EURUSD tumbles to the 1.1100 area; will the decline continue?

The EURUSD pair plunged to 1.1100 following the US-China agreement on reducing reciprocal tariffs. Today's spotlight is on the US inflation report. Find more details in our analysis for 13 May 2025.

EURUSD forecast: key trading points

- Market focus: today’s highlight is the US April inflation statistics, with the Consumer Price Index (CPI) scheduled for release

- Current trend: a downtrend prevails

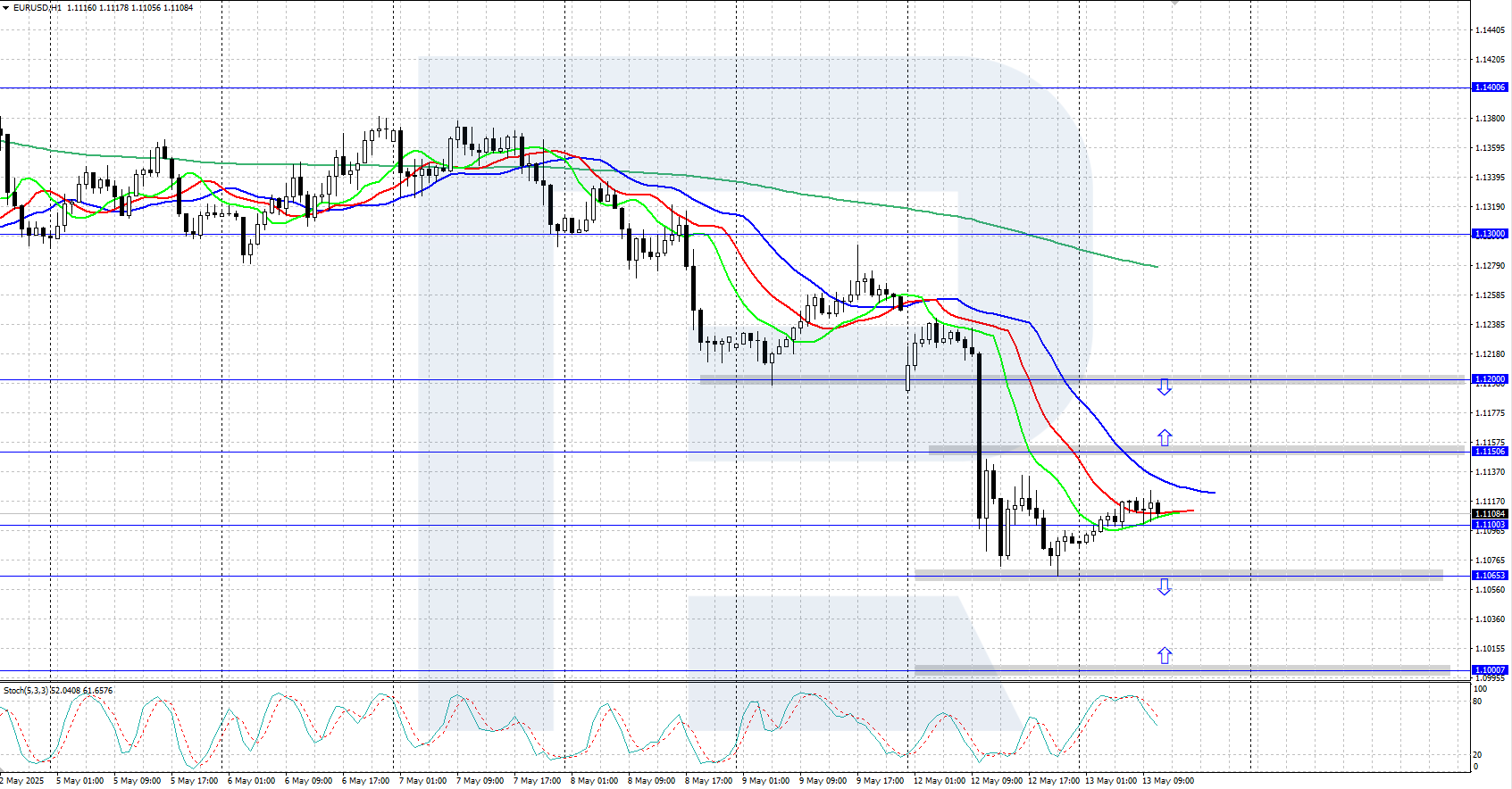

- EURUSD forecast for 13 May 2025: 1.1200 and 1.1000

Fundamental analysis

The EURUSD pair continues to decline as the US dollar gains strength amid optimism over a de-escalation in the US-China trade dispute. The two countries agreed to a 90-day reduction in tariffs after talks in Geneva, signalling a meaningful thaw in trade tensions that had intensified last month.

Today, all eyes are on the US CPI data for April. The consensus forecasts suggest an increase of 0.3% month-on-month and 2.4% year-on-year. Any substantial deviation from these expectations could fuel heightened volatility in the EURUSD pair.

EURUSD technical analysis

On the H4 chart, the EURUSD pair remains in a downtrend, falling to the 1.1100 area. The Alligator indicator confirms the bearish impulse, moving lower. The local support level is at 1.1065.

The short-term EURUSD forecast suggests a correction towards 1.1200 in the near term if bulls hold the price above 1.1065. Conversely, if bears push the price below 1.1065, a downward movement may continue towards the 1.1000 support level.

Summary

The EURUSD pair has dropped to the 1.1100 area amid improved US-China trade relations. Today, the market will focus on the US inflation statistics.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.