Tesla’s falling revenue and income fail to deter investors. TSLA stock on the rise

Despite a weak earnings report, investors are actively buying Tesla shares. The 2025 forecast indicates that TSLA stock could climb to 380 USD

Tesla’s Q1 2025 report fell short of expectations. The company reported a 39% decline in net income (non-GAAP) to 934 million USD compared to the same period last year. Revenue fell by 9% to 19.3 billion USD, missing the expected 21.45 billion USD. Vehicle deliveries dropped by 13%, with automotive revenues down by 20%. The only factor preventing losses in the automotive segment was revenue from regulatory credits, which amounted to 595 million USD. Nevertheless, investors remain confident in the company’s potential and continue buying Tesla shares, with the TSLA price rising over 7% following the quarterly report release.

This article will analyse Tesla’s electric vehicle sales, its revenue streams, and promising business areas that could significantly increase earnings. It will also outline the risks associated with investing in its shares. The review includes a technical analysis of TSLA stock, forming the basis for the Tesla stock forecast for 2025.

About Tesla, Inc.

Tesla was founded in 2003 by Martin Eberhard and Marc Tarpenning. In 2004, Elon Musk joined the co-founders and became the largest investor, assuming the role of Chairman of the Board. In 2008, Musk became the CEO of the company.

Initially, Tesla focused exclusively on electric vehicle production, but new business areas eventually emerged. The first electric car, the Tesla Roadster, was introduced in 2008, marking the beginning of the electric vehicle manufacturing era. In 2014, the company introduced a driver assistance system, which later evolved into a fully autonomous driving system, known as Full Self-Driving.

In 2016, Tesla acquired SolarCity, a company specialising in solar panel installation, leading to the creation of Tesla Energy – a division focused on manufacturing solar panels and energy storage devices. In the near future, the company plans to launch a robotaxi service using autonomous vehicles for passenger transport, enter the freight market with the electric Tesla Semi truck, complete the development of the Optimus humanoid robot, and build the world’s most extensive Artificial Intelligence (AI) cluster for the Dojo supercomputer.

Image of Tesla, Inc.’s nameTesla, Inc.’s main revenue streams

Tesla, Inc. generates revenue from various sources, reflecting the diversity of its products and services. The main revenue streams include:

- Vehicle sales: covers both direct sales to consumers and leasing

- Regulatory credits: regulatory credits sold to other automakers that need them to comply with environmental regulations

- Energy generation and storage: manufacturing and selling solar energy systems and energy storage devices – Powerwall (for residential use), Powerpack (for commercial applications), and Megapack (for large-scale energy needs)

- Services and other revenues: maintenance and repair centres, the Supercharger network, and insurance services for Tesla vehicle owners

- Software and autonomous driving: fees for advanced driver assistance systems (Autopilot), the Full Self-Driving (FSD) package, and software updates

- Battery and powertrain sales: supplying other companies with electric batteries, power units, and drivetrains

- Renewable energy projects: contracts with utility companies and large energy consumers for the deployment of Tesla’s energy storage solutions

Tesla, Inc. Q3 2024 performance

Tesla released its Q3 2024 earnings report on 23 October, highlighting the following key figures:

- Total revenue: 25.18 billion USD (+8%)

- Net profit: 2.17 billion USD (+17%)

- Earnings per share (EPS): 0.62 USD (+17%)

- Operating margin: 10.8% (+323 basis points)

- Capital expenditures: 3.51 billion USD (+43%)

Revenue breakdown by segment:

- Vehicle sales: 20.02 billion USD (+2%)

- Energy generation and storage: 2.38 billion USD (+52%)

- Services and other revenue: 2.79 billion USD (+29%)

In its commentary on the report, Tesla’s management noted that, despite revenue falling short of Wall Street’s consensus estimate (25.18 billion USD vs. 25.47 billion USD), the company beat profit forecasts, reporting EPS of 0.72 USD compared with the expected 0.60 USD. This was achieved through higher gross margins, supported by reduced per-unit production costs. Tesla delivered a record 462,890 electric vehicles in Q3 2024, its highest quarterly total to date.

Tesla plans to introduce more affordable vehicle models in H1 2025, expecting sales growth of 20-30% for the year. Mass production of the Cybercab is scheduled for 2026, with a target output of at least two million units. Additionally, Tesla announced that its 4680-battery cell technology is approaching cost competitiveness, which could significantly shift the economics of battery production.

Management expressed confidence in the company’s strategic initiatives and its leading position in both the automotive and energy sectors.

Tesla, Inc. Q4 2024 performance

On 29 January, Tesla released its Q4 2024 earnings report, showing a 71% decline in net profit. The key figures from the report are as follows:

- Total revenue: 25.70 billion USD (+2%)

- Net profit: 2.12 billion USD (-71%)

- Earnings per share (EPS): 0.60 USD (-71%)

- Operating margin: 6.2% (-204 basis points)

- Capital expenditures: 2.78 billion USD (+21%)

Revenue breakdown by segment:

- Vehicle sales: 19.80 billion USD (-8%)

- Energy generation and storage: 3.06 billion USD (+113%)

- Services and other revenue: 2.84 billion USD (+31%)

Tesla set a new record for electric vehicle deliveries in Q4 2024, with 495,570 units sold. The Tesla Model Y was the best-selling car worldwide in 2024. Elon Musk highlighted the successful production ramp-up at the Berlin and Texas Gigafactories, which played a key role in achieving these figures.

Tesla’s energy storage business also showed significant growth, driven by increased demand for products like Megapack and Powerwall. Musk emphasised that this segment is essential to Tesla’s automotive business.

The Full Self-Driving (FSD) technology continues to evolve, with the Beta program now available to more users, helping collect valuable data. Musk expressed confidence that Tesla will achieve full vehicle autonomy soon. Looking ahead, the company aims to increase vehicle deliveries by approximately 50% year-on-year while expanding its model lineup and boosting production capacity at existing factories. Tesla also focuses on cost reduction and improving operational efficiency.

A notable remark from Elon Musk concerned the Optimus robots. He stated that by the end of 2025, several thousand Optimus units will be capable of performing practical tasks, initially tested and deployed at Tesla’s factories. Musk outlined Tesla’s ambition to rapidly scale Optimus production, projecting that even with a 50% annual growth rate, production could reach 100 million units per year within a few years. He underscored the importance of robotics and AI for Tesla’s future, seeing them as part of the company’s strategy to lead not only in electric vehicles but also in AI and robotics – a vision that could make Tesla the most valuable company in the world.

Tesla, Inc. Q1 2025 performance

On 22 April, Tesla released a weaker-than-expected Q1 2025 report. Its highlights are outlined below:

- Total revenue: 19.34 billion USD (-9%)

- Net income: 0.93 billion USD (-39%)

- Earnings per share: 0.27 USD (-40%)

- Operating margin: 2.1% (-343 basis points)

- Operating expenses: 2.75 billion USD (+9%)

- Capital expenditures: 1.49 billion USD (-46%)

Revenue by segment:

- Vehicle sales: 13.97 billion USD (-20%)

- Energy generation and storage: 2.73 billion USD (+67%)

- Services and other revenue: 2.63 billion USD (+15%)

Tesla’s Q1 2025 report reflects a challenging period for the company. Financial performance was lower than expected, with EPS (non-GAAP) at 0.27 USD, below the forecast of 0.42 USD. The automotive segment, the company’s primary revenue source, contracted by 20%, driven by a 13% decline in deliveries and lower average selling prices. These results highlight the impact of the temporary suspension of Model Y production, an aggressive pricing policy, and a reliance on regulatory credit revenues (595 million USD), without which the automotive division would have posted a loss. Macroeconomic factors, uncertainty surrounding trade policy, and reputational risks associated with Elon Musk’s public activity further complicated the company’s position.

Nevertheless, Tesla’s energy business showed an impressive 67% increase in revenue, reaching 2.73 billion USD and delivering a record gross profit, confirming the company’s success in the energy storage segment. Free cash flow turned positive, reaching 664 million USD compared with a deficit of 2.53 billion USD a year earlier, indicating effective capital management despite significant AI investments.

The strategic focus on autonomous technology remains the company’s key growth driver. The launch of Full Self-Driving (FSD) as a paid service is scheduled for June, with millions of autonomous vehicles projected to be deployed by the end of 2025.

The Optimus humanoid robot project, which aims to achieve annual production of one million units by 2029, underscores Tesla’s ambition to expand beyond the automotive sector.

The market reacted positively to the report, with the stock gaining over 7% following the release, reflecting confidence in these initiatives, particularly in light of Musk’s statements about prioritising Tesla. However, short-term risks remain considerable. The withdrawal of the 2025 delivery growth forecast signals demand uncertainty, exacerbated by potential tariffs and growing competition from Chinese manufacturers such as BYD. A 9% increase in operational expenses, combined with the absence of details regarding the launch of more affordable models, adds to the uncertainty.

Tesla’s management provided no specific forecasts for Q2 2025, stating instead that they would revise the 2025 outlook after the Q2 2025 results, citing ongoing uncertainty in the automotive and energy markets amid shifting trade policies and macroeconomic conditions. Analysts forecast Q2 2025 revenue of around 24.45 billion USD, although Tesla has not confirmed or revised this figure.

Given these factors, Tesla remains a highly risky investment. The energy segment, AI development, and long-term strategic vision offer the potential for substantial growth. However, delivering on these ambitions will require Elon Musk to return to active management of the company, as he promised. His involvement in US politics negatively affected Tesla’s reputation, and the company now faces the challenge of restoring trust among both consumers and investors.

Promising business areas for Tesla, Inc.

Below are the promising business areas that Elon Musk is developing, which could prove successful:

- Robotaxi: Tesla is actively developing a robotaxi service, where autonomous vehicles will provide transportation without human drivers. In the future, Tesla owners will be able to add their cars to the Robotaxi network when not for personal use and earn income by renting them out as taxis. Consumers will be able to hail a Tesla robotaxi via a mobile app, similar to Uber and Lyft. Revenue will come from ride fares and network usage fees

- Tesla Semi truck: this electric lorry is designed to replace traditional diesel trucks on the roads. Unveiled in November 2017, it features advanced driver assistance systems, including Autopilot. The monetisation of the Tesla Semi project includes direct sales, servicing, maintenance, and charging infrastructure

- Full Self-Driving (FSD) project: this fully autonomous driving system is offered to Tesla EV owners as a paid upgrade. The project has multiple monetisation avenues. Once perfected and approved by regulatory bodies, Tesla could sell FSD software to other car manufacturers, later generating revenue from updates and technical support services

- Tesla Optimus humanoid robot: on 19 August 2021, during Tesla AI Day, the company unveiled the Tesla Bot, also known as Optimus. The robot is designed to carry out various tasks in both industrial and household environments. Monetisation is expected through robot sales and spare parts, as well as rental, subscription services, and maintenance

- Tesla Dojo supercomputer: Tesla is developing a large-scale AI cluster for the Dojo supercomputer, designed to process massive datasets for machine learning models. Monetisation will come from leasing computing power and developing new AI-driven products and services

- Energy business: Tesla is actively expanding its energy division, which includes the production and sale of solar energy panels, energy storage systems, and energy services. The company will generate revenue through equipment sales, installation, maintenance, and energy service contracts

Expert forecasts for Tesla, Inc. shares for 2025

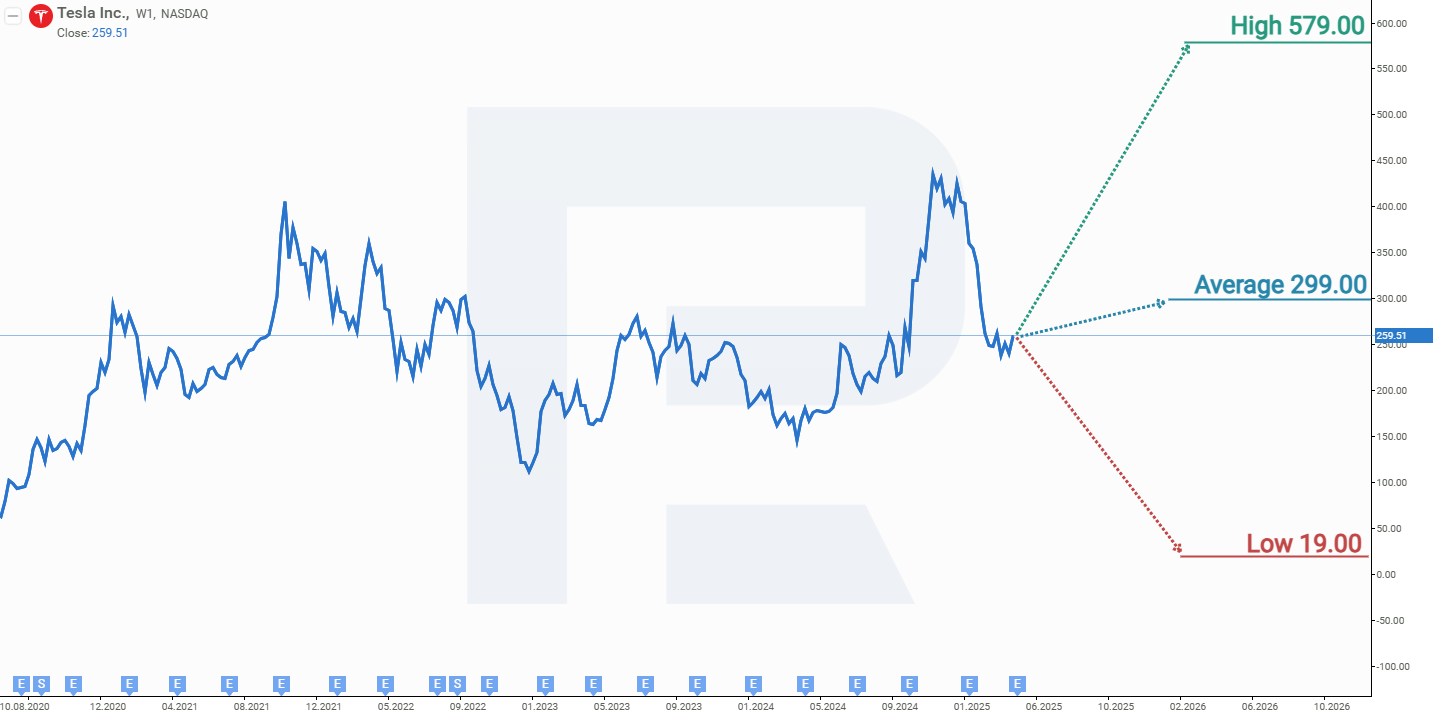

- Barchart: 16 of 41 analysts rated Tesla shares as a Strong Buy, three as Buy, 12 as Hold, and 10 as Strong Sell. The highest price target is 488 USD, while the lowest is 120 USD

- MarketBeat: 22 out of 41 specialists rated the shares as Buy, 10 recommended Hold, and nine as Sell. The highest price target is 460 USD, while the lowest is 19 USD

- TipRanks: 16 of 39 professionals recommended Buy, 11 Hold, and 12 Sell. The highest price target is 465 USD, while the lowest is 115 USD

- Stock Analysis: out of 37 experts, eight rated the shares as Strong Buy, nine as Buy, 13 as Hold, four as Sell, and three analysts gave a Strong Sell rating. The highest price target is 579 USD, and the lowest is 19 USD

Tesla, Inc. stock forecast for 2025

On the weekly timeframe, Tesla shares are trading in an ascending channel and testing support at 373 USD. Based on Tesla’s current stock performance, the two possible scenarios for the stock price in 2025 are:

The optimistic forecast for Tesla shares suggests a rebound from the support at 373 USD, followed by a price increase to 440 USD. A breakout above this resistance could trigger further price growth to the channel’s upper boundary at 520 USD.

The pessimistic forecast for Tesla shares assumes a break below the 373 USD support, which could cause the stock price to drop to 300 USD. This movement would be considered a correction within the broader upward trend. A rebound from the 300 USD level would signal the end of the correction and the resumption of the price increase. In this case, the target for further growth would be the channel’s upper boundary, which will already be above 520 USD.

Technical analysis and 2025 forecast for Tesla, Inc.’s stockRisks of investing in Tesla, Inc. shares

Considering the factors that could negatively impact the company’s future earnings is crucial when investing in Tesla, Inc. shares. Below are the main risks:

- Increased competition: Tesla faces growing competition from both traditional automakers, such as Volkswagen, General Motors, and Ford, as well as newer players, including BYD, Rivian, and Lucid. The competition is particularly fierce in China, where BYD has already surpassed Tesla in total electric vehicle production, including hybrid vehicles. Increased competition could lead to a loss of market share and price wars, reducing Tesla’s profitability

- Economic conditions: elevated interest rates and economic downturns can impact consumer spending on expensive goods, such as electric vehicles. If interest rates remain high or increase further, the cost of financing a new Tesla could deter potential buyers

- Policy changes: changes in government policy, such as the cancellation or reduction of tax incentives for electric vehicles, could affect demand for Tesla cars. For instance, sales could drop if the US IRA tax credit of 7,500 USD is abolished. State-level policies, such as a potential new credit system in California, where Tesla may not meet the criteria, could also further impact sales

- Manufacturing and supply chain issues: delays or inefficiencies in ramping up production of new models, such as the Cybertruck or the next generation of more affordable vehicles, could prevent Tesla from meeting market demand. Supply chain disruptions, chip shortages, or factory shutdowns could also affect production capabilities

- Technological challenges: if Tesla’s advancements in autonomous driving or battery technology fail to meet expectations, or if competitors outpace Tesla in these areas, it could result in a loss of competitive advantage and investor confidence

- Global Market Dynamics: fluctuations in exchange rates, trade tensions (especially with China, where Tesla has significant sales and production), or new tariffs could impact Tesla’s international revenues

These factors, in combination, could influence Tesla’s revenue trajectory in 2025, creating a challenging environment where the company will need to navigate both internal and external challenges to maintain or improve its market position.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.