone sales also demonstrated resilience, increasing by 2% to 46.84 billion USD despite a 2% decline in sales in China, which was offset by growth in the Americas and Japan.

Nevertheless, the company faces significant challenges. First, the potential imposition of new tariffs in the US, particularly on products assembled in China, could significantly impact the results for Q3 2025 of the financial year. Apple estimates that if the proposed package of tariff measures within the revised US trade policy is implemented, the company’s total costs could reach 900 million USD as early as the June quarter. These expenses are related to the rising costs of components manufactured or assembled in China, including key device categories such as the iPhone, MacBook, and accessories. This increase in costs could reduce margins and affect retail prices, potentially impacting demand. Apple’s management has openly expressed concern, particularly amid ongoing geopolitical tensions and uncertainty in US-China trade relations. The company is already accelerating the reorganisation of its supply chain, including shifting iPhone assembly for the US market to India, though this process requires both time and investment.

Secondly, the ongoing antitrust investigation and legal proceedings concerning the App Store’s structure and terms for third-party developers could potentially affect the services business, as the App Store is a key component of this rapidly growing revenue category.

Thirdly, Apple is experiencing delays in launching the updated version of the Siri voice assistant, which is highly anticipated in the context of generative AI development. These difficulties create uncertainty regarding the company’s upcoming innovations in user experience and artificial intelligence.

Looking ahead, Apple forecasts revenue growth for Q3 2025 in the low to mid-single-digit range, with an expected gross margin between 45.5% and 46.5%. This projection reflects the company’s cautious optimism amid market pressure and internal challenges.

For Apple shareholders, the announcement of a large-scale share buyback program worth 110 billion USD and a 4% increase in quarterly dividends to 0.26 USD per share was a positive development.

Expert forecasts for Apple Inc. shares in 2025

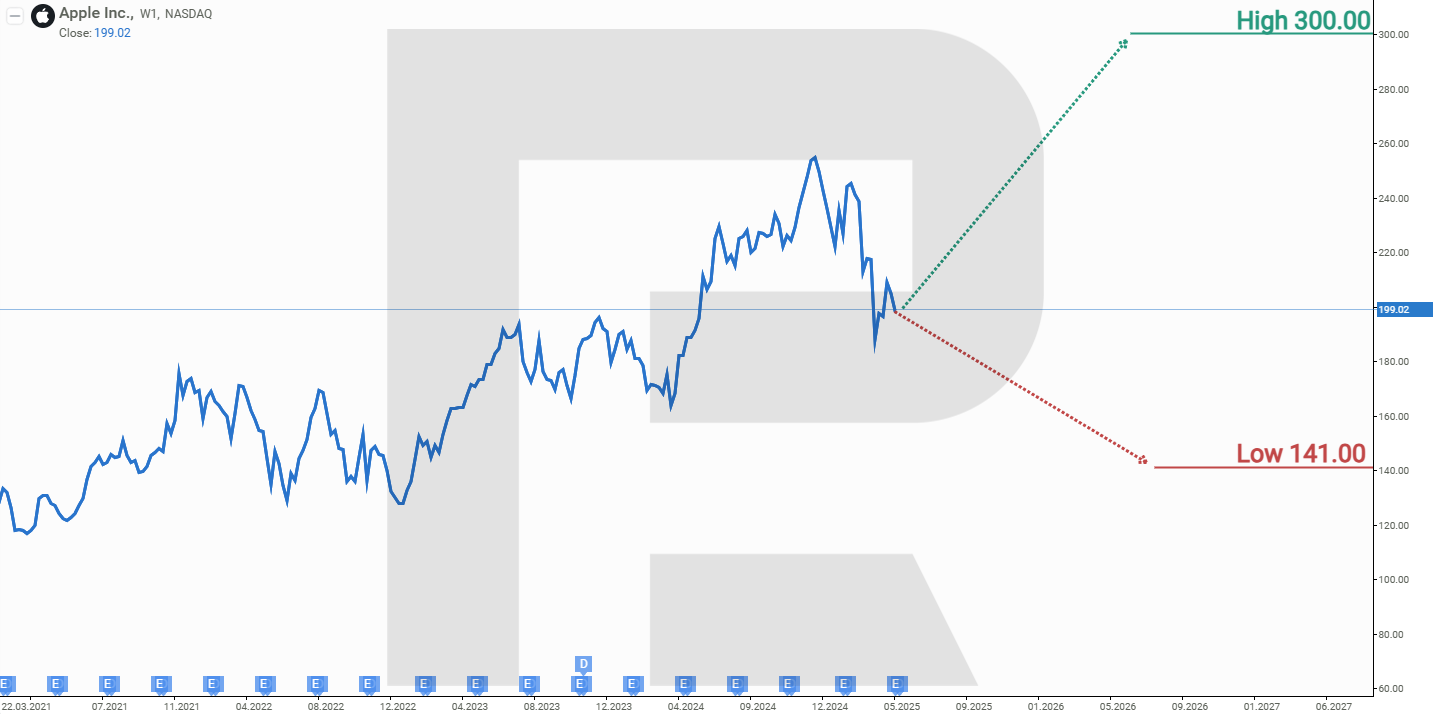

- Barchart: out of 37 analysts, 18 rated the stock as a Strong Buy, four as a Moderate Buy, 12 as a Hold, one as a Sell, and two as a Strong Sell. The maximum projected price for growth is 300 USD, while the minimum target price is 141 USD

- MarketBeat: of the 34 analysts, 20 assigned a Buy rating, 11 recommended Hold, and three suggested Sell. The maximum projected price for growth is 300 USD, while the minimum is 170 USD

- TipRanks: out of 29 experts, 17 advised Buy, eight advised Hold and four advised Sell. The maximum projected price for growth is 300 USD, while the minimum target price is 170 USD

- Stock Analysis: among 36 professionals, 13 rated the stock as a Strong Buy, 10 as a Buy, nine as a Hold, three as a Sell, and one as a Strong Sell. The maximum projected price for growth is 300 USD, while the minimum target price is 160 USD

Technical analysis and 2025 forecast for Apple Inc. stock

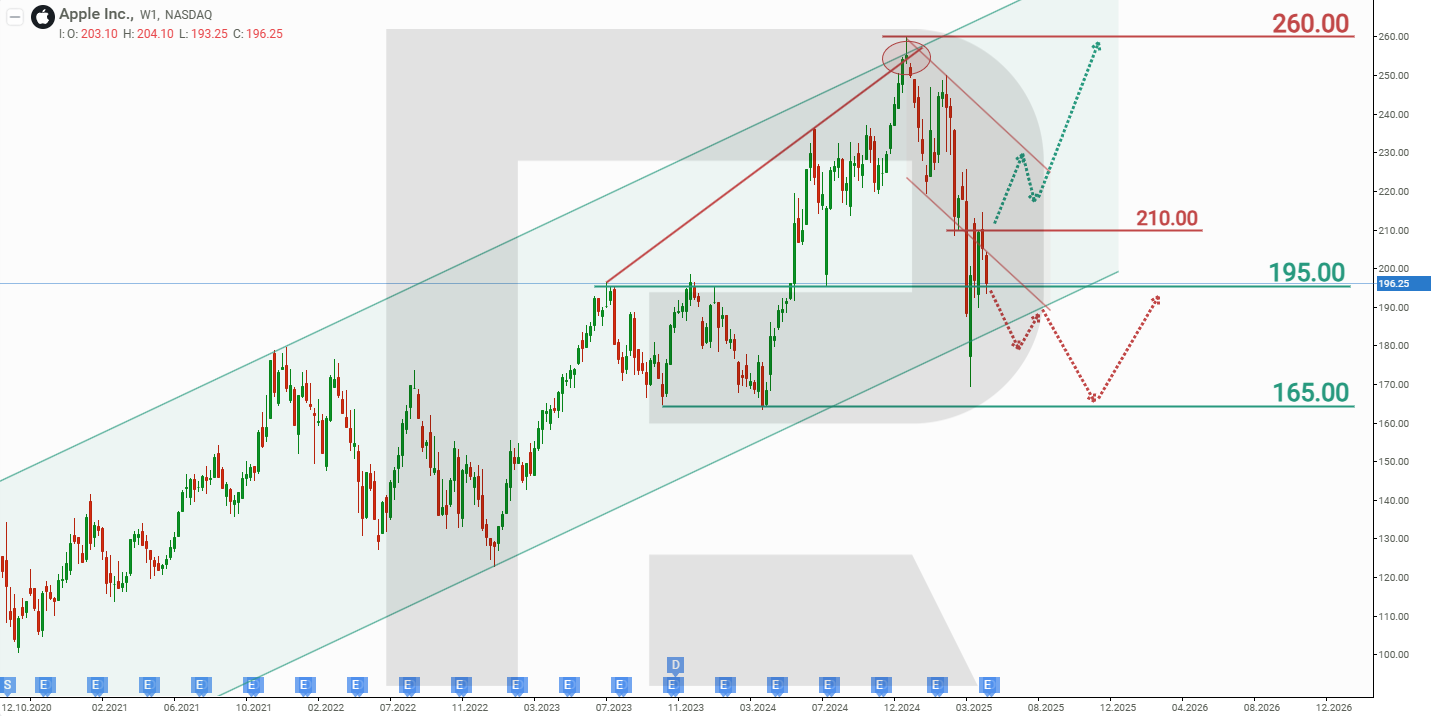

On the weekly timeframe, Apple shares are trading within an ascending channel. In April 2025, AAPL prices bounced off the trendline, which had served as support, signalling the end of the correction and the resumption of the price rise within the upward trend. Based on the current performance of Apple stock, the potential price movements for 2025 are as follows:

The optimistic forecast for AAPL shares suggests a breakout of resistance at 210 USD, which would catalyse further price growth towards the historical peak of 260 USD. This forecast is supported by the large-scale share buyback program, with around 110 billion USD allocated.

The pessimistic forecast for Apple stock predicts a breakdown of support at 195 USD. In this case, the AAPL share price could fall to 165 USD.

AAPL stock analysis and forecast for 2025Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.