Gold (XAUUSD) in the green: demand for safe-haven assets on the rise

Gold (XAUUSD) prices have risen to 3,260 USD. With elevated risk levels, the precious metal finds strong support. Discover more in our analysis for 5 May 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) is on the rise, driven by demand for safe-haven assets

- The market closely follows US-China trade tensions, awaiting concrete developments

- XAUUSD forecast for 5 May 2025: 3,276

Fundamental analysis

Gold (XAUUSD) prices climbed to 3,260 USD on Monday. Amid high uncertainty surrounding US-China trade talks, demand for safe-haven assets is increasing. This is an environment in which gold traditionally thrives.

The core issue lies in the lack of clarity. US President Donald Trump claims China is inclined to strike a deal, while Beijing insists specific conditions must be met before any discussions can proceed. The ongoing holidays in China add further ambiguity.

Gold also finds support in the weakening of the US dollar, making the metal more attractive to investors using other currencies.

Looking ahead, the Federal Reserve is set to hold its policy meeting this week. Although a rate cut would benefit gold, such a move is unlikely at this stage.

The forecast for Gold (XAUUSD) is positive.

XAUUSD technical analysis

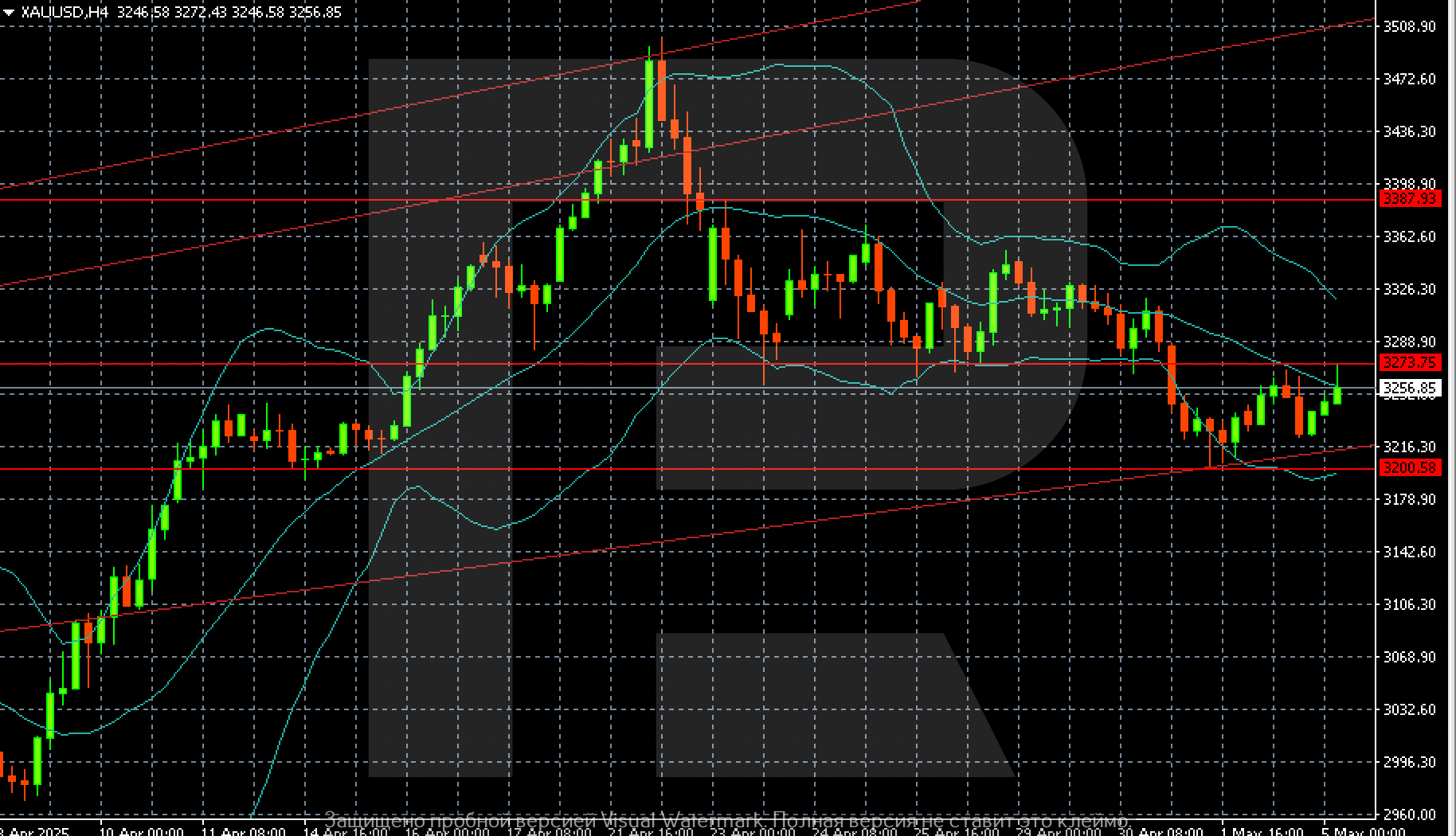

On the H4 chart, Gold (XAUUSD) is extending its ascent, with the first upside target at 3,276. If the market maintains its momentum and gains a foothold above this level, the next target will be 3,387.

Summary

Gold (XAUUSD) is on the rise, supported by renewed interest in safe-haven assets. The weakening US dollar adds further support. The Gold (XAUUSD) forecast for today, 5 May 2025, anticipates a continued upward wave with a target at 3,276.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.