Gold (XAUUSD) plunges, possible pullback to 3,000 USD

XAUUSD prices continue to decline, falling below 3,200 USD amid productive trade negotiations between the US and China. Today, the market focus shifts to US producer inflation statistics. Find more details in our analysis for 15 May 2025.

XAUUSD forecast: key trading points

- Market focus: the Producer Price Index (PPI) is expected to rise by 0.2% month-on-month and 2.5% year-on-year

- Current trend: correcting downwards

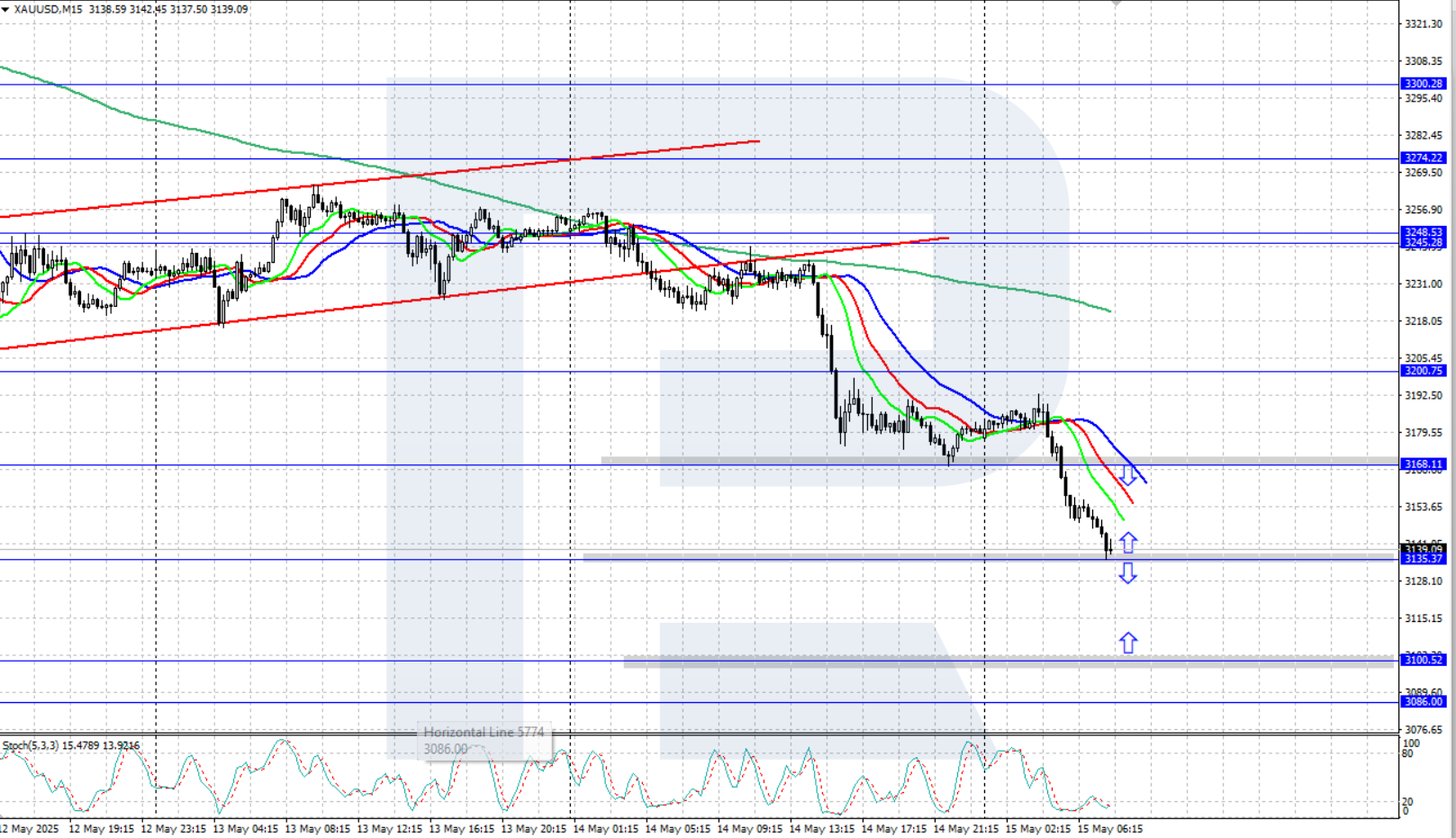

- XAUUSD forecast for 15 May 2025: 3,100 and 3,168

Fundamental analysis

Gold dropped to a five-week low as easing global trade tensions reduced demand for safe-haven assets. The US and China agreed to significantly lower tariffs and launched a 90-day pause to finalise a broader trade agreement.

Additional pressure on the precious metal comes from ongoing trade negotiations led by President Trump with India, Japan, and South Korea. Geopolitical risks have also eased as tensions between India and Pakistan have subsided.

Today, the market will focus on US producer inflation data for April. The PPI is expected to rise by 0.2% month-on-month and 2.5% year-on-year.

XAUUSD technical analysis

Gold is showing strong downward momentum after rebounding from the all-time high at 3,500 USD. A Double Top reversal pattern has formed on the daily chart, signalling a possible decline towards the 3,000 USD area.

The short-term XAUUSD price forecast suggests that if bulls stay above the local support at 3,135 USD, prices could return to 3,168 USD. However, if bears firmly maintain control, the decline may continue to 3,100 USD.

Summary

XAUUSD quotes dropped to the 3,150 USD area amid reduced trade tensions. Today, the spotlight is on US producer inflation data for April (Producer Price Index).

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.