Shock to the market: why weak PMI could crash USDJPY

A decline in the US services PMI could trigger a further correction in the USDJPY rate towards the 143.31 support level. Find out more in our analysis for 5 May 2025.

USDJPY forecast: key trading points

- US services PMI: previously at 54.4, projected at 51.4

- ISM non-manufacturing PMI: previously at 50.8, projected at 50.2

- USDJPY forecast for 5 May 2025: 146.40 and 143.31

Fundamental analysis

The US services PMI reflects business activity across various industries, including transportation, communication, financial intermediation, business and consumer services, information technology, and the hotel and restaurant sectors.

The forecast for 5 May 2025 does not appear optimistic, suggesting a decline to 51.4, which, although above the 50.0 growth threshold, marks a weakening from the previous reading. This relative drop may weigh on the US dollar against the Japanese yen and fuel a further correction in the USDJPY rate.

The ISM non-manufacturing PMI also gauges the health of the US service sector. Based on a survey of purchasing managers, it shows the level of business activity outside the manufacturing sector: in trade, healthcare, finance, IT, and other industries.

The index above 50.0 indicates growth, while a reading below 50.0 points to a downturn. Published monthly by the Institute for Supply Management, it has a strong impact on financial markets as the service sector makes up a significant part of the US economy.

Fundamental analysis for 5 May 2025 takes into account that the index may drop to 50.2 from 50.8. Although the decline is not critical, it could weigh on the US dollar.

USDJPY technical analysis

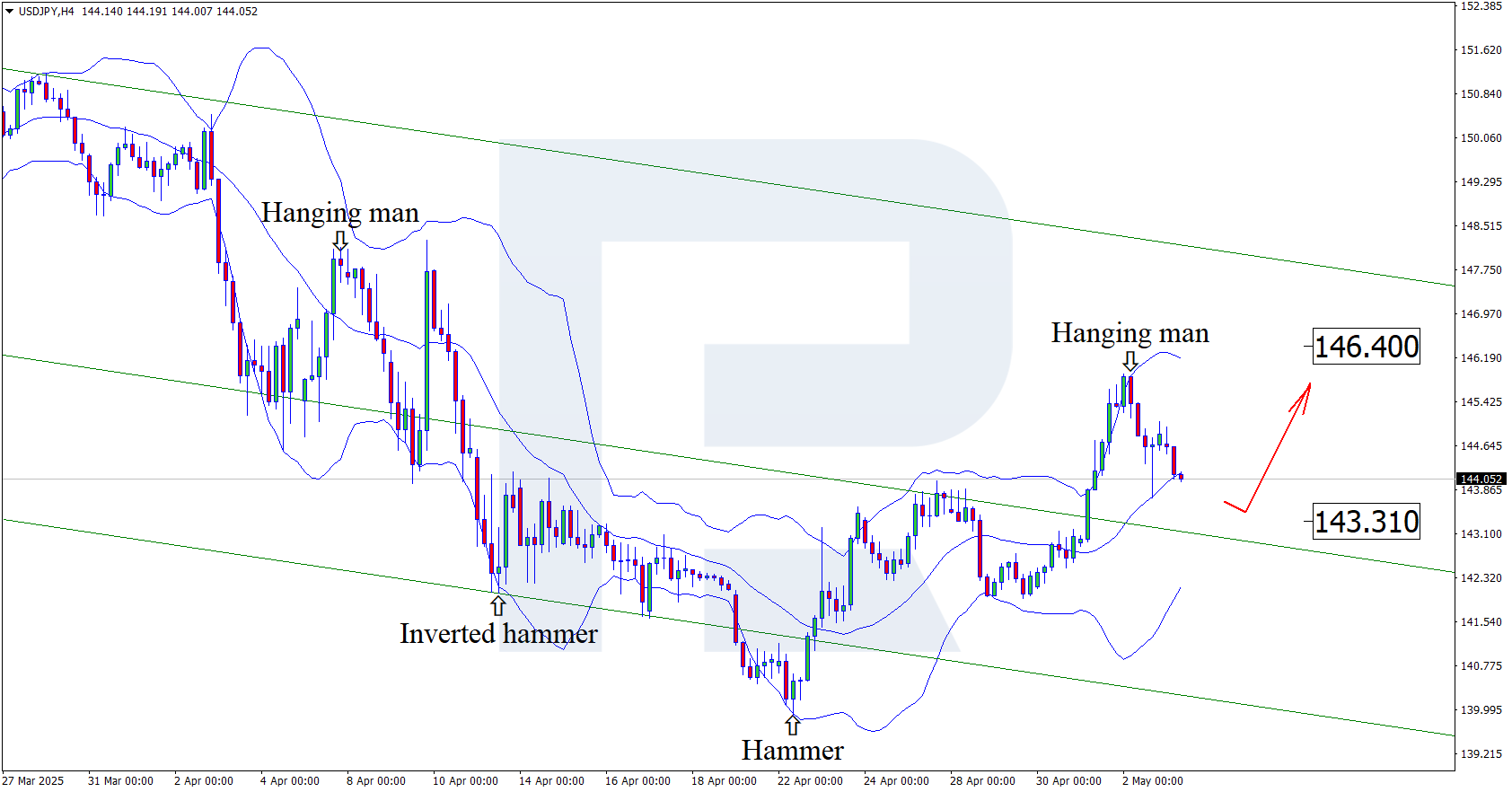

Having tested the upper Bollinger band, the USDJPY price has formed a Hanging Man reversal pattern on the H4 chart. At this stage, it continues to form a corrective wave following the pattern signal. Since the pair continues to decline within a descending channel, it could reach the 143.31 level.

However, the USDJPY forecast for today also suggests an alternative scenario, where the price climbs to 146.40 without testing the support level.

Summary

Weakening US economic data could drive USDJPY lower. The USDJPY technical analysis suggests a continued correction towards 143.31.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.