Gold (XAUUSD) declines for the second day: everyone wants risk

Gold (XAUUSD) prices fell below 2,236 USD, heading towards its monthly low. Discover more in our analysis for 13 May 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) continues to decline amid reduced demand for safe-haven assets

- Hopes for stabilisation in US-China trade relations weigh on gold prices

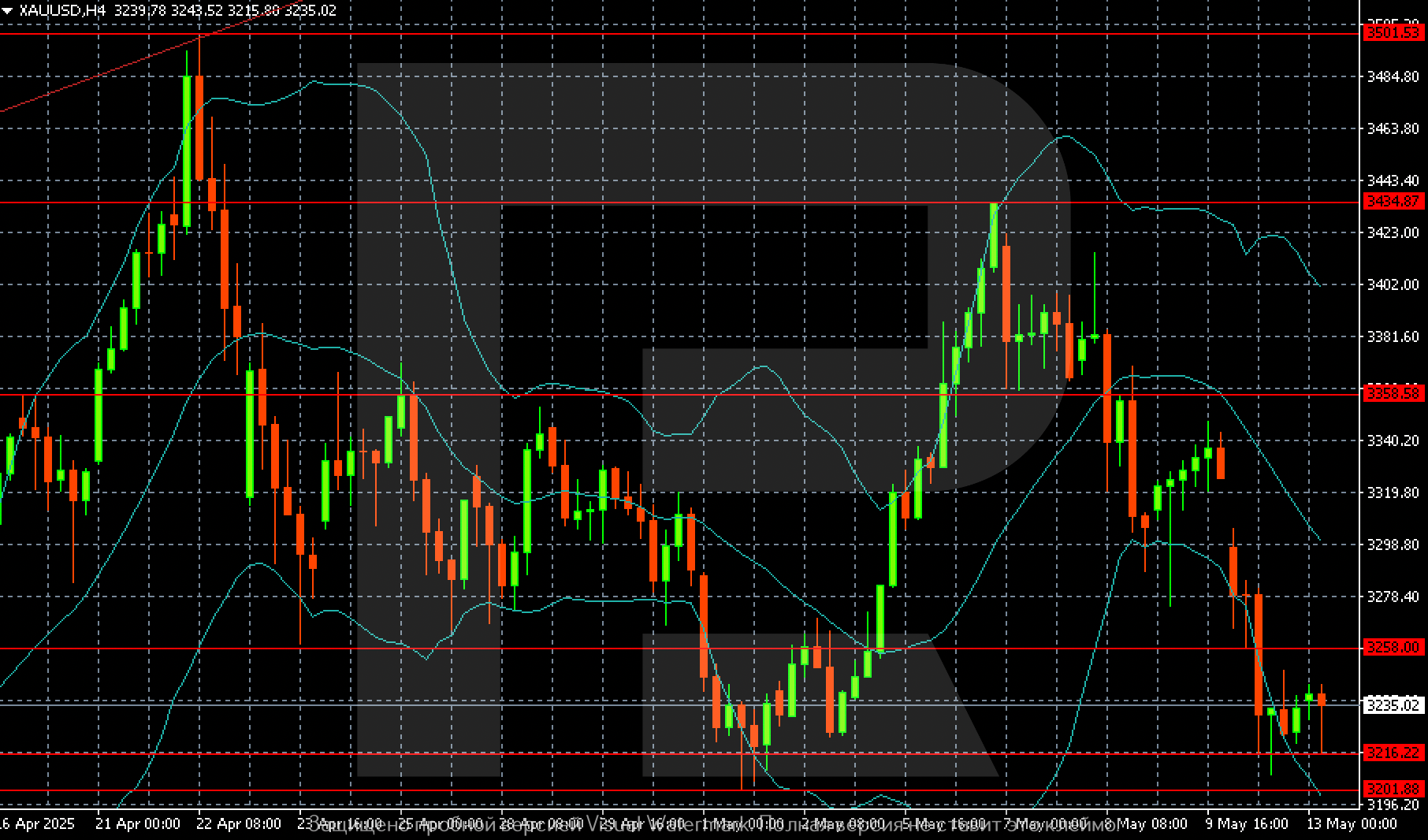

- XAUUSD forecast for 13 May 2025: 3,223 and 3,201

Fundamental analysis

Gold (XAUUSD) prices have fallen for the second consecutive day, now reaching 2,236 USD, putting it on course for a monthly low.

The decline is driven by rising risk appetite and reduced demand for safe-haven assets after a breakthrough in trade negotiations between the US and China. Both sides agreed to lower reciprocal tariffs: the US will reduce duties on Chinese imports from 145% to 30%, while China will cut tariffs on US goods from 125% to 10%. This agreement will be in effect for 90 days.

Market focus now shifts to key upcoming US economic data. The Consumer Price Index (CPI) will be released today, followed by April retail sales figures on Thursday. These releases may offer further clues regarding the Federal Reserve’s next moves on monetary policy.

The gold (XAUUSD) forecast is moderately negative.

XAUUSD technical analysis

On the H4 chart, gold (XAUUSD) is moving steadily towards the previous targets at 3,223 and 3,201, respectively.

On a broader timeframe, the ascending channel remains intact. However, price action near 3,200 may determine whether the current trend changes direction.

Summary

Gold (XAUUSD) quotes are nearing their monthly low amid improving trade sentiment between the US and China, with the first step towards easing tensions already made. The XAUUSD forecast for today, 13 May 2025, suggests continued selling pressure towards 3,223 and 3,201.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.