USDJPY strengthens as yen loses ground on economic slowdown

The USDJPY pair is climbing amid disappointing data from Japan, with the price currently at 146.07. Find more details in our analysis for 12 May 2025.

USDJPY forecast: key trading points

- Japan's current economic conditions index dropped to its lowest since February 2022

- Tokyo’s economic outlook index fell to its weakest since April 2021

- USDJPY forecast for 12 May 2025: 148.55

Fundamental analysis

The USDJPY rate is recovering, with buyers poised to test the 146.50 resistance level. Waning demand for the Japanese yen is due to deteriorating domestic economic indicators, increasing concerns over Japan's internal economic health.

The current economic conditions index dropped to 42.6 in April 2025, down from 45.1 in March, marking the lowest level since February 2022 and the fourth consecutive monthly decline. Simultaneously, the economic outlook index fell to 42.7, the lowest since April 2021. This downturn reflects growing concerns about US trade policy and persistent cost pressures.

Despite weak domestic demand, Japan's external sector remains resilient. The country posted a current account surplus of 3.45 trillion yen in March, slightly down from a record 4.06 trillion yen in February.

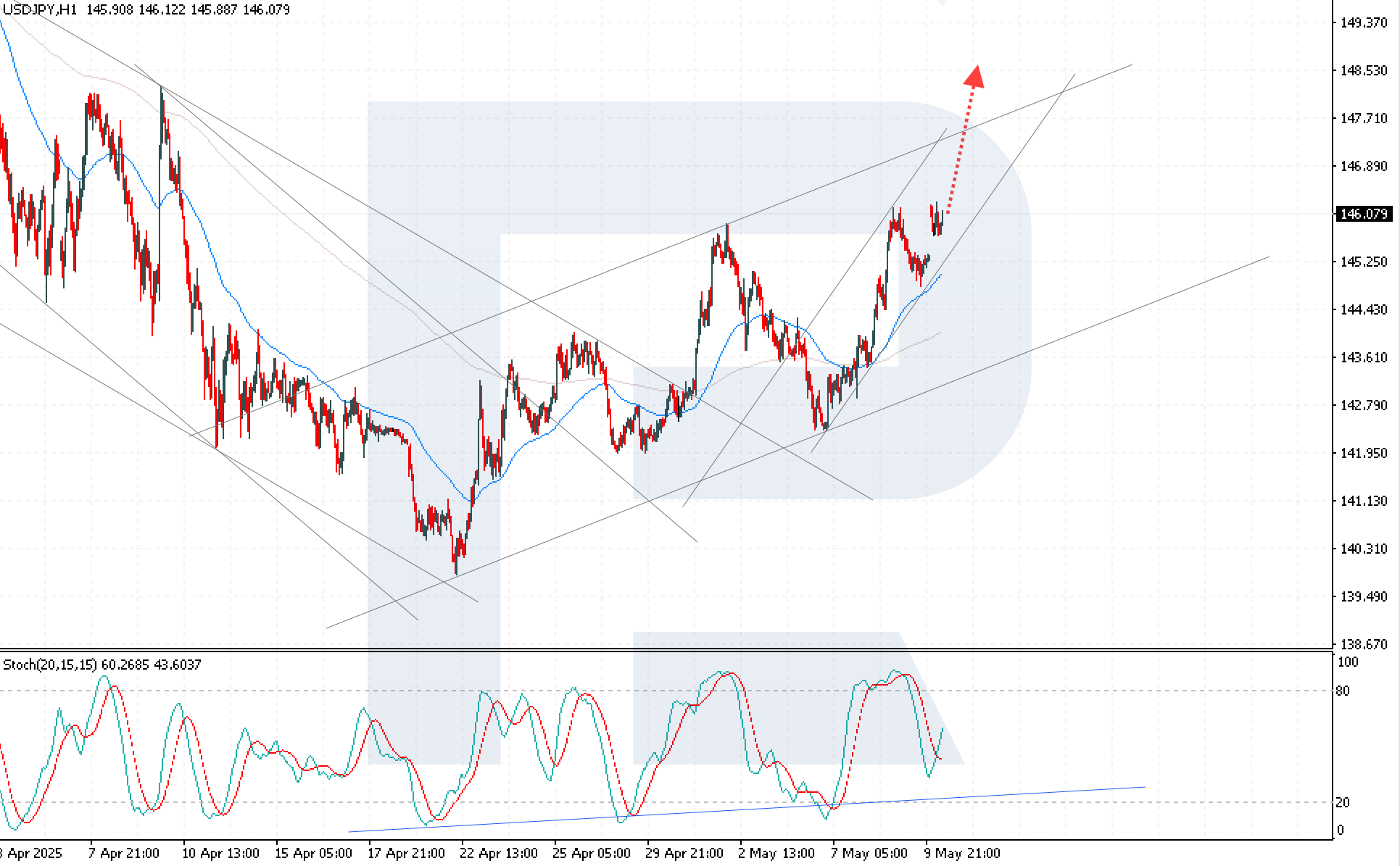

USDJPY technical analysis

The USDJPY rate maintains its upward momentum, with buyers aiming for a breakout above the 146.50 resistance level. The USDJPY forecast for today suggests further growth, with a target at 148.55.

The pair is trading firmly above the EMA, confirming the prevailing bullish sentiment. The Stochastic Oscillator has formed a bullish crossover and reversed upwards, signalling strengthening buying interest.

The price consolidation above the nearest resistance level at 146.50 would confirm the market’s readiness to push higher.

Summary

Coupled with stable external performance, Japan’s weakening internal economic indicators continue to pressure the yen. The USDJPY technical analysis indicates continued bullish momentum, with a breakout above 146.50 likely opening the way to 148.55.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.