US trade balance in deficit: gold (XAUUSD) may make a surprise leap

A drop in the US trade balance may trigger another bullish wave in XAUUSD, pushing prices towards 3,440 USD. Find out more in our analysis for 6 May 2025.

XAUUSD forecast: key trading points

- US trade balance: previously at -122.7 billion, projected at -124.7 billion

- Current trend: moving upwards

- XAUUSD forecast for 6 May 2025: 3,440 and 3,310

Fundamental analysis

The trade balance reflects the difference between a country's exports and imports. A positive figure indicates more exports than imports, while a negative one signals the opposite.

The XAUUSD price forecast for 6 May 2025 considers a possible further decline in the US trade balance. The previous value stood at -122.7 billion USD, and the forecast now projects a wider deficit at -124.7 billion USD. This suggests continued export contraction, which could weigh on the US dollar and support growth in XAUUSD quotes.

XAUUSD technical analysis

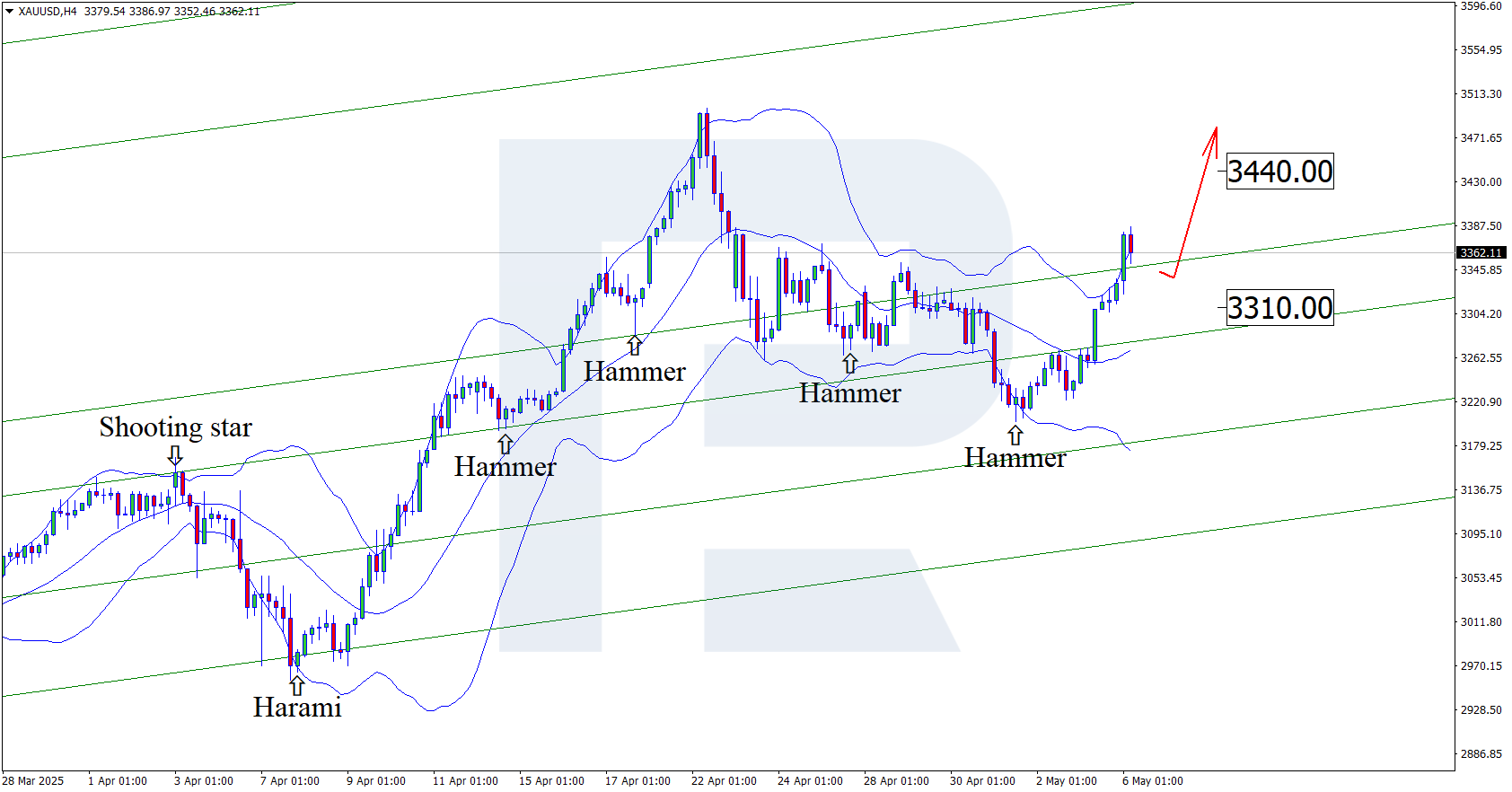

On the H4 chart, XAUUSD prices formed a Hammer reversal pattern near the lower Bollinger band. The pair is currently forming a growth wave following the signal from the pattern. Since prices are still moving within an ascending channel, the uptrend may continue, with the next potential upside target at the 3,440 USD resistance level.

However, the XAUUSD technical analysis for today also suggests an alternative scenario, where the price corrects towards 3,310 USD before maintaining its upward trajectory.

After this potential pullback, XAUUSD prices may aim to set a new all-time high near the 3,700 USD level.

Summary

The XAUUSD outlook for today, 6 May 2025, points to a potential rally towards 3,440 USD, supported by technical analysis and pressure on the US dollar due to a widening trade deficit.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.