Markets hold breath ahead of Fed decision: EURUSD poised for growth

The EURUSD pair is regaining ground, with bulls aiming to test the 1.1495 resistance level. Discover more in our analysis for 6 May 2025.

EURUSD forecast: key trading points

- The ISM services PMI in the US rose in April, exceeding analyst expectations

- The Federal Reserve’s two-day policy meeting, concluding on Wednesday, will be one of the week’s key events

- Most market participants do not expect any change in the interest rate

- EURUSD forecast for 6 May 2025: 1.1615

Fundamental analysis

The EURUSD rate is showing moderate recovery as buyers keep the pair above the key support level at 1.1265. The US ISM services PMI rose to 51.6 in April from 50.8 in March, beating the forecast of a drop to 50.6. Although a reading above 50.0 signals expansion, the upbeat data only briefly supported the US dollar.

The main focus of the week is the Federal Reserve’s two-day meeting, which concludes on Wednesday. Investors are looking for signals regarding potential monetary easing. Despite strong US labour market data, most market players expect the Fed to leave rates unchanged. This supports a moderately bullish outlook for the EURUSD pair.

EURUSD technical analysis

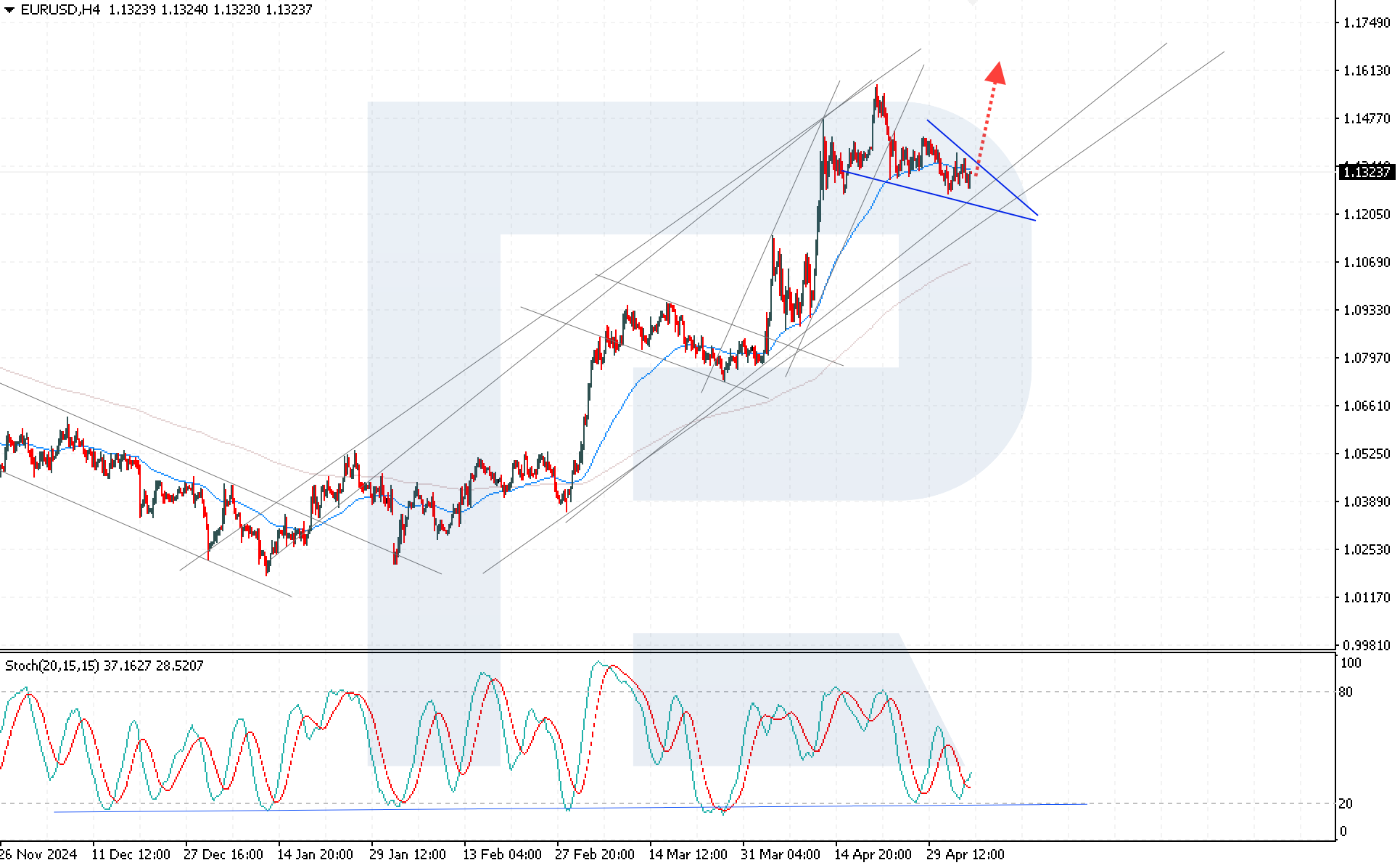

The EURUSD rate is trading near the upper boundary of a Wedge pattern following a corrective dip. The EURUSD forecast for today anticipates further gains, targeting 1.1615.

Technical indicators support the bullish sentiment, with Moving Averages pointing upwards and the Stochastic Oscillator turning upwards after rebounding from the support line near the oversold area, suggesting a new impulse may form.

A price consolidation above the 1.1355 level will confirm the bullish scenario, indicating a breakout above the Wedge’s upper boundary and the beginning of the pattern implementation.

Summary

With the market focused on the Federal Reserve meeting and expectations of the Fed keeping rates unchanged, the EURUSD forecast remains positive despite strong ISM data. Technical analysis suggests a potential rise towards 1.1615 if the price breaks above the Wedge pattern.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.