Brent rebounds slightly, but the sell-off is not over yet

Brent oil has recovered to 61.17 USD. The sharp two-day drop has paused. Discover more in our analysis for 6 May 2025.

Brent forecast: key trading points

- Brent prices have stabilised, but remain near a four-year low

- The oil market faces simultaneous supply growth and a slowdown in global economies

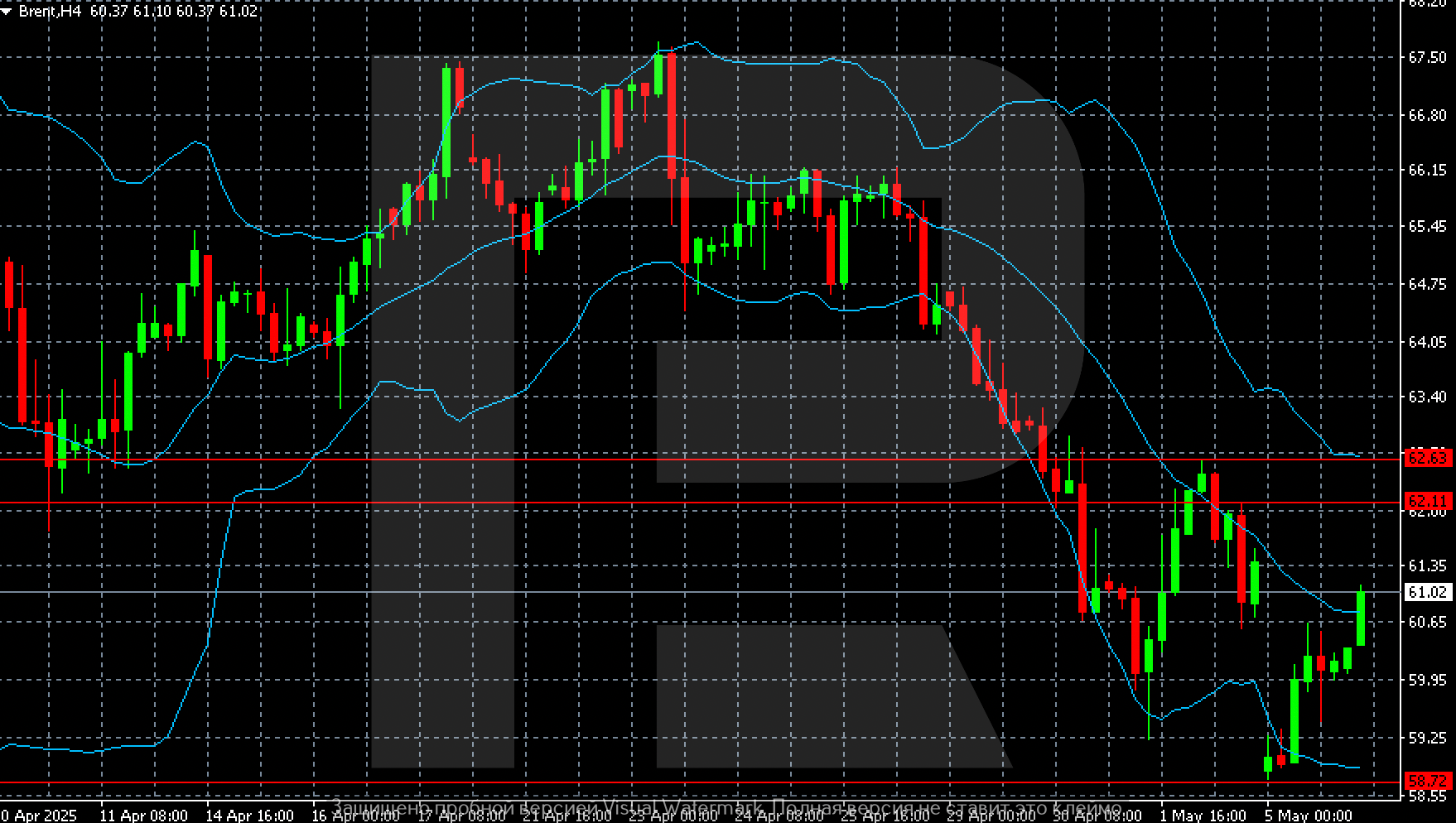

- Brent forecast for 6 May 2025: 62.11 and 62.63

Fundamental analysis

Brent crude stabilised around 61.17 USD per barrel by Tuesday, halting a steep two-day sell-off. The pause in price decline was prompted by fresh headlines from the Middle East: Israel launched airstrikes on the port of Hudaydah in Yemen and a cement plant in response to a Houthi missile strike, which had targeted Israel’s main airport.

The day before, Brent dropped by 1.7% as concerns about oversupply resurfaced. These worries intensified after OPEC+ announced its decision to accelerate production hikes for the second consecutive month.

Saudi Arabia, leading the group, also warned it may further raise output if member states that exceed quotas fail to bring production back in line.

This additional supply continues to weigh on prices, which now hover near their lowest levels in four years. Trade tensions between the US and China have reignited concerns over a global economic slowdown and weakening energy demand.

The forecast for Brent is negative.

Brent technical analysis

On the H4 chart, Brent prices have rebounded from a local low of 58.72 and moved up towards 61.00. For the bounce to transition into a sustained reversal, prices must consolidate above 62.11. This would pave the way for further gains towards 62.63.

However, the broader trend remains bearish.

Summary

Brent prices have recovered after a steep drop, but still trade near four-year lows. Markets are closely watching trade negotiations and OPEC+ actions. Geopolitical factors are again in focus. The Brent forecast for today, 6 May 2025, suggests a continued correction towards 62.63, passing through 62.11.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.