USDCAD has rapidly reversed upwards; will the rally continue?

The USDCAD rate closed last week with solid gains, consolidating above the 1.3900 level. The pair now shows potential for further upside. Discover more in our analysis for 12 May 2025.

USDCAD forecast: key trading points

- Market focus: trade tensions between the US and China are easing after high-level talks in Switzerland over the weekend

- Current trend: correcting upwards

- USDCAD forecast for 12 May 2025: 1.3900 and 1.4000

Fundamental analysis

The USDCAD pair climbed to the 1.3900 area, as weak Canadian labour market data combined with lingering trade frictions with the US weighed on the Canadian dollar. According to last week’s release, Canada’s unemployment rate rose to 6.9%, the highest level since last November.

Meanwhile, the Federal Reserve decided at its last meeting to keep interest rates at 4.25-4.50%. The Fed’s cautious stance regarding persistent inflation and labour market risks increased demand for US assets, supporting a stronger US dollar.

USDCAD technical analysis

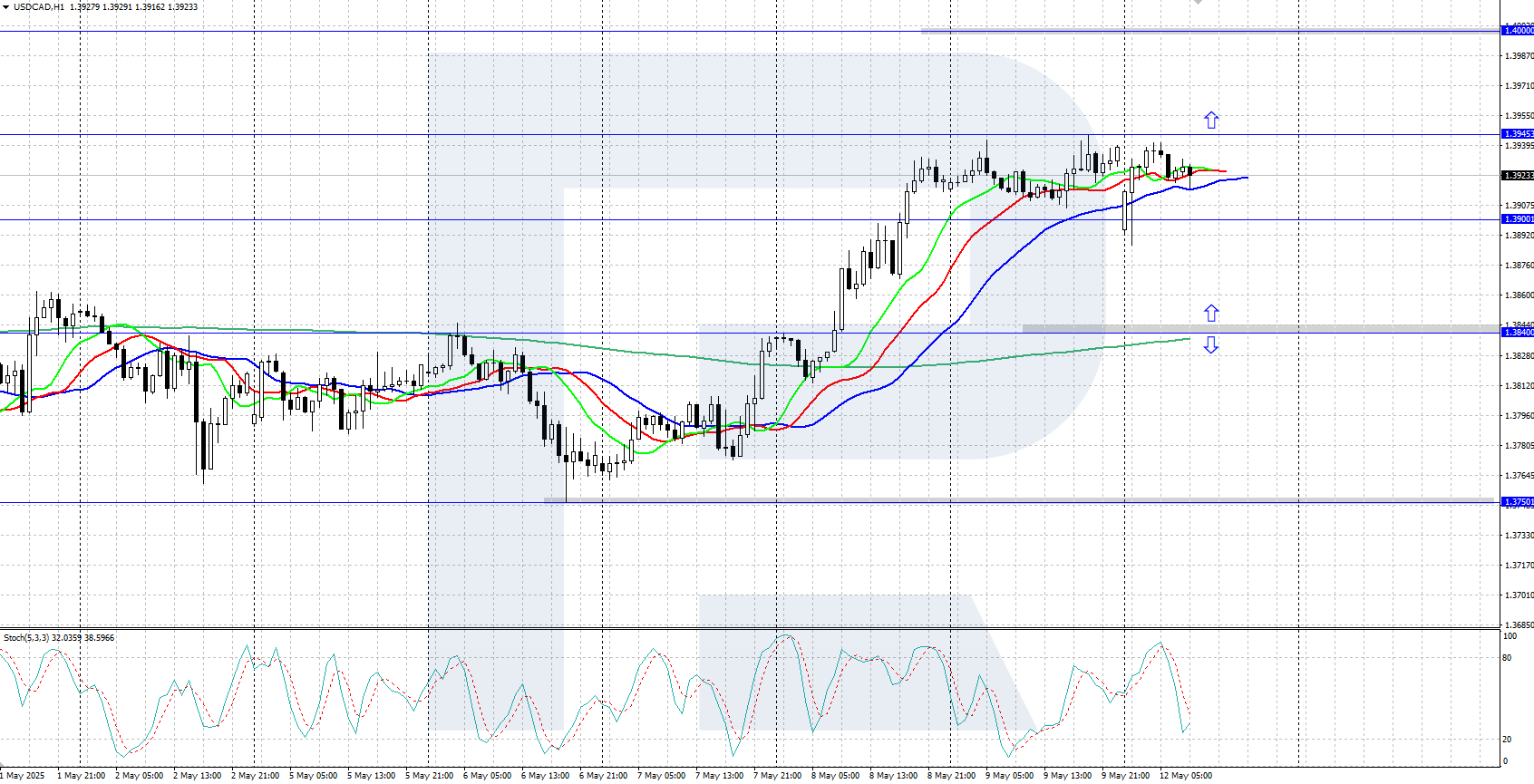

On the H4 chart, the USDCAD pair is showing a bullish correction within a broader downtrend. The pair is currently trading near the 1.3900 support level. The Alligator indicator has turned upwards, with the weekly chart showing a bullish Engulfing pattern.

The short-term USDCAD forecast suggests a continued decline if the bears push the price below 1.3840, with the price likely to reach 1.3750 in the near term. If the bulls retain control and hold above 1.3840, the rally could extend towards 1.4000.

Summary

The USDCAD pair reversed upwards, breaking above 1.3900. An upward correction is underway, which may continue.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.