Gold (XAUUSD) at weekly low as market bets on good news

Gold (XAUUSD) has dropped to 3,275 USD as demand for safe-haven assets fades. The market is awaiting the announcement of a potential deal between China and the US. Find out more in our analysis for 12 May 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) prices decline amid expectations of progress in China-US trade talks

- The market anticipates official statements on the issue as early as Monday

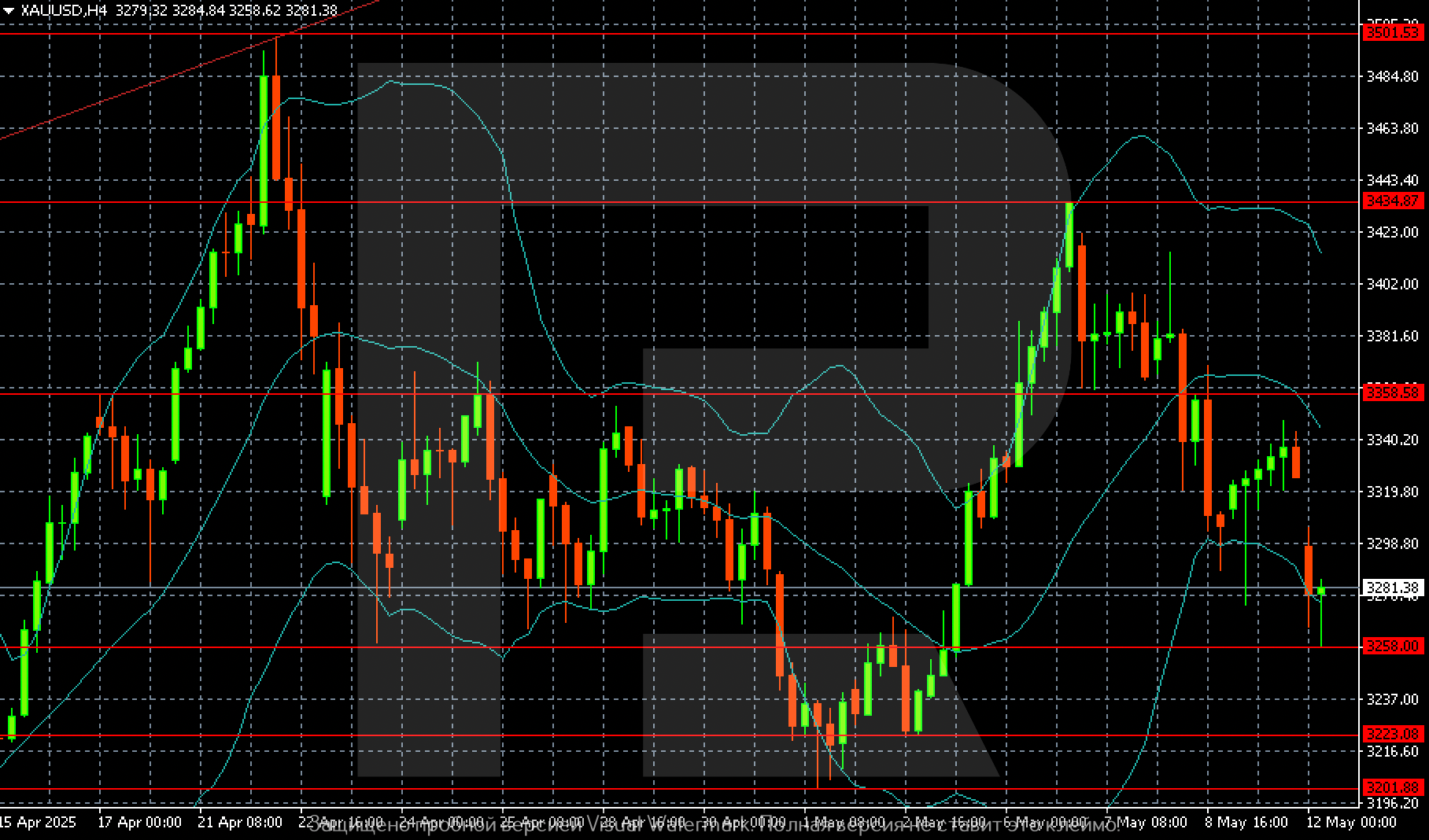

- XAUUSD forecast for 12 May 2025: 3,258 and 3,223

Fundamental analysis

Gold (XAUUSD) prices fell to 3,275 USD on Monday, marking their lowest level in a week, a roughly 1% drop from Friday. The decline is driven by expectations, with the market awaiting an official announcement on progress in China-US trade negotiations early this week. Rumours suggest that productive developments are underway, and confirmation could arrive today.

Against this backdrop, investor appetite for safe-haven assets has diminished. Market participants are clearly pricing in a favourable outcome. Although little concrete information has been released, Chinese officials have indicated readiness for formal talks, and Washington has suggested that conditions for progress are in place. In any case, this will be known today.

Gold also came under pressure last week following comments from the US Federal Reserve. Speaking after the recent meeting, Fed Chairman Jerome Powell noted that there are no current plans for pre-emptive interest rate cuts.

The Gold (XAUUSD) forecast is cautious.

XAUUSD technical analysis

On the H4 chart, Gold (XAUUSD) continues to face downward pressure, with the potential to decline first to 3,258, then to 3,223, and possibly 3,201.

On a broader timeframe, the ascending channel remains intact.

Summary

Gold (XAUUSD) quotes have retreated to a weekly low amid growing market confidence in an imminent breakthrough in China-US trade negotiations. This development is highly significant for global sentiment and economic stability. The Gold (XAUUSD) forecast for today, 12 May 2025, anticipates further selling pressure, with targets at 3,258 and 3,223.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.