World indices overview: news from US 30, US 500, US Tech, JP 225, and DE 40 for 6 May 2025

Amid speculation about China’s attempts to strike a trade deal with the US, global stock indices recouped losses seen on 2 April 2025. Find out more in our analysis and forecast for global indices for 6 May 2025.

US indices forecast: US 30, US 500, US Tech

- Recent data: the US unemployment rate was 4.2% in April

- Market impact: with unchanged unemployment, slowing job growth reduces the risk of aggressive rate hikes, which is favourable for rate-sensitive sectors

Fundamental analysis

NFP exceeded expectations, confirming economic resilience and driving demand for stocks, especially for companies in the domestic consumer sector. Job growth has slowed compared to March, while unemployment has not fallen below 4.0%, reducing the likelihood of additional rate hikes.

The data does not signal overheating or a recession, with the baseline soft-landing scenario remaining in place. This should keep US stock market sentiment in positive territory, although investors’ focus will shift to future Federal Reserve comments and inflation reports.

US 30 technical analysis

The US 30 stock index rose by more than 13% from its lowest level seen in early April 2025. However, the overall downtrend persists. If the 37,060.0 support level does not break, a sideways movement could follow. Only a breakout above the 42,535.0 resistance level could signal the beginning of the uptrend.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: a breakout below the 37,060.0 support level could send the index down to 35,060.0

- Optimistic US 30 forecast: a breakout above the 42,535.0 resistance level could drive the index to 43,890.0

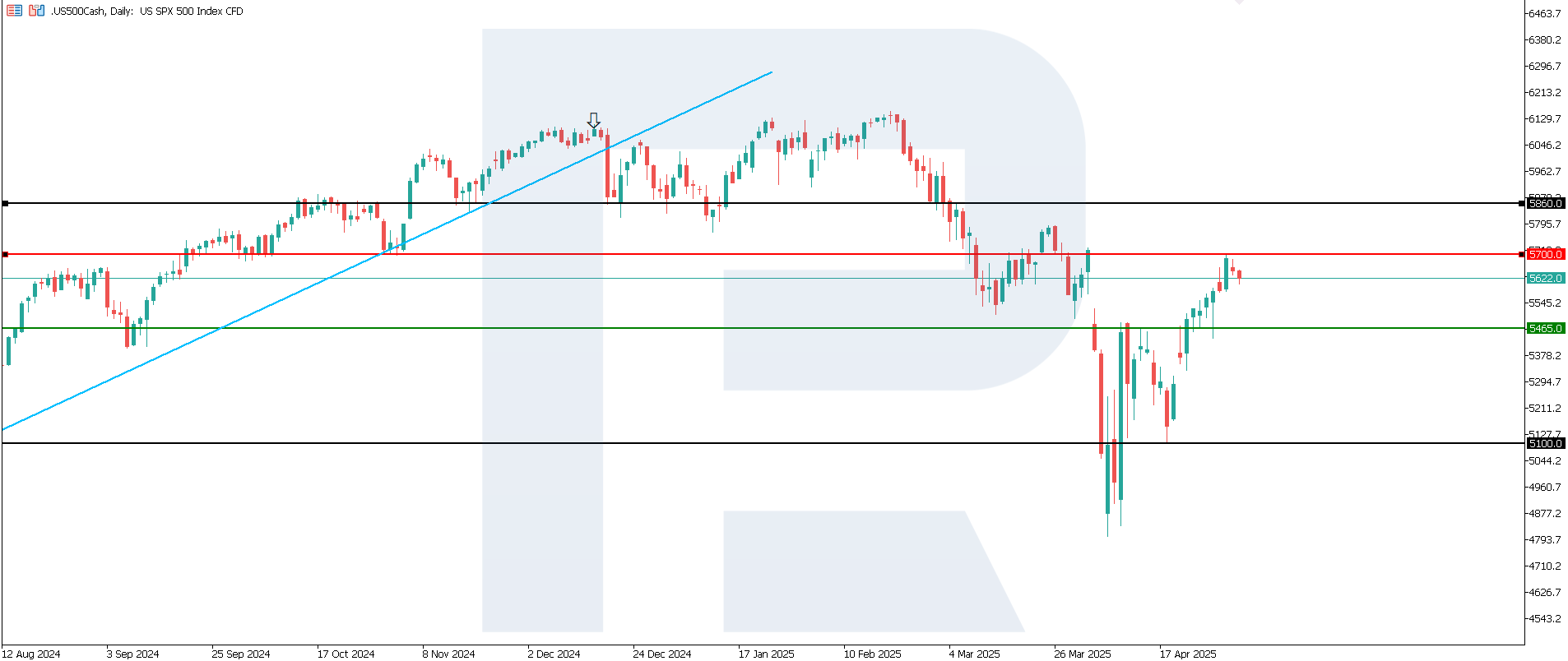

US 500 technical analysis

The US 500 stock index formed a resistance level at 5,700.0. The index is correcting within the uptrend following the longest winning streak this year. The support level has shifted to 5,465.0.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 5,465.0 support level could push the index down to 5,100.0

- Optimistic US 500 forecast: a breakout above the 5,700.0 resistance level could boost the index to 5,860.0

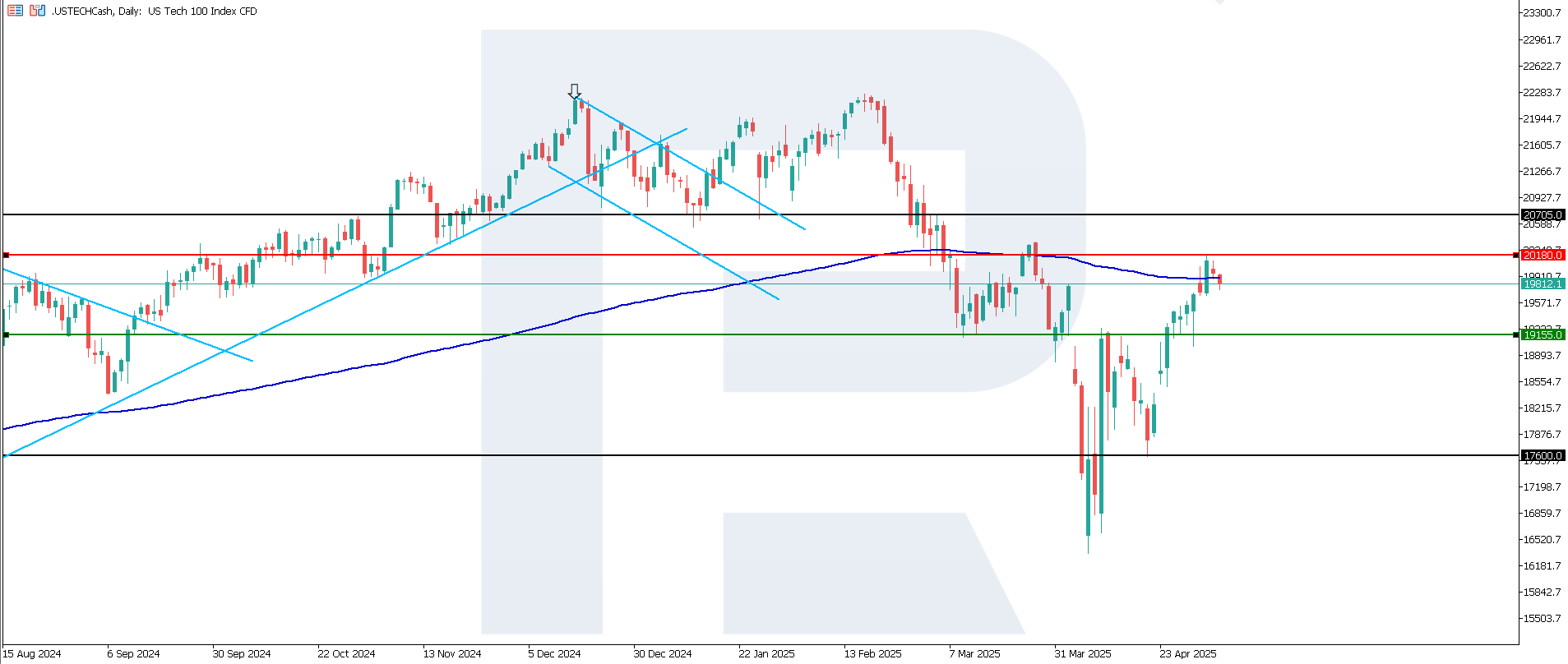

US Tech technical analysis

The US Tech index formed a resistance level at 20,180.0, with support at 19,155.0. Although the price broke above the 200-day Moving Average, the current uptrend is weak and is likely to be short-term. This may be confirmed by the price return below the 200-day Moving Average.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 19,155.0 support level could send the index down to 17,600.0

- Optimistic US Tech forecast: a breakout above the 20,180.0 resistance level could propel the index to 20,705.0

Asian index forecast: JP 225

- Recent data: Japan’s manufacturing PMI came in at 48.7 in April

- Market impact: investors may perceive the slowdown in the PMI decline as an early sign of stabilisation, which will support demand for industrial and commodity stocks

Fundamental analysis

With the manufacturing PMI still below 50.0, the Bank of Japan will likely maintain its dovish rhetoric. Low rates continue to bolster the stock market. Export and machinery companies may receive a small boost amid expectations of further improvement.

While the indicator remains negative, its improvement eases fears of a sharp downturn. The Japanese stock market may react neutrally and positively, especially in the industrial segment, with overall caution prevailing.

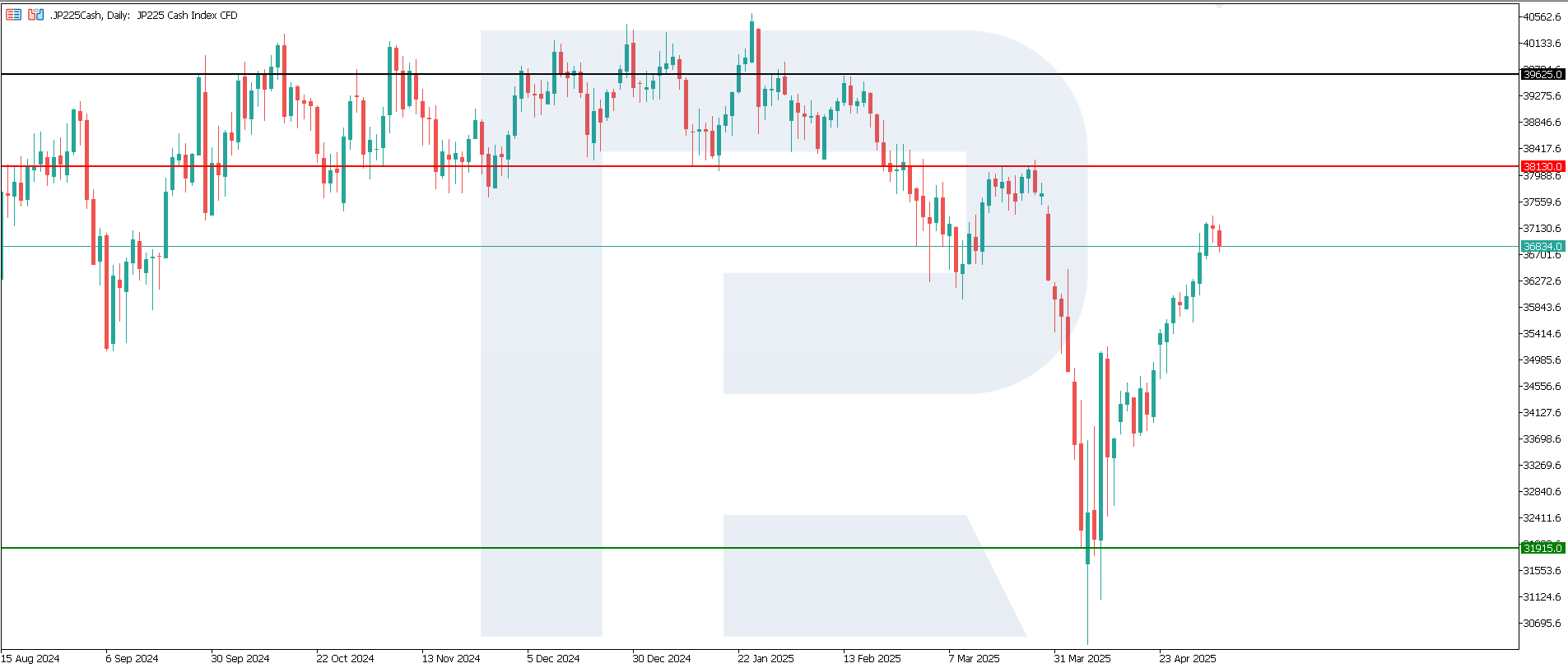

JP 225 technical analysis

A medium-term sideways range will likely form for the JP 225 index. The general trend remains downward. However, a false breakout below the 31,915.0 support level, followed by a reversal, is possible. However, such a reversal appears unlikely in the short term.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 31,915.0 support level could push the index down to 28,720.0

- Optimistic JP 225 forecast: a breakout above the 38,130.0 resistance level could propel the index to 39,635.0

European index forecast: DE 40

- Recent data: Germany’s manufacturing PMI came in at 48.4 in April

- Market impact: slowdown in the rate of decline may support machinery and auto stocks

Fundamental analysis

The manufacturing PMI below 50.0 adds to arguments in favour of a soft ECB policy, which is generally positive for the market: cheap financing will support rate-sensitive sectors such as real estate and technology. An improvement in tenths of a per cent does not change the fact that business activity is declining. Therefore, the stock market is not expected to see a serious rally, but there is no panic either.

The PMI remains in contraction territory, with sentiment in the German stock market remaining cautious. Moderate gains due to a slowing decline mitigate the risk of a strong sell-off, while expectations of normalised trade conditions between the EU and US act as a growth driver.

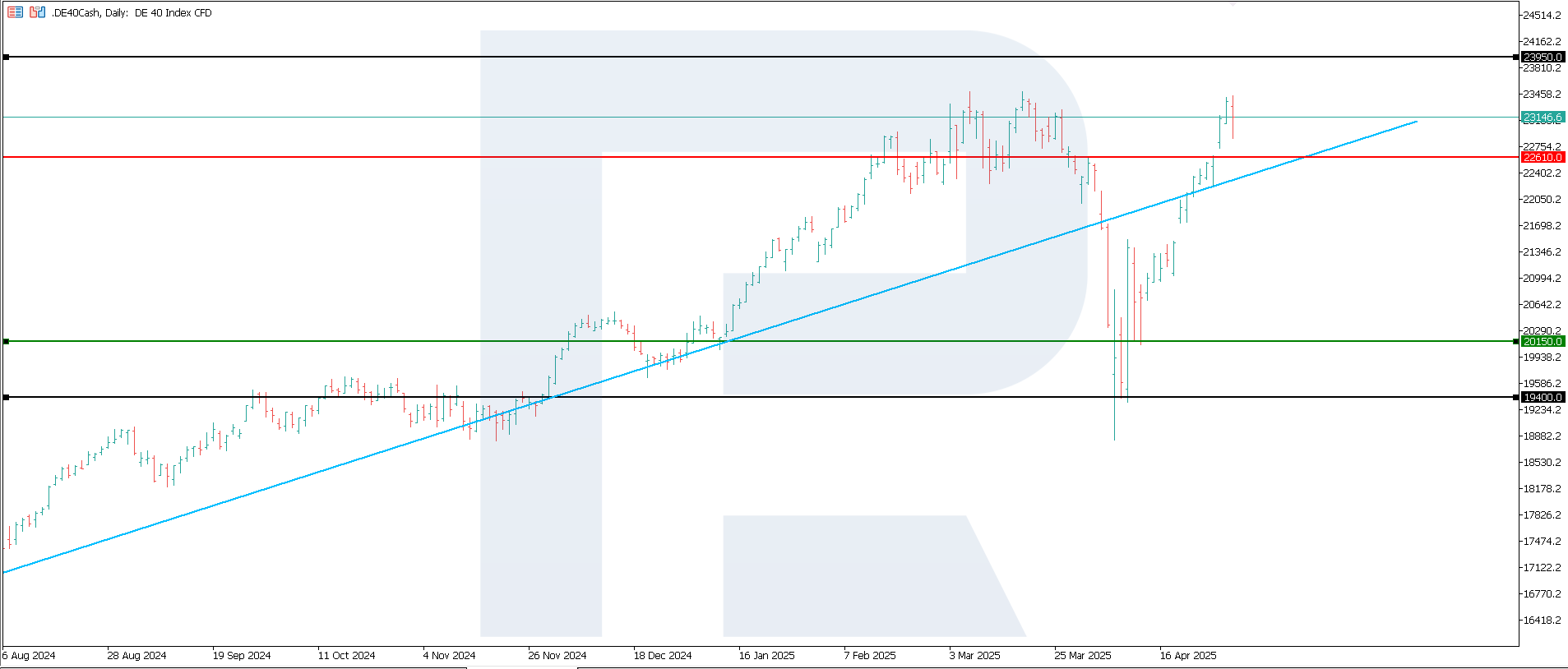

DE 40 technical analysis

The DE 40 stock index broke above the 22,610.0 resistance level, with support shifting to 20,150.0. The index is trading around an all-time high and may renew it. It is too early to assess the strength of the emerging uptrend until the resistance level is formed.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: a breakout below the 20,150 support level could push the index down to 19,400.0

- Optimistic DE 40 forecast: if the price consolidates above the previously breached resistance level at 22,610.0, the index could climb to 23,950.0

Summary

All global stock indices see upward momentum. However, the trend is yet to reverse in the US 30 and the Japanese JP 225. The positive sentiment is driven by expectations of normalised trade conditions between the US and China. If their negotiations are successful, the stock market will get a hefty boost. In the future, investors will also follow the US Federal Reserve's comments on future monetary policy.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.