Japan’s economy under pressure, USDJPY poised to surge

The downward revision of Japan’s GDP forecast may propel the USDJPY pair towards the 149.50 level. Discover more in our analysis for 13 May 2025.

USDJPY forecast: key trading points

- Bank of Japan’s summary of opinions

- USDJPY forecast for 13 May 2025: 149.50

Fundamental analysis

Fundamental analysis for 13 May 2025 takes into account that the Bank of Japan published its summary of opinions following its meeting held on 30 April and 1 May. The document reflects policymakers’ concerns about the impact of new US tariffs on Japan’s economy and inflation outlook.

Key highlights:

- Economic growth and inflation: the BoJ lowered its GDP forecast for 2025 from 1.1% to 0.5% and for 2026 from 1.0% to 0.7%, citing negative effects of US tariffs on exports and global trade

- Monetary policy: while the key rate remains at 0.5%, some board members believe it is possible to resume rate hikes if inflation nears the 2.0% target. However, others are concerned about high uncertainty and suggest temporarily refraining from policy changes until global trade stabilises

- External factors: several officials noted that shifts in US trade policy could both support or hinder Japan’s economy, requiring flexibility in monetary policy decisions

The BoJ maintains a cautious stance, closely monitoring external factors and preparing for possible policy adjustments depending on future developments. In this context, the USDJPY forecast does not appear optimistic for the yen, with the pair likely to continue its uptrend after a correction.

USDJPY technical analysis

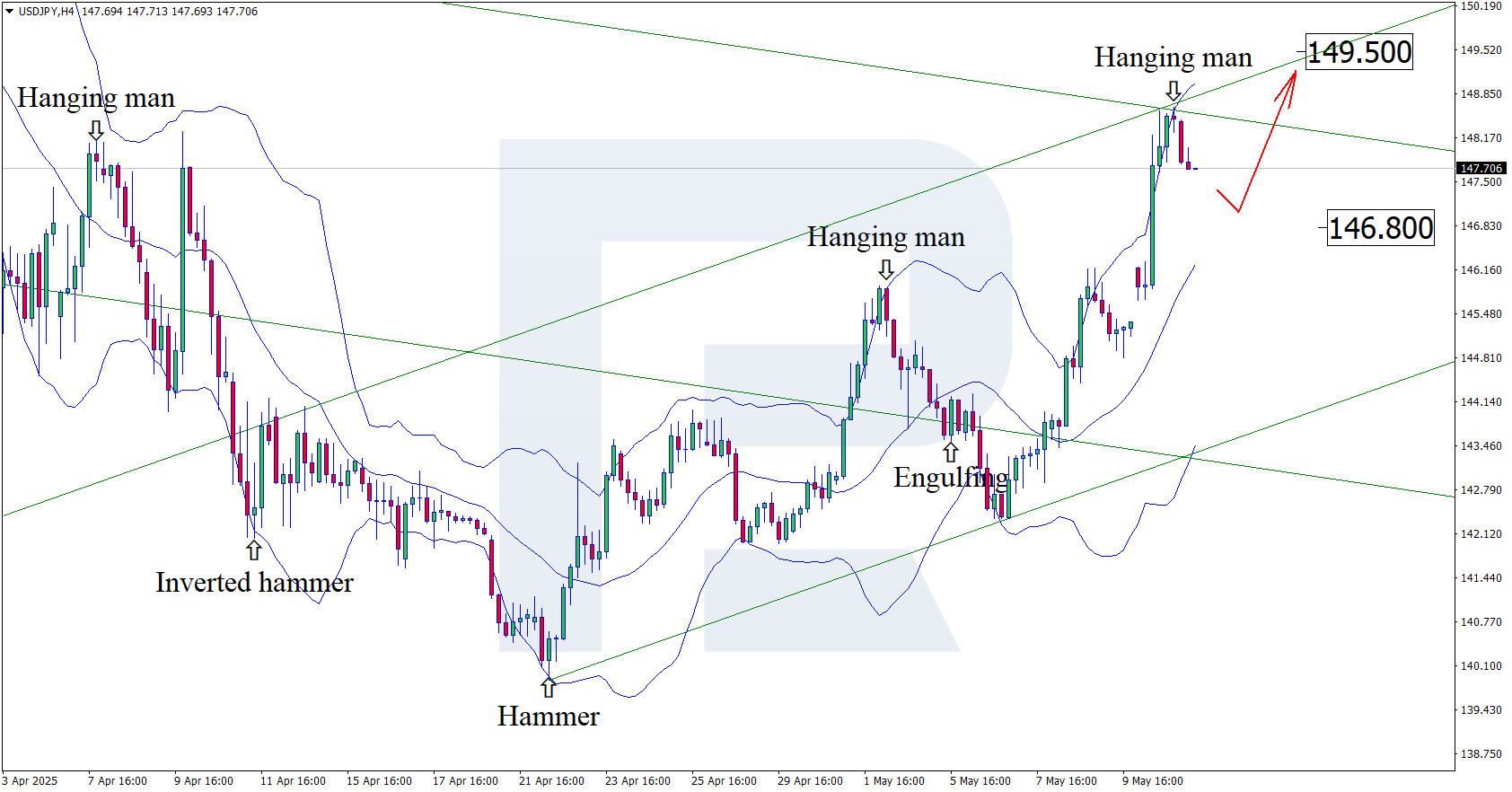

On the H4 chart, the USDJPY price tested the upper Bollinger Band and formed a Hanging Man reversal pattern, hovering around 147.60. It may now form a corrective wave following the signal from the pattern. Since the price remains within an ascending channel, it could reach 146.80.

However, the USDJPY forecast for today also considers another scenario, where the price rises to 149.50 without testing the support level.

Summary

Coupled with the USDJPY technical analysis, the decline in Japan’s economic data suggests a correction towards 146.80 before growth.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.