Brent prices fall: US increases reserves, what happens next

The rise in US crude oil inventories triggered a correction in Brent quotes, with prices possibly reaching the support level around 63 USD. Discover more in our analysis for 15 May 2025.

Brent forecast: key trading points

- Brent oil prices continue their correction

- US crude oil inventories: previously at -2.032 million, currently at 3.454 million barrels

- Brent forecast for 15 May 2025: 63.00 and 67.00

Fundamental analysis

Fundamental analysis for Brent for today, 15 May 2025, takes into account that prices are declining, trading around 64.00 USD per barrel. The correction may be due to a rise in US crude oil stocks. Since the start of the year, Brent has lost more than 13% in value.

The decline is primarily driven by:

- Expectations of a nuclear deal between Iran and the US, which could lead to increased oil supply in the market

- An unexpected rise in US oil inventories, fuelling concerns about oversupply

- A downgraded oil production growth forecast for non-OPEC+ countries in 2025, particularly in the US, due to falling prices and reduced investment

Brent technical analysis

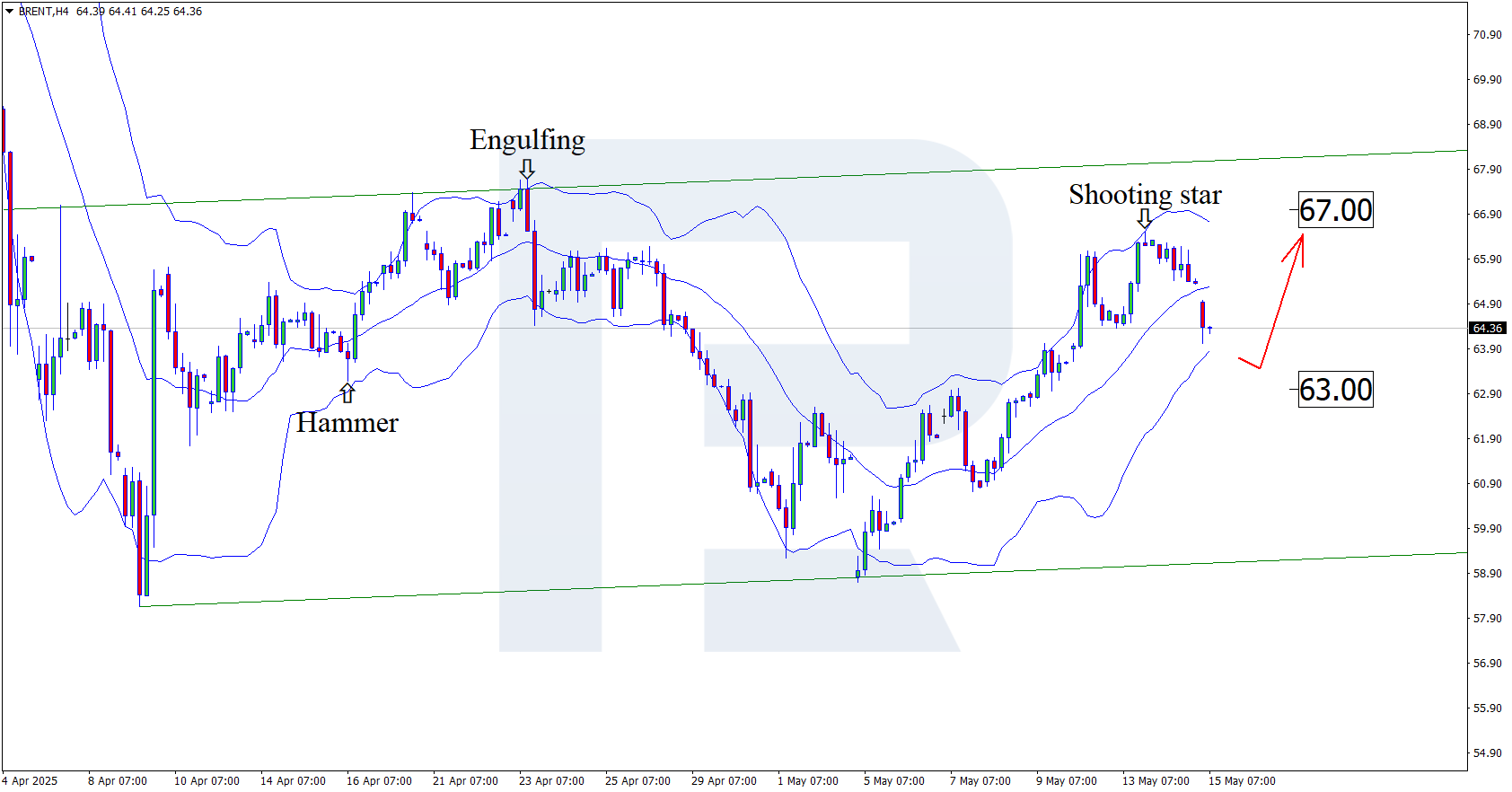

Having tested the upper Bollinger band, Brent prices formed a Shooting Star reversal pattern on the H4 chart. Quotes currently continue their corrective wave as this pattern plays out.

The Brent forecast for 15 May 2025 suggests the 63.00 USD level could be a target for the correction. A rebound from the support level may open the potential for a more substantial upward wave.

However, an alternative scenario is also possible, where Brent prices rise towards resistance at 67.00 USD without testing the support level.

Summary

The Brent price forecast currently favours the US dollar, with quotes continuing to decline amid expectations of an Iran-US deal. Technical analysis suggests a correction towards the 63.00 USD support level before an upward movement.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.