Sentiment down – dollar down: what lies ahead for USDJPY

While US economic optimism declines, the USDJPY pair still has the potential to rise towards 146.40. Find more details in our analysis for 6 May 2025.

USDJPY forecast: key trading points

- Japan holiday: Greenery Day

- IBD/TIPP US Economic Optimism Index: previously at 50.2, projected at 49.1

- USDJPY forecast for 6 May 2025: 146.40 and 143.00

Fundamental analysis

The IBD/TIPP Economic Optimism Index is a monthly survey-based indicator reflecting Americans’ confidence in the US economy. It covers expectations about personal finances, national economic outlook, and stock market sentiment. A reading above 50.0 suggests general optimism, while a reading below 50.0 signals prevailing pessimism. The index is often seen as an early signal of changes in consumer activity and investment sentiment.

The forecast for 6 May 2025 factors in a potential decline to 49.1 from the previous 50.2. While this is not a core economic indicator, combined with other data, it may influence the USDJPY rate both upwards and downwards.

The USDJPY forecast appears mixed, with the US dollar able to lose ground on the news. However, given that today is another holiday in Japan, the opening of the Asian trading session could make adjustments to the USDJPY rate.

USDJPY technical analysis

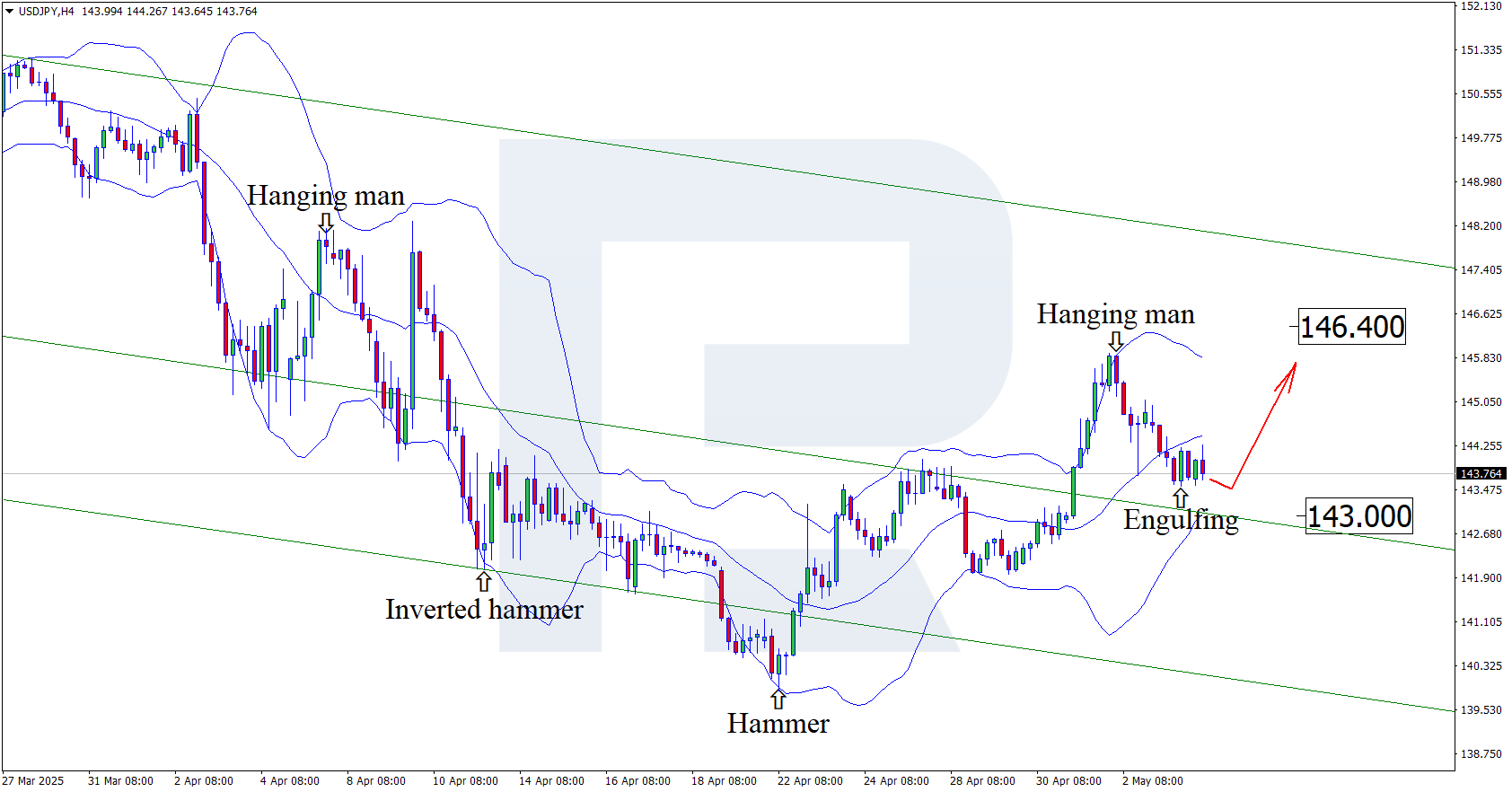

Having tested the middle Bollinger band, the USDJPY pair has formed an Engulfing reversal pattern on the H4 chart, currently standing at 143.70. It may now form a growth wave following the pattern signal. The price could reach 146.40 as the pair trades within a descending channel.

However, the USDJPY forecast also takes into account an alternative scenario, where the price could fall to 143.00 before growth.

Summary

Weaker US fundamental data may pressure the US dollar. At the same time, the USDJPY technical analysis points to a possible rise towards the 146.40 resistance level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.